in Capital Markets , Investor Briefings , Other , Aviation Banks and Lenders

Sunday 18 December 2016

The Ishka View: Will 2017 be a hard or soft landing?

As a relatively good year for aviation comes to its end, the industry faces the prospect of a weaker 2017, which in turn begs one question - will 2017 be a hard, or a soft, landing?

Ishka provides its view on the key issues and metrics that have contributed to performance in 2016 and how they are shaping up for the New Year.

Aircraft supply

Airlines have no shortage of seats. Both the aircraft order backlog and aircraft deliveries are running at record highs. Fitch estimates that Airbus and Boeing will reach close to 1,540 deliveries in 2017 (up 8%) and 1,600 in 2018 (up another 4%) with Bombardier and Embraer adding another 145 in 2017. Good news for the OEMs, but as production rates for 2017/8 onwards exceed some forecasts of demand, some discipline is needed. Boeing’s recent announcement of a reduction in the 777 production rate is both prudent and necessary from a capacity standpoint. Add in the rate reductions for A330s and A380s, and this discipline will help the market balance for wide bodies.

Lower fuel prices are a significant driver. With oil around the $55 a barrel mark, older aircraft have regained some competitiveness and retirement and part-out volumes have consequently been reduced, creating a growing risk of surplus active capacity. Some airlines have already seen yields and load factors retreating.

Aircraft demand and the '12 year itch’

Demand for new aircraft is a function of satisfying replacement and growth needs. The replacement demand for older aircraft is real, but today it is relatively small. There are around 1,700 commercial aircraft still flying that are over 20 years old, this includes 1,200 A320s, 757s, 767s, MD-80s and 737 Classics, of which 35% are in North America and 24% in Europe (over 1,000 aircraft in total). That is little over a years’ worth of current new production, so, theoretically, it is easily replaced.

Of more concern is the propensity for the replacement of ‘younger’ aircraft, what we at Ishka call the ’12-year itch’. Owners of aircraft that are coming off their first or second lease at around 12 years of age, or else are close to their major airframe/engine overhaul schedule, have to answer two key questions. The first is: can I place this aircraft on lease elsewhere, and for how long? The second questions is: Can I achieve the required lease rate to make investing in its overhaul a worthwhile proposition? Airlines today hold the upper hand, they have a wide choice of fleet options of both new build and used aircraft. Consequently not every 12-year old aircraft will find a home.

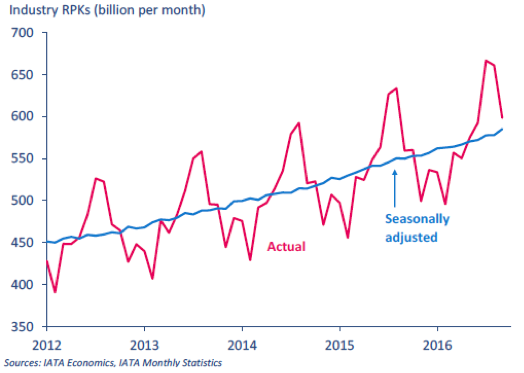

Growth demand is also real with passenger traffic growth continuing to remain strong, although passengers remain sensitive to ticket pricing. With ASKs growing faster than RPKs, it is a good time for passengers to travel.

Aircraft retirements and economic lives

Aircraft retirements in 2016 are likely to be less than half the numbers in 2013 (around 330 compared to over 700) as the relatively low fuel price environment gives older aircraft an economic life boost. This unplanned ‘second wind’ has the potential to add to the overcapacity equation.

In terms of economic life, Ishka agrees with some market observers that the asset value curve is probably more important for financiers than the survival curve. It is small comfort that a 15-year old aircraft can exist for another 10 years if there is limited prospect of placing it on lease in that time at a justifiable rate, or selling the aircraft for anything close to book value.

