in Lessors & Asset managers , Capital Markets

Tuesday 7 April 2020

Lessor bonds: Ratings agencies bearish on lessors, while new issuances drop

Ratings agencies have become more bearish on the aircraft leasing sector with Fitch and Moody’s changing their outlook on the sector from stable to negative. Lessors issued fewer bonds in 2020 Q1 year-on-year, and many lessors have seen spreads widen on existing notes.

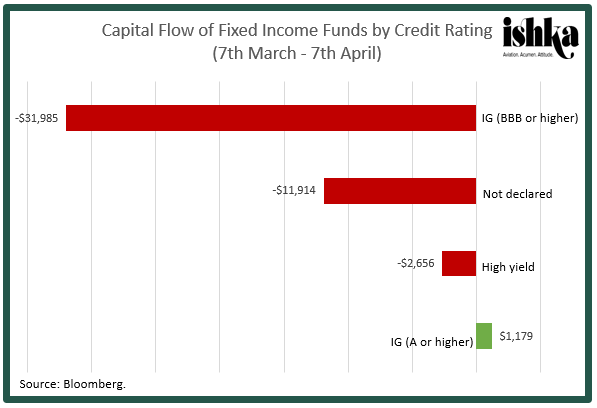

Separately, sub-A rated investment-grade instruments, which would include most aircraft lessor bonds, have seen record levels of capital outflow in the last few weeks.

Bloomberg data shows that fixed income facilities have recorded $45.7 billion of capital outflows in the past 30 days as investors reel from the world’s various coronavirus lockdowns. This is versus $40.6 billion inflow for equity funds, $11.7 billion inflow for commodities and $6.7 billion in the money markets.

Sub-A rated IG instruments have been the hardest hit, losing $32 billion compared to an inflow of $1.2 billion for facilities rated A or higher. This could spell bad news for aircraft leasing fixed income instruments. Out of a sample of 274 currently trading lessor bonds, just over half (51%) have are IG-rated by at least one rating agency. Of these IG bonds, only 48% by both Fitch and S&P’s standard are rated A- or higher.

At the same time, a flurry of rating cuts has swept through the financial markets, with Deutsche Bank reporting that $90 billion of debt was downgraded to junk in March alone. Last week, Moody’s cut its outlook for the aircraft leasing sector to negative from stable and revised the outlooks of five IG-rated lessors – AerCap (Baa3 backed issuer rating), Aviation Capital Group (Baa2 issuer rating), Avolon (Baa3 backed issuer rating) and DAE Funding (Baa3 backed long-term senior unsecured) – to negative. The agency did, however, affirm those IG ratings.

This is not to say, however, that IG bonds have been immune as the coronavirus lockdown spread globally. Investors have also flown from IG bond funds, with data from Refintiv revealing a record-breaking $35.6 billion of outflows from US IG bonds in the seven days following 11th March.

