in Lessors & Asset managers , Aviation Banks and Lenders

Sunday 7 November 2021

5-year-old aircraft values, DAE’s results, AerCap completes GECAS purchase

This is the 62nd in a series of supplements to Ishka’s ‘Transaction Economics’ service. It delivers ‘the Ishka View’ on events that have a bearing on the near-term performance of aircraft values, lease rates, and the market dynamics that matter, under today’s market environment.

Drawing on market events and aircraft activity, this report examines how aircraft types are faring through the current crisis, which types are in favour or ‘on watch’ and which are most exposed or impacted by the evolving aircraft environment. The COVID-19 pandemic has severely impacted the airline industry worldwide, with airlines making material changes to their networks, fleets, operations and liquidity. Their survival, and the nature of economic recovery, will shape asset values and lease performance.

IMPACT INTELLIGENCE 25th OCTOBER – 5th NOVEMBER 2021

DUBAI AIR SHOW – from 14-18th November, eyes will be turned to the first large Air Show since 2019. Traditionally a time to make product launches and announce flagship orders, is the industry ready for a wave of renewed optimism?

TWO SIDES OF THE SAME COIN?… Lessors and investors are leading the way – With the AerCap-GECAS deal completed to make the largest aircraft lessor even larger, the ABS market is also showing a flurry of activity with a number of ABS portfolios announced over the past two weeks to meet investor appetite, with more to come. Add in a wide range of recent sale and leaseback deals, with more RfPs in the offing, and the investor market appears to be anticipating a strong airline and traffic recovery. Yet the airlines are still trying to rebalance their finances and manage their expanded debt profiles, with greater success noted in the larger domestic markets than in the longer haul international sectors, which are still disrupted by travel restrictions. This complex environment has more to offer…

