in Other , Aviation Banks and Lenders

Friday 20 December 2019

Future deliveries update: Asia-Pacific

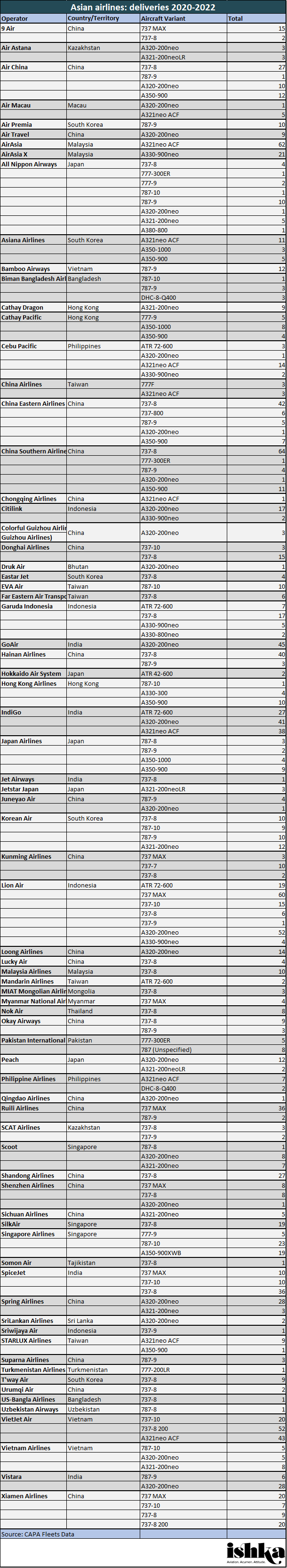

The tables below provide a guide to aircraft scheduled for delivery to airlines in Asia over the next 24 months. It covers the five main manufacturers – being Airbus, ATR, Boeing, Bombardier and Embraer. The data has been sourced from the CAPA Fleets database.

A reminder to the reader: recreating skyline deliveries is an inexact science as certain slots can be reassigned as the result of deferrals and, in certain instances, airline failures. Further, given the status of the 737 MAX programme, a degree of circumspect should be used in relation to the number of aircraft stated.

Asia

Air China continues to receive a range of aircraft in its aim to add 170 aircraft from 2018 to 2020 to its fleet. On the Airbus narrowbody side, 21 A320neo have been delivered with the next aircraft set to arrive in December 2019 and nine others scheduled to arrive in 2020. In July 2019, Air China entered a purchase agreement for 20 A350-900 with 12 of these set to be delivered during the next 24 months. A number of Boeing 737-8 MAX aircraft are due to be delivered in 2020 although the type’s grounding leaves the schedule in a state of flux. Air China also ordered 35 ARJ21-700s in 2019 although no delivery date has been set.

China Eastern Airlines, including subsidiaries such as Shanghai Airlines, is closing in on completing all its remaining mainstream orders, resulting in a combined fleet approaching 800 aircraft by the end of 2019. Having taken over 60 aircraft per year in 2017 and 2018, China Eastern is likely to have taken delivery of fewer than 40 in 2019 due the 737 MAX grounding. The delivery profile in 2020 will also be heavily contingent on the 737 MAX returning to service. China Eastern has continued taking A320neos in 2019, with up to 21 deliveries anticipated this year. The airline is also taking deliveries of Airbus A350-900, the first of 20 arriving in 2018, and Boeing 787-9. China Eastern also has orders with COMAC for 20 C919s (delivery dates unknown) and 35 ARJ21-700s (to be delivered between 2020 and 2024 to subsidiary Eastern Jet). The regional subsidiary will receive three in 2020, six in 2021, eight in 2022 and nine each in 2023 and 2024.