Asset Values

New aircraft deliveries – the ‘delivery value’ range for unencumbered aircraft has effectively been capped for years (the majority of 737s and A320s have delivered to airlines in the $40 million + range since the mid-1990s) but in sale & lease back (SLB) terms they are trading at the top of, or at a premium to, the cap. This premium is being sustained through intense competition from new / young entrants in the leasing market, who are building their portfolios. Some ‘seasoned’ lessors are not taking part in SLBs despite having the capital. With regards to portfolio sales by lessors, there are signs of diminishing gains in what has been a ‘sellers’ market’. Ishka takes this as a warning sign that markets have peaked.

Airline profits

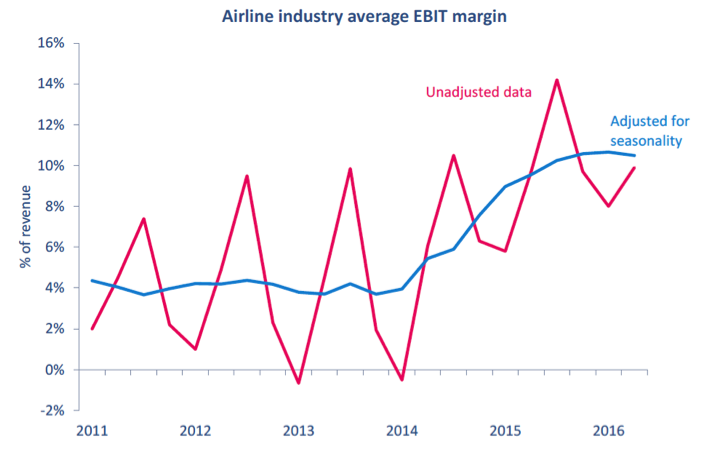

The airline profitability cycle is also showing signs of peaking. After a strong improvement in margins in 2014, followed by margins more than doubling by late-2015, EBIT margins levelled off during the first half of 2016. This has coincided with downward pressure on yields and unit revenue, and an end to the fall of spot fuel prices. With the business cycle for airline profitability being stressed due to soft economic conditions, fuel prices creeping up and unit revenues remaining under pressure, Ishka anticipates a declining performance in 2017, albeit still a profitable one.

Source: IATA

Airline Yields

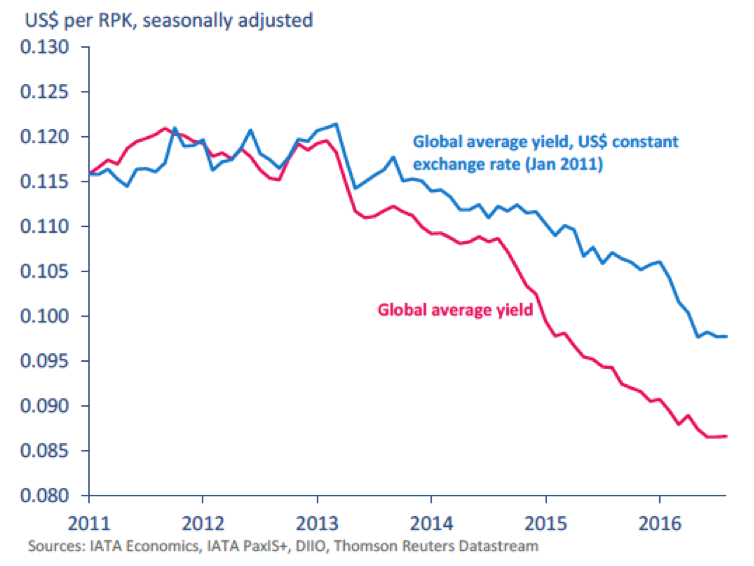

Global average yields have continued to trend downwards, from 0.120 USD/RPK in 2013 to 0.085 USD in 2016 - over 25% decrease in three years. The downward pressure on underlying yields has intensified over the last six months, which ties in with a moderation in demand conditions during the first half of 2016.

