in Airline trends & analysis , ESG & Regulation

Friday 11 April 2025

Mexican carriers delay aircraft deals in response to tariff uncertainty

Two Mexican airlines appear to be reacting to the uncertainty unleashed by the numerous tariffs introduced by the Trump administration by ‘pausing’ or delaying the introduction of additional capacity.

Following Delta Air Lines’ announcement that it will defer Airbus deliveries affected by tariff-related costs, Ishka understands that two Mexican low-cost carriers have paused operating lease and extension discussions amid ongoing market uncertainty.

Viva had begun discussions with lessors on potential requests for proposals (RFPs) for additional A320neo aircraft as part of its fleet expansion plans. However, Ishka understands that the process has been paused as the airline awaits further clarity on the ongoing tariff disputes.

Similarly, Volaris also recently approached lessors to explore extension options for operating leases tied to its current fleet, with several due to expire over the next 12 to 24 months. The airline had requested responses by mid- to late March, but Ishka now understands that the process has been deferred because of market uncertainty.

Volaris was also rumoured to be preparing an RFP to help finance upcoming aircraft deliveries, though it remains unclear whether tariff developments will disrupt the process. The Mexican low-cost carrier last year stated it has an active orderbook for 138 Airbus NEO aircraft, comprising 112 A321neo and 26 A320neo.

It’s a rational response, muses Eddy Pieniazek, Ishka's Head of Advisory, who warns that one of the immediate risks of the tariffs is to reduce travel demand globally.

"Tariffs are acting as a catalyst by accelerating the sentiment around weakening demand. So it's not necessarily the cause of it, but it is contributing to it. Some airlines are going to factor in tariffs as a reason to reduce their spending. We are seeing some airlines putting off expanding their networks, especially in the US, where there's probably some delivery deferrals coming, and not just with Delta, which has been public about this - not everyone needs all their aircraft right now."

Lessors struggle with the ‘chaos’ of new tariffs

Aviation tax advisors and lawyers state they are receiving dozens of calls from clients on the potential impact of tariffs as lessors struggle to understand exactly how tariffs will impact their business.

“It’s so uncertain and that’s the big issue at the minute. For an airline or a lessor, because you don't know from day to day if the US government is going to change the tariff rate or enforce it, or not enforce it, or give an exemption to Boeing, but not Airbus, or, any of these things,” reflects one senior US aviation lawyer speaking with Ishka.

In other news, China’s Juneyao Airlines is delaying the delivery of a 787-9 Dreamliner, worth around $120 million, according to Bloomberg. The aircraft was due to arrive in three weeks but has now been delayed due to ongoing tariffs on US imports. The Chinese commerce ministry announced today that it will raise tariffs on all US goods to 125% starting tomorrow, stating: “at the current tariff level, there is no market acceptance for US goods exported to China.”

Costs and (endless) questions

Tax advisors say that new tariffs pose a challenge for aviation customers given the speed of implementation and their blanket nature. Tariffs will potentially add costs for airlines looking to add capacity, take spare engines, or undergo maintenance - given the need to import parts.