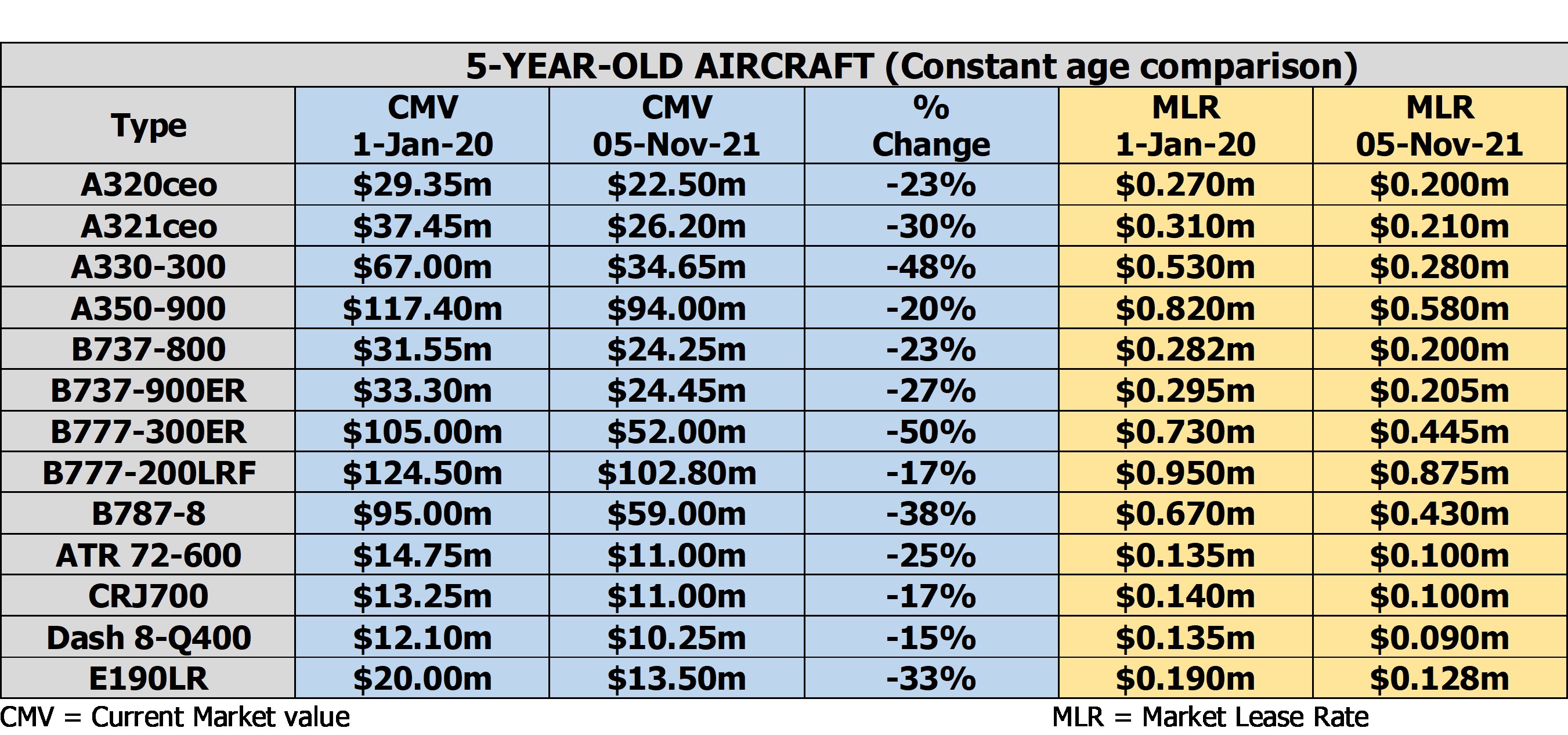

AIRCRAFT VALUES & RENTALS: 5-YEAR-OLD AIRCRAFT

This week Ishka looks at 5-year-old aircraft, and the values of a 5-year-old aircraft today compared to a 5-year-old at the start of 2020. The values and lease rates assume aircraft are off lease and available at each point in time and are illustrative of the changes seen to current market values (CMV) and monthly lease rates (MLR) over the last 18 months.

As airlines get a better sense of the market recovery (and demand) the values of older aircraft continue to be flexed as more aircraft flow through the market. PBH lease deals, rather than fixed rentals are common in many new leases, at least for the initial months of an agreement, but our MLR rate is intended to reflect the underlying sentiment for that aircraft and vintage. The overall volume of surplus aircraft and availability (freighters excepted) continues to pressure the pricing levels, whether through sale or lease. It will take time for some of the capacity overhang to be absorbed.

These numbers reflect unencumbered assets; aircraft placed on decent leases with good credits can generate a different set of results.

NOTE: The Values behind the above data reflect lease-free aircraft and reflect what might be achievable based on prevailing market conditions. ISTAT definitions apply. Values reflect Basic Configuration aircraft in ‘half-life’ condition. In reality many aircraft are likely to be of a higher than basic specification. This data is for comparative and trend observation purposes. For more detailed appraisal and valuation information please contact the Ishka team.

THE ISHKA INDICATORS

AIRBUS REPORTS… Airbus’ Half-Year 2021 results reveal that in the first six months of 2021 the OEM delivered 297 commercial aircraft. The OEM also reported revenues of $28.36bn and a free cash flow before M&A and customer financing of $2.42bn. Their main focus has been securing the A320 Family production ramp-up and obtaining Board of Director's approval for the A350 Freighter derivative aircraft.

DAE REPORTS… DAE has reported its financial results for the first nine months of 2021, in which it recorded a $90.5m profit for that period. Revenues reached $925.3m, down -6% year-on-year, while operating profit was down -10.8% to $385.8m, with a net profit of $90.5m, -45.9% down year on year. Total asset value at the end of the 9 month of 2021 was $13.177bn with cash and cash equivalents of $947.1m and total liabilities of $10.164bn. In the same period, the lessor added 10 owned aircraft and 13 managed aircraft; sold 16 owned aircraft, compared to 10 sold last year. The company also issued $2.83bn of unsecured financing. DAE's ratio of unsecured debt to total debt increased to 68.6% at the end of September from 62.6% at the end of 2020. The fleet now totals 386 aircraft, 292 owned and 72 managed and 22 committed aircraft. The weighted average age of the owned fleet was 6.6 years, and the weighted average remaining lease term was 6.4 years at the end of September.

SHOW ME THE MONEY…

ABL Aviation has formed a JV with Ellington Management Group (Ellington), an alternative investment manager, to target $800 million in aircraft assets. ABL Aviation will act as asset servicer and manager for all aircraft, while Ellington will provide financial and strategic support. Air Madagascar is to receive government help for the airline’s restructuring. The carrier’s debts are around $80m, to which aircraft leasing costs have been a contributor. Government indicates that contracts may be terminated after an audit of all the airline's debts is undertaken. Hainan Airlines is to receive funding as the creditors of HNA Group have approved the restructuring plan. HNA will receive a $5.88bn investment after its restructuring. AerCap Holdings has completed its acquisition of GECAS from General Electric as of 1st November. The lessor is now managing a portfolio of over 2,000 aircraft, 900 engines and 300 helicopters, with an order book of around 450 aircraft. American Airlines latest enhanced equipment trust certificate (EETC) transaction offering has been scaled up to $757.8m, secured against a portfolio of 21 A321neo due for delivery in H1 2022 and 5 E175 E1s previously delivered in H2 2020. With a starting LTV loan-to-value ratio of 54%, the notes have a weighted average life of nine years.

