in Lessors & Asset managers , Aviation Banks and Lenders

Wednesday 22 May 2019

JP Lease and Stratos price first JOL aircraft ABS

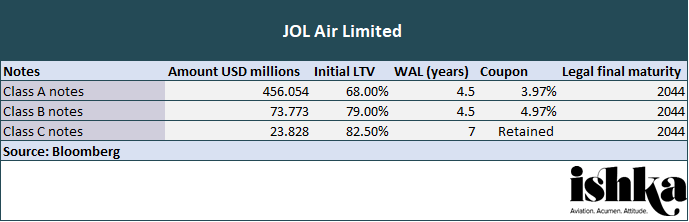

Japanese lessor JP Lease has priced a $553.65 million debut aircraft securitization (JOL Air Limited) and has teamed with Stratos Aircraft Management Limited (Stratos) as the servicer. The deal is the first aircraft ABS to include a Japanese Operating Lease (JOL) structure.

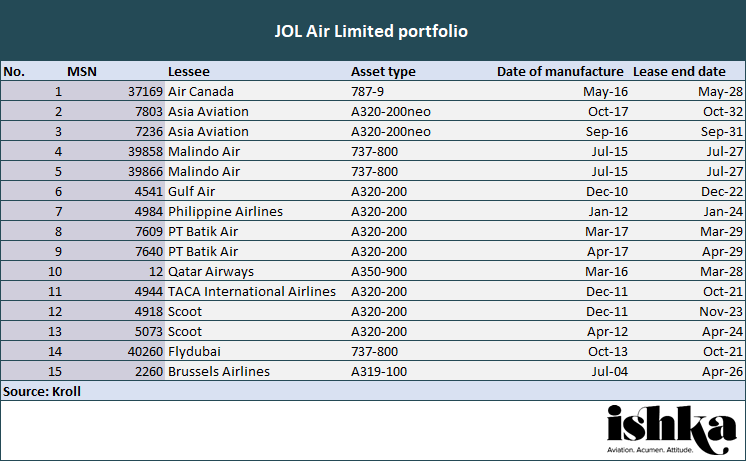

JOL Air Limited will acquire 15 aircraft with an initial weighted average age of 4 years and a weighted average remaining lease term of approximately 8.3 years. The deal is split between three series of notes while the equity will be sold to Japanese investors under a tokumei kumiai (TK) arrangement.

Stratos will initially be purchasing a minority proportion of the Class C Notes issued by JOL Air but will not be retaining any of the equity.

Source: Bloomberg

The start of more JOL aircraft ABS deals?

Japanese operating leases (JOLs) have become one of the most competitive forms of leases available currently in aviation finance. JOLs have gained in popularity as they offer Japanese investors a tax benefit through owning a depreciating asset, such as a leased aircraft. Under a JOL the Japanese equity investors become the owner of the aircraft via a special purpose entity called a tokumei kumiai (TK) in which the investors have a silent partner arrangement with the JOL lessor.

The cheap equity typically available through JOLs make the leases particularly competitive and appealing to airlines. JOLs typically involve a single lease on a single aircraft and JOL Air Limited represents a departure in that the Japanese investors are acquiring equity into a pool of aircraft leases.

The portfolio

Source: Kroll

The portfolio consists of 13 narrowbody aircraft which is split between A320-200ceos, 737-800s, two A320-200neos and 1 A319. The portfolio also includes two widebodies, a 2016 787-9 on lease to Air Canada and a 2016 vintage A350 on lease to Qatar Airways, which together account for 36.6% of the value of the portfolio. The Class A and Class B Notes amortize on a 14-year straight-line schedule with a supplemental scheduled amortization that amortizes on an 11.5-year straight-line schedule.

Kroll states the JOL Air Portfolio represents one of the more “attractive portfolios” relative to other recent aircraft ABS transactions thanks to the young average age of the aircraft and the length of the average remaining length of lease. The rating agency also acknowledges that the portfolio is small and fairly concentrated. The three largest lessees by value are Air Canada, Qatar Airways and Asia Aviation, accounting for approximately more than half (50.3% in total) of the initial portfolio.

The ABS has several structural enhancements for the A and B note holders. The Class A Notes and Class B Notes have a 100% cash sweep at the bottom of the waterfall before the equity is paid, while the Class C Notes will not receive any principal until the fifth anniversary of the closing date.

The Ishka View

JOL Air Limited could represent the start of a potential wave of new aircraft ABS transactions selling to Japanese equity buyers. Return hurdles for Japanese JOL equity are much lower than competing sources of capital because the equity earns a tax benefit. This makes it easier for arrangers to source leased aircraft as they can bid more aggressively but could also help ensure a more active pipeline of aircraft ABS deals.

JOL Air Limited is unusual in that it relies on JOL investors to invest in a pool of leased aircraft rather than a single airline credit. The deal has priced successfully, albeit with the C note retained. Ishka believes that there are likely to be more similar deals coming through, as demand is high among Japanese investors for more JOL product. Ishka notes that JOL Air Limited has one of the smallest pool sizes of aircraft for an ABS and meets the 15-aircraft minimum aircraft required by KBRA.

Any one default has therefore greater implications than for a portfolio of 25-30 aircraft. The portfolio has some structural mitigants (for example a faster amortisation and 100% cash sweeps for the A and B notes), but the issuer has imposed some relatively high LTVs across the three series of notes. In addition, the three largest lessees represent 50.3% of the portfolio by value, while the country risk for the same three lessees is over 61% and much higher than comparables.

Sign in to post a comment. If you don't have an account register here.