Thursday 2 August 2018

AerCap clears the decks

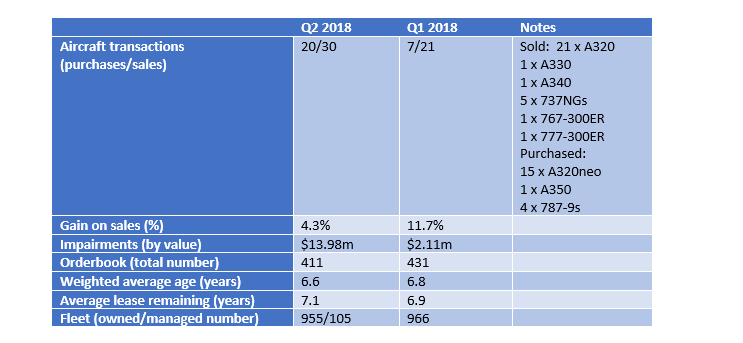

AerCap states that the deterioration in net income and some of its other headline metrics for a second quarter in a row in Q2 2018 was temporary and that its ambitious growth plan worth ca. $15 billion in capital expenditures to the end of 2020 will reverse the trend. The average age of the fleet will continue to decrease to approximately 6 years—from the current 6.6 years—and the lease term remaining will lengthen beyond the current 7.1 years as new deliveries provide a boost to both the asset base and lease revenues, the lessor maintained in its Q2 reporting. The lessor is preparing to take deliveries of another 50 aircraft from its orderbook in the second half of 2018, with further 87 and 97 slated for 2019 and 2020, respectively. The vast majority of these—a combination of liquid, new technology aircraft from Boeing, Airbus and Embraer—have been pre-placed on leases.

Mixed signals?

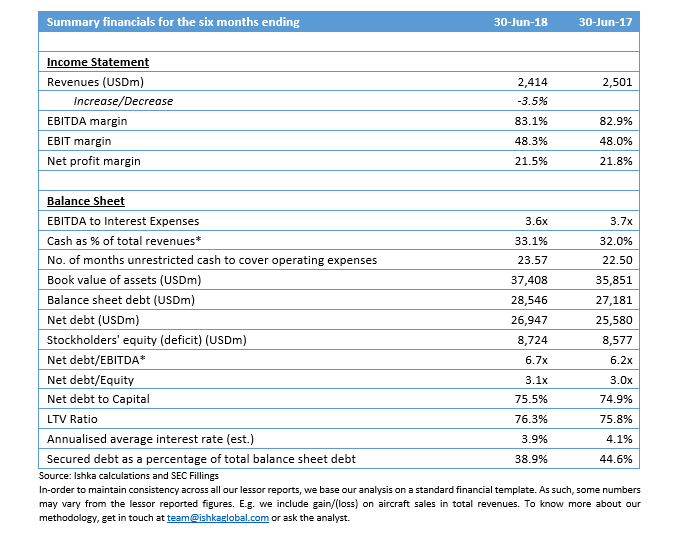

Despite taking delivery of 20 new aircraft in the second quarter, top-line lease revenue came under pressure from the sale of 30 older, and therefore higher-yielding, aircraft. AerCap’s total revenues dropped by 5% versus the same period last year primarily due to a lower gain on sale of aircraft and decrease in other income; other income--$12.4 million in Q2 2018 vs $36.7 million the year prior—was buoyed last year by lease-termination payments. Notably, gain on sale in the reporting period was lower both in absolute and in percentage terms compared to the same period the year before—4.3% and 9.6%, respectively. Ishka notes the energetic pace of AerCap’s disposals in H1—50 in all—and surmises that such high trading volumes are as much a function of the lessor’s desire to capitalise on the market’s appetite for mid-life and older assets as of its re-fleeting plans.

There was also loss of lease revenue from ex-Air Berlin and ex-Monarch aircraft which have remained on the ground in anticipation of being re-leased. This was partly due to a global shortage of MRO slots, AerCap said, as MROs have struggled to accommodate the large number of aircraft exiting the two bankrupt airlines. The expenses associated with transitioning the aircraft from the two airlines also put significant pressure on AerCap’s leasing costs, driving them up by 48% to $68.4 million, from $46.2 million in the same period of 2017.

On the expenses side, there was an uptick in interest expense, as AerCap continues to replace ILFC bonds with longer-term paper; the all-in cost of debt increased in the reporting period to 4.1%, from 3.9% at the end of the same period the year prior. The lessor recorded ca. $14 million in impairment charges that arose as a result of lease terminations and sales; some of those were offset by maintenance or end-of-lease compensation amounts.

With $1.5 billion in capex in Q2 and an expansive share buyback campaign underway, AerCap’s cash balances decreased somewhat but, at $11.7 billion in absolute terms and at 1.3x in terms of coverage ratio, overall liquidity cushion remained solid and in line with the lessor’s target. Also within AerCap’s internal target is the current leverage ratio which stands at 2.8x.

The Ishka View

The timing and scale of aircraft disposals by AerCap may have dented some of its credit metrics in Q2 but Ishka does not think the effect is either significant or long-lived—leverage and liquidity remain healthy and there is no suggestion they are likely to come under pressure. The lessor closed on $2.7 billion in additional debt financing which, together with available cash flows, should ensure that the planned growth spurt is sufficiently funded without stressing AerCap’s capital structure. The high preplacement levels for the incoming deliveries is also a source of comfort but does rely on the resilience of air traffic flows in the next few years.

Sign in to post a comment. If you don't have an account register here.