Airline failures

Interestingly, airline failures are running at low levels, despite one or two high-profile failures recently. Transasia is the latest, with 24 aircraft being returned to owners or lessors, as well as VLM in Europe. There have been 10 failures so far in 2016, compared to peaks of 60 in 2008 and 45 in 2011. The Ishka view is that there will inevitably be mnay more failures in 2017/18 if fuel continues to rise and yields continue to fall.

Aircraft orders, cancellations, deferrals and switching

There has been both an up-gaging in narrow body and wide body models on order, as well as a downsizing or the deferral of large swathes of orders, each reflecting the circumstances and strategies of the individual operator or lessor and providing an indication of future trends.

Aircraft lessors – ‘business as usual’ or time to prepare for turbulence?

The lessor community is still in expansionary mode, with portfolio growth evenly split between sale & leasebacks and deliveries direct from their orderbooks, but for many it is also a time to ‘de-risk’ their portfolios by selling off slices. Fleet utilisation is at high levels (a relatively small percentage of fleet is AOG), and forward placements are high (although there is debate as to how secure some of these might be).

The established lessors have benefited from a very active secondary market thanks to the deep pool of relatively cheap capital and a flood of new leasing entrants. This has enabled them to report portfolio sales at a premium to book value, although this margin is slowly declining.

Some lessors are deferring purchases through sale & leasebacks even though they have the capital to deploy, as they see pricing on many deals being too high. Instead, they are turning to improving their credit profiles.

The Ishka View is that there are a number of relatively new lessors that have yet to experience a significant ‘downturn’. While it may never happen (although in Ishka’s experience it happens often enough) management needs to be ready for any eventualities - this is a very competitive environment.

Impairments

Publicly quoted lessors have recorded impairments on their portfolio values of $3 billion since 2012. Billions more were written down in the preceding years, following the financial crisis of 2007/8.

Ishka anticipates there is more to come from the wider lessor community. Aircastle recently put twelve aircraft ‘on watch’ for possible impairment, citing “persistent supply glut in cargo due to weak demand growth in capacity arising from new freighters and higher belly capacity in wide body passenger aircraft” plus “age limits in some countries and lower utilisation levels.”

There appears to be a consistently over-optimistic view on realisable asset values for a number of aircraft types. The Ishka View is that depreciation rates for aircraft clearly need more scrutiny.

Financing environment

Availability of financing remains plentiful and has not been an issue in 2016. Operating lessors are enjoying Capital Markets (very receptive) and ABS Markets (which are bustling). This is thanks to investor appetite for:

- Yield

- USD denominated hard assets

- Attractive pricing levels

- Variety of maturities

The trend to sell down portfolio slices into the capital markets is likely to continue into 2017.

There were several examples of capital markets/ABS transactions in 2016. These included: Aircastle’s $400 million 7-year unsecured bond (March 2016); BOC Aviation’s $750 millionunsecured 10-year bond (March 2016), Apollo Aviation’s $510 million ABS (March 2016)— Air Lease Corp’s $600 million 5-year unsecured bond, Castlelake's $916 million ABS (August 2016), and more, including the Blackbird and Aergen ABS deals.

Ishka’s concern is that the deep pool of capital could become one of the ingredients for a problem of the industry’s own making, by driving aircraft acquisition prices up, only to have to correct the equation through impairments at a later date if traffic does not live up to expectations. Passenger and airline revenue growth will have to remain robust for the markets to balance out without incident.

The Ishka View

Demand side markets have been good for some years now, but show consistent tell-tale signs that growth is weakening. Supply side markets are in danger of creating overcapacity. In both cases the participants generally recognise this and are responding, although Ishka suspects the response requires a little more ‘oomph’. Lessors have learned to manage, and in some cases benefit from, the market cycles in recent years.

For those new to this environment, a host of challenges await! 2017 is primed to be managed into a soft landing, but a hike in fuel prices and/or an exogenous shock have the ability to spoil everyone’s preparations. As always, stay alert, and stay informed.

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Photo: Steven Pisano

Sign in to post a comment. If you don't have an account register here.