China Southern Airlines, Asia’s largest airline by fleet size, will grow its current fleet of 800 aircraft (including subsidiaries) to over 1,000 aircraft by the end of 2021. Many recent deliveries are being financed through sale & leaseback transactions with the airline’s Guangzhou Nansha FTZ-based leasing arm CSA International. China Southern signed a purchase agreement for 20 A350-900 aircraft in April 2017 and has received five to date. The airline expects to receive 11 more A350s over the next 24 months, including one in December 2019 and another in February 2020.

Despite some delays in the delivery of new aircraft, IndiGo continues to grow faster than its Indian rivals and in 2019 benefited from the collapse of Jet Airways. The LCC has been inducting A320neo aircraft and, since December 2018, A321neo. IndiGo increased its Airbus orderbook with an additional 300 A320neo Family aircraft in October 2019 – a mix of A320neo, A321neo and A321XLR. Deliveries from a 2017 order for 50 ATR72-600 are due to be completed by July 2020.

The Lion Air group has been decelerating its growth in recent years. The airline adds to its fleet from a large backlog of orders while using an in-house leasing business to facilitate financing, fleet distribution and disposition. The airline was the first carrier in Asia-Pacific to receive the A330neo and is expecting another four in the next 24 months. The airline will also receive its first 52 of 113 A320neo aircraft on order over the next two years. Sixty-five A321neo aircraft will be delivered from 2023. Lion Air expected to receive more 737 MAX aircraft but the type’s grounding has delayed deliveries.

Singapore Airlines is currently modernising its fleet with the consequential phase-out of older aircraft. Until March 2020, over twenty aircraft will be released from the fleet while a similar number of new aircraft will be acquired. Over the next period, there are 47 widebody aircraft on order (71 are on order in total) with the first arrival of the 777-9 due in 1H 2021 and the continued arrival of the 787-10 until 2022.

VietJet Air is awaiting the delivery of its first 737 MAX aircraft. The Vietnamese airline received its first A321-200neo ACF aircraft in September 2019 and is scheduled to induct 43 more by 2022. The airline intends to induct 30 aircraft and retire 10 per year from 2020 to 2025.

Xiamen Airlines (A subsidiary of China Southern Airlines) expects to receive 56 aircraft over the next 24 months, although the 737 MAX grounding may impact this schedule. Twenty 737-8 MAX and 10 737-10 MAX aircraft were originally due to be delivered between 2019 and 2022.

Southwest Pacific

Air New Zealand continues to receive deliveries of the ATR 72-600 and awaits the final three aircraft to bring the ATR fleet to a total of 29. Air New Zealand ordered eight 787-10s in September 2019 to be delivered between 2022 and 2027.

Jetstar Airways, part of the Qantas Group, is cutting domestic capacity by around 10% in January 2020 and weighing the sale of three Boeing 787-8 aircraft to counter industrial action by its pilots. It is expecting the first A321neoLR arriving in October 2020 to replace the outgoing 787-8s. The Qantas Group has an order for 18 A321neoLR aircraft assigned to Jetstar Airways.

The Ishka View

Over the next 24 months, Asian airlines are scheduled to receive almost 1,600 new aircraft. A few airlines, however, depend on the 737 MAX returning to service to achieve their delivery targets. SpiceJet, for instance, has a MAX-only orderbook. Consequently, several airlines are evaluating the possibility of ordering A320 Family aircraft at the likely expense deferring fleet renewal.

To some extent, the MAX delays may have been fortuitous: the pace of traffic growth remains well below that of 2018 amidst a weaker economic backdrop in some of the region’s key economies, combined with trade tensions between the US and China and more recently between Japan and South Korea. The protests in Hong Kong have also contributed to subdued regional passenger demand and led to acute capacity cuts to/from this important hub airport.

In the Southwest Pacific region, some of the biggest airlines have either been through or have a lull in fleet replacement; hence, the number of aircraft delivering to this region is minimal. There is a chance that these could be accelerated should other regions begin deferring deliveries.

Sign in to post a comment. If you don't have an account register here.