Tuesday 25 October 2016

Whatever happened to Trump Shuttle Inc?

Long before he set his eyes on the White House, the US businessman and reality TV Star, Donald Trump, ran an unsuccessful US carrier in the early 90s. Trump entered into aviation when Eastern Airlines, which needed to raise extra cash, decided to sell its North East Shuttle. The Shuttle, a New York icon of sorts, was a subsidiary carrier which had been running since 1961, transporting business travellers between New York, Boston, and Washington DC.

“I hope my name does a lot for the shuttle, and I hope the shuttle does something for my name,” he said when purchasing the airline in June 1989 for $365 million. By 1991, Trump had abandoned the venture leaving millions of dollars in defaulted bank loans behind him and the Shuttle’s reputation in ruins.

Trump’s aviation legacy is a sorry one. Trump made the acquisition with 100% debt from a syndication of 22 banks leaving the creditors in a bind when he defaulted. Chronic overspending meant the over-leveraged carrier, already saddled with an old fleet and high maintenance costs, was unable to turn a profit. Ishka believes that the demise of ‘Trump Shuttle’ after only two years is a warning to those who invest in the aviation industry without understanding how it works. The Ishka View is that Trump Shuttle serves as a reminder of some of the key risks when entering the airline space.

Trump’s flawed timing: buy high, sell low

Trump paid $365 million for the carrier, which included 21 ageing Boeing 727s and was widely believed to have overpaid. For reference, his team estimated the cost of starting an airline from scratch at $300 million. “It was incredibly well financed,” Trump said at the time. He had negotiated a $380 million loan from a syndicate of 22 banks led by Citicorp to fund the acquisition. “That was the days where banks put up more than 100 percent of financing.”

Trump acquired the airline using 100% bank debt and the heavy debt burden this imposed was the major cause for the demise of the business. Since its inception, the Shuttle had a strong bottom line, provided a steady revenue stream for Eastern Airlines, and had grown year-on-year for two decades. But in late 1989 the market had started to turn. This prompted Eastern Airlines to sell the subsidiary. But under Trump, the onset of recession and a spike in fuel prices due to unrest in the Middle East, helped to cripple the carrier.

The Shuttle was able to cover operating costs but was not making enough to pay down its large debts. The airline was unable to turn a profit after 18 months and had lost $128 million. Then in September 1990, Trump Shuttle missed a $1.1 million interest payment. Trump’s debts were so large that they threatened the solvency of some of his creditors, who were keen for him to carry on running the airline. In order to escape from his debt pile, Trump gave up control of the carrier towards the end of 1991, leaving the Shuttle saddled with $245 million in unpaid loans. Ownership passed to the 22 creditor banks led by Citicorp. Of the $135 million that Trump had personally guaranteed to the banks, about $100 million was subsequently waived.

Under a 10-year management contract, US Airways began operating the fleet after Trump’s departure, quickly stripping the aircraft and the airline of his name, becoming the US Airways Shuttle. The carrier then bought the rest of the Shuttle outright in 1997 for $285 million: $80 million less than Trump had paid for it almost a decade earlier.

Over-leveraged Shuttle struggled to turn a profit

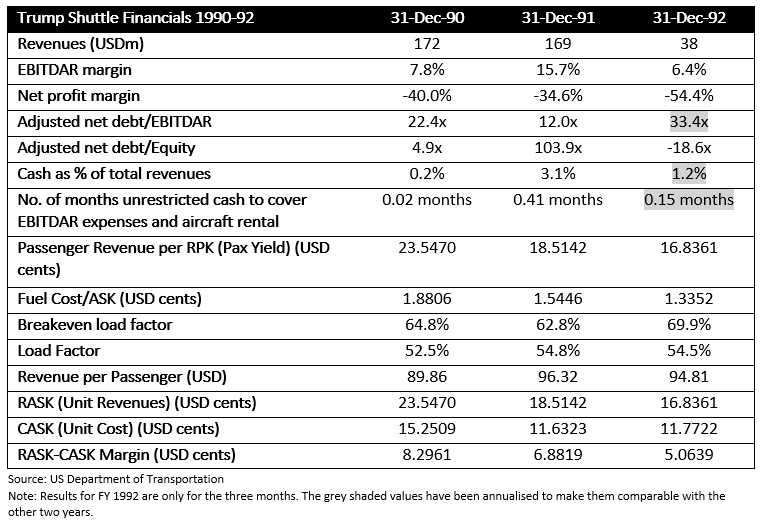

Operationally the Shuttle boasted reasonable operating numbers and decent EBITDAR margins. However, the carrier struggled with large expenses and high fixed costs. As can been seen from the table, the Trump Shuttle continued to be highly leveraged even after Trumps departure. The damage was lasting. Its adjusted net debt to EBITDAR was unsustainable across the three years of Trump’s reign, pushing up interest expenses.

As a result of its high debt, the Shuttle’s interest expenses became significant. The airline had little liquidity, and struggled to generate sufficient cash flows to cover its debts. It was only therefore a matter of time before the airline collapsed. Without an equity infusion from the owners or a bank loan to provide for working capital needs, the airline was not able to stay afloat. Banks were also unwilling to risk lending more to Trump Shuttle, after the September 1991 default.

“The oldest, worst-maintained 727s then flying”

According to the then marketing director, Henry Harteveldt, the Trump Shuttle fleet “had 21 of some of the oldest, worst maintained 727s then flying.” On average the fleet was 25 years old. Trump wanted to create a luxury service aboard his short-route airline. Having overpaid for the airline, Trump set about spending around $500,000 to rebrand every aircraft with the TRUMP livery and refurbish with lavish ‘Trumpian’ interiors. A large figure given that each aircraft was worth around $4 million.

Because the shuttle owned most of its fleet, depreciation and amortisation expenses were extremely high. In addition, the carrier had more aircraft than it actually needed and could actually fill. The carrier’s low load factors were consistently lower than breakeven levels. As a result, the airline did not generate enough revenues to cover its fixed costs. While the airline’s operating income (EBITDAR) over the three-year period was not very impressive, it was nevertheless positive. However, a combination of high depreciation charges and high interest expenses ate up any marginal operating profit the carrier made.

The Ishka View

Trump Shuttle’s fleet was old when Trump acquired it, and the aircraft have all been scrapped and parted out since Trump’s brief experience at the helm. Trump’s experience demonstrates the perils of investing in an airline when investors have little experience in the industry. Trump believed that his name carried a premium, but that assumption was unsuited to a utilitarian carrier where luxury was not a real concern for customers. Trump Shuttle never achieved load factors higher than 55% - lethal for a commuter service and far lower than its breakeven load factor. Ultimately, high debts and capacity management felled the carrier when recession came. Trump Shuttle should be a salutary lesson to investors, and lenders, about a management team choosing to acquire the wrong aviation assets at the wrong prices. Trump’s other mistaken assumption, that of offering unnecessary luxury in airlines, has been replicated by other tycoons since, most recently by Indian businessman Vijay Mallya and the failures surrounding Kingfisher Airlines. The Indian carrier was forced to completely cease operations in 2013 by Indian authorities after mounting losses at the carrier. Ultimately Trump Shuttle is a colourful historical lesson about some of the pitfalls that exist for unwary aviation lenders or investors.

Sign in to post a comment. If you don't have an account register here.