in Lessors & Asset managers , Airline trends & analysis

Tuesday 6 September 2016

Young operator analysis: Go2Sky

Go2Sky is a Slovak ACMI operator that was founded in 2012. The bulk of the firm’s work is in providing ACMI (wet-lease) services. “Around 95% is ACMI while around 5% is charter services, but we only offer ad-hoc charter in the winter season for passengers, cargo and mail”, explains CEO and founder, Daniel Ferjanček. The firm holds a Slovak AOC and operates a fleet of five aircraft, which include three Boeing 737-400s and two Boeing 737-800s – all of the aircraft are leased.

Ownership

Daniel Ferjanček is the CEO and the majority shareowner of the company with a 65% stake. Peter Ferjanček, Daniel’s brother, and the firm’s training manager Miroslav Kaličiak are the two other equity owners. Kaličiak was the former CEO of Slovak Airlines (Slovenske Aerolinie). The rest of the firm’s management team have a background in wet leasing.

Operating revenue

According to Ferjanček the company produces on average EUR1.5 million ($1.6 million) annually in gross profit. Because of the uneven nature of ACMI work, which tends to rely on short contracts and is particularly active in the summer, the firm’s available cash tends to vary year from year. As of January 2016 the firm had EUR2.1 million ($2.3 million) (31.12.2015) in cash, but any aircraft placed in winter dramatically adds to the firm’s bottom line. Ferjanček has a long-term agreement with Mistral Air and states the firm is in discussions with three other carriers for potential 3 to 5 year ACMI agreements.

Costs

Ferjanček suggests that the total leasing costs are approximately EUR5.1 million ($5.6 million) a year including maintenance reserves (2015). The company’s total costs are EUR15.2 million a year (2015) ($16.9 million).

Fleet

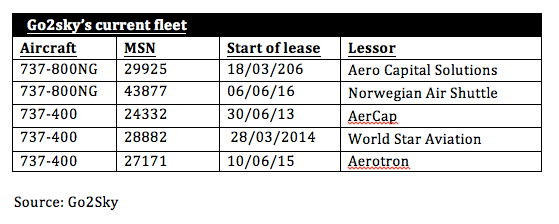

The firm leases three Boeing 737-400s from AerCap, UK lessor Aerotron and World Star Aviation and two Boeing 737-800s, one from Aero Capital Solutions (ACS) and a second on a short-term summer dry lease from Norwegian Air, which is wet-leased back to Norwegian (see chart below). All of these aircraft are on three-year to five-year agreements with the exception of the short-term deal with Norwegian. The firm plans to eventually replace its classic fleet with NGs on a gradual basis but it does not plan to increase the fleet of the aircraft to more than five aircraft. “Every year we have something new and something different in terms of business agreements but in aviation it is dangerous to grow very quickly”, adds Ferjanček. This year the firm plans to return one classic and lease one new NG.

The company has one 737-800 is on lease for five years and a 737-800 on lease from Norwegian for the summer season. “Ideally we would lease an NG for three years but you cannot lease an NG for less than 5 years, a few are offered at six years. You can obtain a reasonable price on 16-year old aircraft from the 2000 vintage at around $200,000 a month. Any aircraft older than 2000 vintage tend to have higher maintenance costs but aircraft that have a 2006, 2007, and 2008 vintage tends to be $270,000 - $280,000 a month which is too much for the ACMI market,” adds Ferjanček.

Sign in to post a comment. If you don't have an account register here.