in OEMs, Cargo & Engines , Aviation Banks and Lenders

Monday 10 April 2017

Aircraft retirements to put pressure on part out firms

An acceleration on fleet retirements is likely to increase pressure on part-out firms as the aftermarket for aircraft parts become depressed. Part out firms, recycle around 70% of a given aircraft as airlines and lessors look for cheap parts and a way to extract value from ageing fleets.

According to the Aircraft Fleet Recycling Association, around 12,000 commercial aircraft are due for de-commissioning in the next two decades. Most of these will be narrow bodies such as the A320 and Boeing 737. But Abdol Moabery, president and CEO of GA Telesis, believes that the real crunch will come by 2020:

“The biggest fundamental issue that we have to watch is the number of retirements circa 2020. If there are 400 to 800 engines available for part out, trade or green time leasing, it’s going to have a detrimental impact on the overall market.

“A few part-out companies in distress are on our radar. We think there are three or so more to come in the next 18 months.”

There are signs that some firms are already feeling the pressure, with the likes of TES Aviation and AeroTurbine having been acquired or restructured in recent months. The Ishka View is that more consolidation can be expected in the part out sector. As increased retirements compress prices and reduce demand from operational fleets smaller firms will find their margins compressed.

Two hundred retirements a year by 2020?

Moabery estimates that there will be around 200 aircraft retirements a year by 2020. The value of aircraft parts is directly connected with the number of aircraft still flying and fluctuate on a daily basis, though prices are holding up for the time being. If too may aircraft are retired in the same year then it will begin to undercut demand for material.

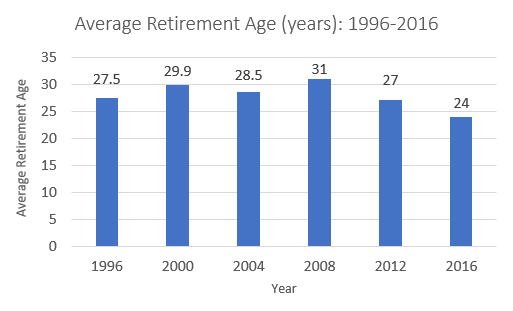

Source: Ishka calculations. Includes both wide and narrow body aircraft.

“The math is simple, right,” says Moabery. There are about 5,000 Boeing 737 and 5,000 Airbus A320s currently in operation. Many of these aircraft are approaching the end of their useful economic lives, which has also shortened in recent years (see graph above). The A320 family became 30 years old in 2016 and the 737NG will hit 20 years in 2018. “By 2020 we will be looking at up to 200 retirements each year,” adds Moabery.

Of course, not all of these aircraft will be parted out. As once source close to the market pointed out, for this to happen, it must be assumed that no operator or lessor re-leases, refinances, or trades any of their aircraft — all or which is quite likely given that the cost of financing is currently very low.

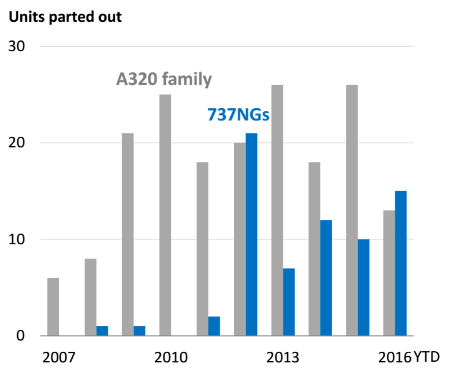

But there does remain potential for even a moderate rise in parted out aircraft to put strain on the industry. As the graph below shows, only 13 A320 family and 15 737NG aircraft were parted out in 2016. Even when 50 aircraft of either type reach teardown, there is going to be a tremendous amount of pressure on pricing with implications for many of the firms involved.

Source: Boeing.

Consolidation is on the cards

Margin compression means there is a need for consolidation among the larger companies, because everyone’s margins are higher with fewer players and smaller firms find it harder to turn a profit. There is some evidence that this is underway already.

Two companies that operated in the part out space have entered into difficulty in the last 18 months. Total Engine Support (TES) Aviation went into administration and was acquired by Willis Asset Management in October 2016. While leasing company AerCap made the decision to downsize its subsidiary AeroTurbine, writing-down $18.2 million in it parts inventory. The former spare parts specialist will now focus on serving its parent company. And in March, Aircraft Recycling International, a Hong Kong-based unit of China Aircraft Leasing Group, acquired Universal Asset Management which is based in the US.

Robert Korn, President at Apollo Aviation, agrees that consolidation is on the cards: “Where does it go from here? I think it will just continue, the big guys get bigger and the small guys get smaller.”

The complexities that have crept into the part out market in recent years are also driving consolidation with regards to inventory carriage costs, financial strength and infrastructure costs. But, as aircraft retirements increase it will be the second and third tier companies that feel the pressure.

“These companies eventually will not make it because they just can’t keep up in terms of volume. Meaning, they don’t have a wide enough distribution network that allows them to part out aircraft in the US and sell them globally,” says Moabery.

Large companies have sophisticated models that allow them to have some semblance of a forecast and algorithms that help them to price parts efficiently in order to move them. That said, the market moves daily. The only thing that will lead to success is having a distribution network that is as broad as possible.

The Ishka View

Narrow body aircraft retirements are set to increase dramatically up to 2020, driving down prices for parts and reducing overall demand from A320 and 737NG operators. Two hundred retirements a year is a useful indicator of how much the part out market could be affected, though the actual figure will probably be lower. But even half that figure will be a serious concern for the industry. TES Aviation and AeroTurbine have already entered into difficulty and it would be prudent to expect more companies to follow suit. The competition is driving consolidation in the business as three or four large companies dominate the space alongside more boutique players who focus more on certain platform types.

Sign in to post a comment. If you don't have an account register here.