DAE has reportedly executed COVID-19 relief packages with 40 airline customers, up from 33 customers at the end of last year. Relief has mostly been given in the form of rent deferrals, loans to airlines or other leases amendments and amount to $216.6m as of the end of September, which represents 18.7% of lease revenue for the 12-month period. DAE has also entered various lease amendments with a total value of $172.6m. ALC has added $138m in revenue from repaid lease deferrals. 54% of granted lease deferrals have now been repaid, which has contributed to a 30% increase in the company's operating cash flow for the first nine months of 2021. The remaining unpaid lease deferrals account for another $117.5m. The lessor delivered 16 new aircraft from its order book, including an A320neo, 6 A321neos, 7 B737 MAX 8s, and 2 B737 MAX 9s in Q3 2021.

TRANSACTIONS UPDATE…

Wings Capital Partners is to purchase two B737-800s and one A320-200 to add to its portfolio. The aircraft are currently on lease in the US and Europe. The company plans to acquire two more single-aisles in the coming weeks. Dynam Aviation and sister company Sato Aviation have agreed the sale and leaseback of four Wizz Air PW-powered A321neo, with delivery in 2022. Following the transaction the companies’ joint portfolio will be 12 aircraft. Norwegian holds LOIs for the lease of up to 13 B737-800s from different lessors. Should the deals close, deliveries are expected to be completed by the end of Q1 2022. Lease terms are from 5-8 years and are said to include PBH terms for the less busy winter seasons of 2021/22 and 2022/23. Under some of the LoIs, Norwegian will be able to replace the B737-800 aircraft with newer A320neo or B737 MAX family aircraft. AFG Aviation Ireland has completed the acquisition of two B747-8Fs from Saudia for the Hongyuan Group. Both are to be operated by AirBridgeCargo in Russia on behalf of Hongyuan Group. Willis Lease Finance has purchased 4 ATR 72-500s from Investec Bank. AerDragon Aviation Partners has entered into a facility agreement with the Luxembourg Branch of the China Everbright Bank Co. to finance two B737-800s on lease to Shandong Airlines (China). DAE is to manage a new ABS portfolio for Navigator. The initial portfolio will consist of 22 aircraft leased to 17 lessees based in 16 countries. The assets are a mix of new technology (46%) and mostly young (76%) aircraft, with a weighted average remaining lease term of 7.3 years. 87% of the aircraft pool are single-aisles. The largest lessee accounts for 22.2% of the portfolio. Deucalion is to manage a $282m ABS portfolio of 21 older aircraft. The assets include five A319s, nine A320ceos, four B737-800s, two B737-900ERs, one A330-200 and one A330-300. The lease terms are on average of 3.2 years and include two aircraft off-lease and three aircraft leased on PBH terms. Ashland Place Finance has launched a new financing facility involving three 10-year-old B737-800s for Pulsar Aero Global. CALC has agreed a sale and leaseback for 12 A321s with China Eastern Airlines and its subsidiaries.

