Equity returns squeezed for leased aircraft

Lessors and investors have confirmed to Ishka that equity returns for leased aircraft have compressed further in the last 12 months thanks to increased competition for assets.

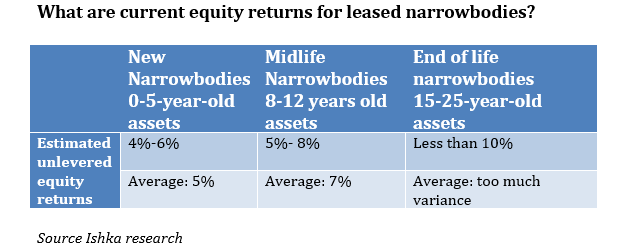

Sources indicate that on average, unlevered equity returns for new leased narrowbody aircraft are around 5%, closer to 7% for midlife aircraft (aircraft with a vintage between 8-12 years old) and below 10% for end of life assets.

The reduction in equity has been linked to airlines winning tighter monthly lease rates and a strong sellers' market for new and used leased aircraft.

“There has been general compression everywhere. Pricing really doesn’t seem to make much sense in some cases,” confirms one aviation fund manager commenting on the higher purchase prices for leased aircraft. “Everyone is finding it hard to buy assets at sensible rates, and I mean everyone.”

Both investors and lessors surveyed agreed that average lease rates had declined over the last twelve months with many lease rates for new aircraft falling below 0.6, especially for sale leasebacks. Investors say sub 0.6 lease rate factors have pushed their returns down to single mid digits in many cases.

However, lessors and investors disagree about how widespread or severe the drop in returns have been. A few investors insisted that some lessors were still being able to charge lease rates at above 0.7 lease rate factors and that returns could exceed the average equity returns highlighted by Ishka, depending on the credit. However there appeared to be a consensus that leased narrowbodies remain particularly difficult to source because of competition and airline demand.

“You can’t get an A320 or an A320 engine for love or money at the moment, neo or ceo," confirmed one lessor. They just don’t exist because of demand.”

Widebody investors feel the squeeze too

Lessors indicate that the erosion in equity returns for single-aisle aircraft has also been mirrored for leased twin-aisle aircraft. Investors state that unlevered equity returns for widebodies are still generally 0.5% to 1% higher than narrowbodies assets but have also experienced a decline in the last 12 months.

“Many of the older widebodies being acquired, and I am really talking about A330s or 777s, are still leased to a good credit. There has been some demand among ABS investors as these aircraft are leased at slightly higher returns and throw off a lot of cash which can help flatter the ABS portfolio numbers,” explains one lessor who has seen returns drop for used twin-aisle aircraft over the last year.

The Ishka View

Leased aircraft are offering investors lower returns than a year ago, and competition from new lessors and investors appears to be the main reason why.

Increased swap rates have, in some instances, squeezed returns and supply chain issues have also impacted the demand for certain aircraft types. However, the early evidence from Ishka’s research is that the flood of capital into aviation has been widespread and has compressed returns for most, if not all, the popular leased commercial aircraft types across all ages.

If returns decline further will investors start to leave the sector for better returns elsewhere? The aviation finance market seems to think so. At a recent ISTAT conference more than half of the audience thought new investors would leave the sector eventually ( Is new equity here to stay?). But there is little evidence this is happening to date. In a report issued earlier this week (GECAS portfolio sale confirms buoyant aircraft trading market) the secondary market for leased aircraft remained extremely active in Q1 2018.

Some fund managers indicate investors are straying away from aviation as they seek better returns in infrastructure or dry bulk shipping but Ishka has heard of plenty of new investors coming to the sector and relatively few, if any, leaving just yet.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.