in ESG & Regulation , Capital Markets , Aviation Banks and Lenders

Monday 5 December 2016

‘Basel IV’ to hit aviation hard but ECAs get off lightly

ECA financing has won an exemption under new proposed amendments to the final elements of the Basel III capital rules – unofficially dubbed “Basel IV” published at the end of last month.

The exemption is a small piece of good news under the draft legislation, which, at present, looks set to penalise traditional bank aircraft financing. The new regulations, which govern capital requirements for banks, are due to come into effect on 1 January 2018 and will see leverage ratios increase across the board for several asset classes including aviation.

The Basel Committee on Banking Supervision (BCBS) aims to increase the resilience of the banking sector, which funds around 28% of all new aircraft deliveries, by pushing banks away from internal risk ratings towards a standard external model.

The Ishka View is that the new rules are set to negatively impact aviation overall and are likely to increase the cost of financing for airlines. The draft rules are set to create a liquidity cost burden of up to $34 billion for aviation banks. This is likely to cause some banks to sell off parts of their portfolio. It will also divert capital away from secured bank loans towards riskier unsecured lending and shadow banks. As a result, some banks may choose to withdraw from the aviation space entirely.

The relaxation of the rules for ECA financing is a positive step, and will make ECA financing more attractive for airlines. However, it is likely to clash with the OECD’s aircraft sector understanding (ASU) rules, which controls ECA premiums. The OECD rules seek to ensure that ECA deals do not compete too aggressively with the commercial bank market.

ECA financing secures leverage ratio exemption

ECA financing has managed to win an exemption under the new rules. Under the draft rules the portion of a loan backed by an export credit agency or central government will receive a 0% risk weighting and not be forced to adopt the minimum 3% leverage ratio requirement. The exemption, won through the lobbying efforts of the export credit working group at the European Banking Federation, amongst others, reflect the low underlying risk in these transactions.

A study published by the Aviation Working Group (AWG), reported a 0% loss given default rate on aircraft-backed loans guaranteed by US Ex-Im, and a 2.7% average for Export development Canada (EDC) and the Brazil Development Bank (BNDES).

Financiers indicate that the rule change will help more banks engage with ECA financing in future. “If anything, this is clearly good news”, says Nicolas Parrot, co-head of transportation at BNP Paribas. “The real limiting factor for banks has been their liquidity cost and the fact that ECA loans often did not pay enough to cover such cost.”

ECA premiums will probably stay the same

Though ECA financing will become more attractive, the exemption is a reinforcement of the status quo. Banks will continue to use their own internal risk models while other types of financing will become more expensive. So, pricing differentials will be relative and not absolute.

In this environment, low-margin, long-tenor products become less attractive than riskier ones. The temptation will be for banks to push up pricing or leave the space altogether. But the arbitrage between ECA bonds and loans will keep pricing low. While the exemption does not harm export credit, it offers little pecuniary advantage over other types of aircraft-backed financing and is likely to remain a low-margin product for banks.

“One of the defining element of the ECA market now is the fact that it can be funded through bonds or through loans,” adds Parrot. Bond investors are not subject to banking regulations. “But what we have seen since 2009, when the bond product was established, is that there is now a constant arbitrage between the two avenues. So, if the regulatory balance shift from one way to the other, the bond product is now there to put a cap on the ECA pricing.”

Any effect will remain hypothetical for the time being since the European ECAs and US Ex-Im remain closed to Airbus and Boeing.

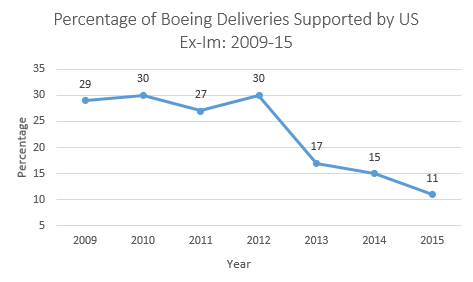

Source: Boeing Capital Corporation

Banks must raise up to $34 billion in fresh capital

Despite the relative low risk in aircraft-backed loans the AWG anticipates that the impact of the proposed capital requirements in the aircraft sector is a x3.5 to x6 increase in Tier 1 capital. This would require banks to raise between $17 billion and $34 billion in new capital to support existing banking books and new aircraft deliveries for the 2017-2020 period.

Fundamentally, this should reduce the capital availability for secured aircraft lending. But it is also very likely that higher liquidity costs will translate into higher pricing on loans. Though the exact impact is hard to quantify because pricing depends on a series of variables including, access to currencies, liquidity costs, bank risk costs, and credit risk.

Rules will make unsecured lending more attractive

According to an AWG study, aircraft-backed loans, like ECA-backed loans, have had remarkably low actual historical loss given default rates, including 0.82% for capital market transactions and 7.8% for senior secured bank loans.

“The biggest problem we have with the proposal is that it doesn’t accurately represent the risk of an aircraft-backed portfolio,” says Daniel da Silva, vice president of strategic regulatory policy at Boeing Capital Corporation and co-chair of the AWG. “Specifically with regard to other asset classes.”