SPOOLING UP…

Eurowings is expecting delivery of its first A320neo in H1 2022, and its first A321neo in 2023. The airline plans to acquire at least 13 A320neo family aircraft as part of its fleet renewal programme, with most coming from Lufthansa's order book. Hawaiian Airlines extended the leases of two A330-200s in August 2021. Akasa Air, India’s latest start-up, is expected to confirm an order for up to 70 A320neo or B737 MAX this month, and to launch operations in the middle of next year. Pelita Air is looking to expand domestic operations in Indonesia by leasing A320s and ATR 72-600s. Romania’s Dan Air is expanding with the addition of a former SAS A330-300, which is due to enter service in December in ‘preighter’ mode. A second A330 is anticipated. The airline currently operates two aircraft - an A319 and an A320, with two more A320s, formerly with IndiGo, to be added shortly. It is understood that the lessor is Aviator Capital. US-Bangla Airlines expects to take delivery of seven aircraft within the next 12 months; 3 B737-800s and 4 ATR 72-600s. The airline currently operates 14 aircraft and has plans to add up to six A321LRs in 2023. FlyArystan plans to expand its fleet from 10 A320s to 17 aircraft by early 2023. Tunisair is financing four A320neos through sale and leaseback agreement, with the first A320neo due for delivery in December, and the remaining three in 2022. IndiGo has returned 13 A320ceo’s to lessors while taking delivery of 8 A320neos, 3 A321neos and 4 ATRs, expanding its current fleet to 279, of which 265 aircraft are leased and 14 are owned. Japan’s Niigata-based Toki Air is to lease two ATR 72-600s from Nordic Aviation Capital on 10-year terms, with delivery in spring 2022. Nordic Aviation will also lease four ATR 72-600s to Ireland’s Emerald Airlines.

SPOOLING DOWN…

Blue Panorama has suspended flight operations and applied to local courts for bankruptcy protection. The Italian carrier had been restructured over the last 10-years but has asked the Italian government for disbursement of COVID-related state aid. If the funding is approved, it will help restart operations. The airline had been operating eight B737-800s, a B737-300, a B737-400 and two A330-200s. Malindo Air will continue operating a downsized fleet of 19 aircraft as opposed to the 47 that used to operate before the pandemic. However, it is expected to start taking delivery of 10 B737 MAX from its Indonesian parent Lion Air from early 2022. The current fleet includes 5 B737-800s, a B737-900, and 13 ATR 72-600s, with the first 3 B737 MAX 8s scheduled for delivery. SWISS restructuring measures are progressing, with the aim to achieve savings of around $546m. The carrier has stored five of its A330s temporarily, downsizing its long haul fleet. It also plans to retire its older A320 family aircraft early, as well as defer delivery of its A320neo family aircraft. The airline was expecting delivery of two A320neos this year. Kenya Airports Authority is to auction 73 abandoned aircraft, most for scrap metal. The aircraft will be available up to mid–November. The most expensive will be listed at around $224,000, whilst only 9 of the 73 will be listed at amounts of $9,000 or more. SIA Engineering is parting out two Singapore Airlines A380s and one B777-200ER for spares and “upcycling”.

CARGO CORNER…

GA Telesis has placed another 6 firm orders for B737-800SF cargo conversions with Aeronautical Engineers, taking the company’s total slots for the B737-800SF up to twelve. The conversions start in early 2022 and finish in 2023. Air Incheon has replaced its last Classic B737-400F with a third B737-800SF on lease from Vx Capital. The Korean cargo carrier now operates an all-B737NG fleet. Western Global Airlines is acquiring a third MD-11F from Lufthansa Cargo, adding to the two that were purchased in 2020. NordStar is to acquire its first freighter, a B737-800BCF next month, with a second expected early 2022. Arena Aviation Capital is managing the conversions and leases. A third B737 is expected to follow. SmartLynx will acquire two more A321-200P2Fs as part of a new deal with Cross Ocean. Conversion is with 321 Precision Conversions. Air Transport Services Group will purchase additional aircraft for freighter conversion to meet lease demand over the next few years. ATSG recently placed an order for 4 B767-300BCF conversions, and its fleet now includes more than 90 B767 converted freighters. Atlas Air Worldwide has acquired 11 B747-400Fs from lessors. Atlas acquired six of the B747Fs by October and is expected to purchase another 5 B747Fs during 2022. Global alternative investment firm Castlelake has announced a sale and leaseback agreement for six A330-200Fs with Avianca under a 10-year lease term.

THE AIRCRAFT VIEW

Alaska Air Group is collaborating with ZeroAvia to develop a Zero-Emission Hydrogen-Electric ‘Powertrain’, capable of powering a Dash 8-Q400 aircraft while delivering a 500nm range performance. Full-size prototype manufacturing of the 2,000kW engine will begin in 2022. An ex-Horizon Airlines 76-seat Dash 8-Q400 will be the test aircraft for the propulsion technology. Alaska has also secured options for up to 50 kits to convert its Dash 8-Q400s to hydrogen-electric power. ZeroAvia has recently ground-tested its 600kW powertrain, which can fly a 10-20 seat aircraft for 500 miles. The company expects its 600kW engines to be ready for commercial operations in 2024 and for its 2,000-5,000kW engine in 2026.

Sign in to post a comment. If you don't have an account register here.