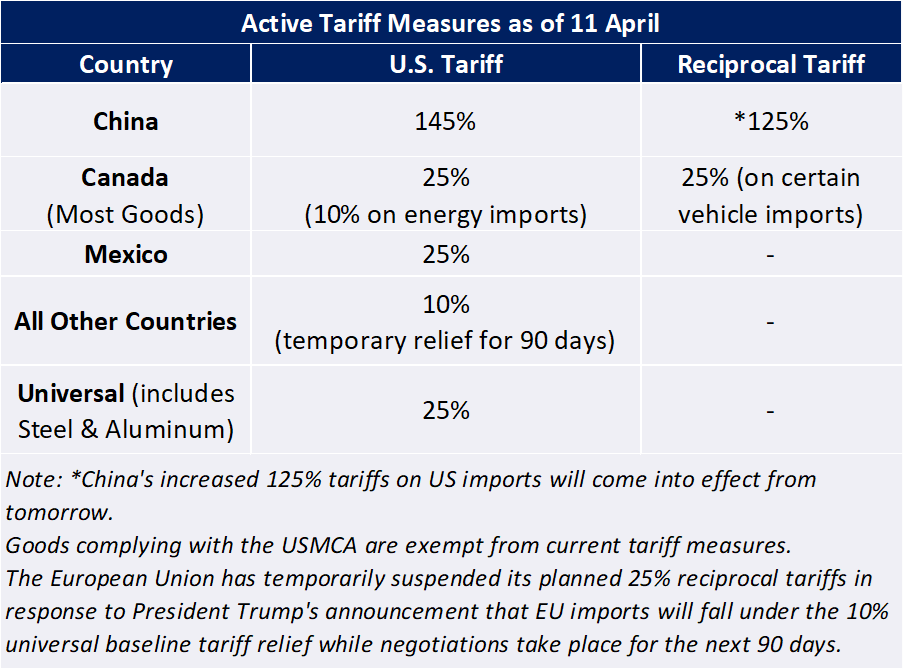

One aircraft parts firm confirmed this week it was still working out the potential implications of US tariffs. European lessors have also been watching how the European Union (EU) will eventually react and what countermeasures may be put in place. The EU decided to delay the implementation of new tariffs against the United States by 90 days to allow for further negotiations. The tariffs, initially set to come into force on 15 April, would have seen a first round of reciprocal 25% tariffs placed on various US imports (see Insight for more details).

It is clear now that the US tariffs, as written, will impact both used and new aircraft imports. For the US the importer of record is the party responsible for paying the tariff at import. One lawyer highlights that this could potentially mean that if a European lessor imported the aircraft for a US airline to then operate it could result in the lessor facing the bill. Ongoing leases are currently not affected by the US tariffs, but an airline could potentially incur costs from an end-of-lease purchase.

“There are two messages, one is uncertainty, and the other is read your contract,” reflects the same lawyer. There are also questions about how enforceable many of these measures will be. One US source comments that the infrastructure simply does not exist to properly quantify exactly how much airlines should be paying when importing aircraft. Moreover, it is hard to imagine how the Federal Aviation Administration (FAA) will struggle to monitor and assess which aircraft are new imports. "It's literally impossible for somebody at Chicago O'Hare to know that an aircraft in United livery is brand new off the assembly line from Airbus, and the FAA is not equipped to deal with this"

Lessors are also trying to assess how tariff costs will be calculated. Will final US tariff costs be based on the final value of the finished product or the percentage of parts originating outside of the US?

Part of the problem is that importation duties normally develop over many years. The sudden and chaotic introduction of large tariffs leaves many questions unanswered. Ishka’s Pieniazek believes that the airlines and lessors will likely seek to minimise tariff bills by separating out US versus non-US manufactured components. "If you're importing an Airbus into the US today... it'll probably have P&W GTF engines, or CFM engines which are half GE. It could have Honeywell or other US avionics... in which case you will try to limit paying a tariff on the whole amount. It's inevitable that airlines will try to minimise the impact of tariffs, no doubt with the help of lawyers.” Volaris and Viva were not available to comment as Ishka went to press.

Note: This information is accurate as of 16:00 GMT on 11 April 2025. However, tariff policy remains a rapidly evolving issue.

The Ishka View

The political situation remains extremely volatile with policy changing practically daily. It is hard to fathom how Boeing will accommodate the rising costs of importing parts from China, given that it often takes years to establish new supply chains.

One immediate impact that Ishka’s advisory team has highlighted is the likely erosion of travel demand worldwide. Travel to the US already looks under threat and Mexican carriers, which rely on US route for a significant portion of their revenue, are set to be hit – arguably Volaris would be slightly more impacted by a reduction in international traffic than Viva, but both are reliant on routes to the US (see Ishka ACPs for more detail on each airline).

Ishka believes that there are likely to be more such ‘pauses’ from airlines on optional capacity increases, as carriers look to assess what the continuing uncertainty means for global GDP, travel demand and operational costs.

Sign in to post a comment. If you don't have an account register here.