The AWG argues convincingly that the Basel III proposals put secured aircraft loans at a drastic risk-return disadvantage relative to higher risk unsecured corporate loans and secured loans with other types of collateral. This is because the leverage ratio is risk-blind i.e. banks are obligated to set aside the same amount of capital for a AAA rated loan as a BBB rated loan, but the AAA loan earns less income. Low risk assets will have to earn their keep.

So, not only will less risky aircraft-back transactions lose out to other types of higher-yielding products, there is also a chance that aviation, as a generally low risk sector, will lose out to other asset classes. “If a bank has a target return on equity of, let’s say, 12%,” says da Silva. “The question then becomes: ‘if there is a disproportionate capital reserve requirement for aircraft-backed secured loans, do we play in that market or do we go for other corporate lending, real estate, or other vehicles?’ And banks shouldn’t have to make those trade-offs due to the Basel proposals.”

It is likely that as a result some banks will choose to reduce the size of low risk aircraft loan portfolios on their books via asset sales, while some players may exit the space entirely. By constraining bank appetite for aircraft loans, the new rules are likely to undermine the long-term partnership between many banks and their airline customers.

Basel III incentivises risk taking

One criticism about the new Basel accords is that it is likely to motivate some specialised finance banks, which includes aviation, to adopt riskier lending practices. If banks desire higher margins to compensate for higher liquidity costs, then they may decide to redirect capital towards riskier types of unsecured lending, thereby increasing their overall risk profile.

As Ralph Lerch, chairman of the export credit working group at the European Banking Federation, has pointed out, The European Banking Authority has already conceded that: “by design, the non-risk-based leverage ratio may incentivise financial institutions with low-risk business to diversify asset portfolios into high-risk business, in particular on a standalone basis.”

Perversely, the Basel III accords are supposed to decrease the incidence of systemic risks in the financial system, not increase it. The AWG, argues that this presents opportunities for institutional investors who do favour long term, capital intensive investments and to a lesser extent, unregulated shadow banks.

Basel Committee and OECD set to collide

By making ECA financing cheaper (in relative terms), the new Basel Accords conflicts with the OECD’s 2011 ASU which aimed to increase the cost of export credit relative to other commercial loans.

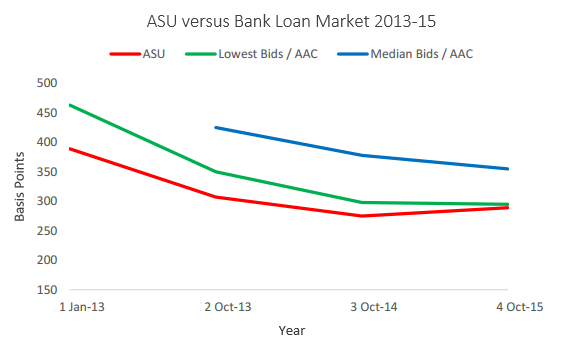

“One of the main objectives of the 2011 ASU was to reduce the differential between the cost of export credit and that of commercial financing,” says da Silva. “Our own research shows that since 2011 the cost of export credit and commercial loans has converged. But here is where the new proposal by the Basel committee would get into conflict with the goals of OECD.”

Before 2013, and in the aftermath of the 2008 financial crisis, ECA financing was far more competitive than commercial lending and even bond market pricing. According to a 2015 study, commissioned by the AWG. Current ECA pricing under the OECD aircraft sector understanding (ASU) is materially more expensive, by an average of 53 basis points, than commercial bank loan pricing in risk categories 1-6. These are the least risky loans, with an average credit rating of between BBB- and B-.

However, as the graph below indicates, even now, ASU pricing is less expensive than commercial loan pricing, by an average of 16 basis points in categories 7-8. That is, in the categories with a credit rating of CCC, CC or C.

Source: AWG submission to OECD, November 2015

If the Basel committee was to implement the rules as currently stated, with a different treatment for export credit then, da Silva argues: “It would begin to distort that competitiveness, and I think that’s contrary to what the OECD set out to achieve with the ASU.” We may even begin to see a divergence once more.

Da Silva does not believe that the BCBS will implement the rules as they currently stand and says the committee has been receptive to their research. In his view, the committee should recognise the low loss given default rates in aircraft deals by considering them in a category of their own, or allow banks to retain their existing internal risk models, which have been very successful to date.

The Ishka View

The Basel Rules exemption for ECA financing is welcome, and Ishka expects export credit to provide a growing share of aircraft financing in the coming years. The new leverage ratios on will make low-margin, long-tenor transactions, including ECA-backed loans, less attractive. Pricing is likely to increase across the board due to a higher liquidity cost burden, estimated at between $17 billion and $34 billion for existing order books and new aircraft deliveries in the 2017-2020 period. Some banks may wish to withdraw from the aviation space entirely, while others will chase higher margins with higher risk unsecured lending. The net result is that Basel IV is likely to either deter banks completely from aviation or encourage more risky lending in aviation- a perverse outcome for regulation that aims to reduce systemic risk in the banking sector. It remains to be seen whether the Basel committee will change its approach to aviation in light of the work done by the AWG.

Sign in to post a comment. If you don't have an account register here.