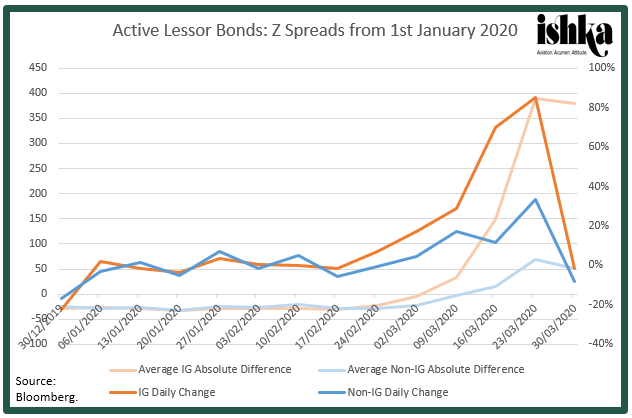

Lessor IG bonds: Widening spreads

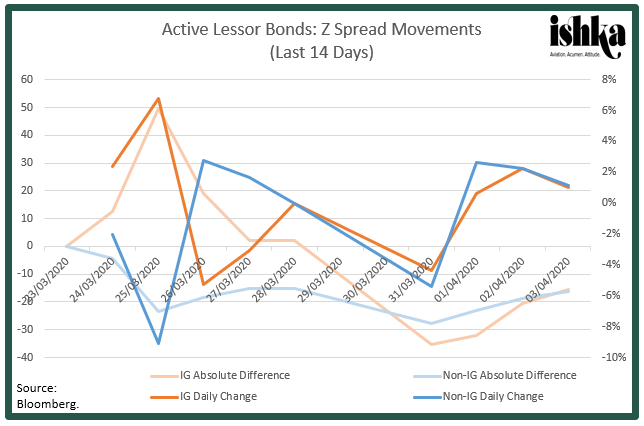

Separating out IG and non-IG lessor bonds shows that Z spreads on IG lessor bonds widened more than twice as much as those of non-IG lessor bonds during February and March. At their peak, IG spreads were nearly 80% higher at the end of March than they were at the beginning of the year. Non-IG bonds, on the other hand, were only around 38% above the beginning of 2020 levels at this same time. Widening on Z spreads have stabilised on both IG and non-IG lessor bonds somewhat over the past week – though only comparative to the previous dramatic movements of the past two months. As of 6th April, Z spreads remain, on average, around 400bps higher on IG bonds and 40bps higher on non-IG bonds than they were at the end of 2019.

New lessor bond issuances drop in Q1

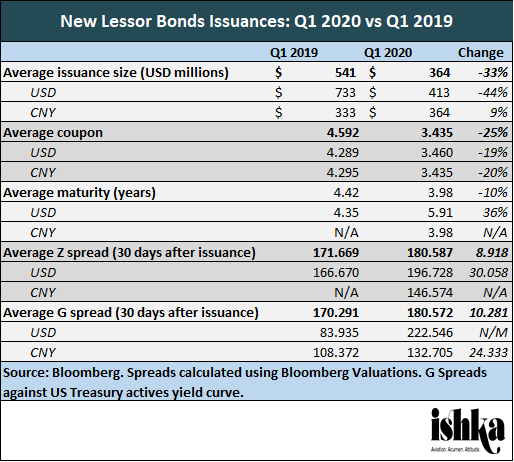

Lessors were less active year-on-year (YOY) in issuing new bonds in Q1. Ishka is aware of $6.6 billion raised in 18 new unsecured and senior unsecured lessor bond issuances in Q1 2020. The same sample of lessors issued $8.1 billion in new bonds in Q1 2019, meaning a 19.3% YOY decrease in volume.

Analysis of a sample of bonds issued by lessors in 2019 Q1 versus 2020 Q1 shows wider comparative Z spreads in 2020. 2019 Q1 bonds were trading with an average spread of 171.669 30 days after issue where 2020 Q1 bonds were at an average of 180.587. Ishka has previously reported that spreads on active lessor bonds are widening disproportionately on bonds issued by non-Chinese lessors (though not necessarily CNY-denominated bonds) (see Insight: ‘Covid-19: Spreads widen on non-Chinese lessor bonds’). As no Z spread data is available for CNY bonds issued in Q1 2020, it is hard to conclude that the same pattern has occurred across Q1 2019 and 2020 for USD and CNY bonds.

2020 Q1: New lessor debt

As fixed income markets see investors pull back, lessors have also been turning to bank loans to maintain liquidity (see Insight: ‘Viral Capital: Airlines, lessors draw down billions of debt in days’). BOC Aviation stated it had raised an additional $1.3 billion from the debt markets – both loans and bonds – in Q1. Avation, meanwhile, has requested alterations to the amortisation profiles of its commercial debt to match its new cashflows, including its relief packages for its lessees.

Avolon fully drew down its $3.2 billion unsecured revolving credit facility in Q1. The lessor also repriced a secured warehouse facility at LIBOR plus 1.50% and extended it maturity from 2020 to 2024, while reducing commitments from $1 billion to $650 million. Avolon stated it had received rent relief requests from more than 80% of its airlines, accounting for more than 90% of Avolon’s annual rental cashflow.

Chorus Aviation, whose largest customer is Air Canada, has requested a two-year unsecured USD $100 million unsecured revolving credit facility from Export Development Canada, with covenants including an event of default being triggered if there is a change in control of Chorus. The lessor is also in the process of raising between $30 million and $50 million secured against four aircraft.

The Ishka View

Capital outflows from sub-A rated instruments could spell trouble for some lessors which have been reliant on the bonds market for liquidity. The recent move by Moody’s, who affirmed its current lessor ratings, but changed its outlook on the sector from stable to negative has not helped either. Many investors have internal policies which require them to hold only IG-rated debt, particularly insurance and pension funds. Ishka suspects that investors, spooked by the impact of the Covid-19 crisis on airlines, could be seeking to sell positions ahead of a feared possible ratings downgrade for lessors. This would partly explain the wider spreads on IG lessor bonds as investors react to the global market disruption.

But lessors are also continuing to tap the commercial debt market. Those announcing them are frequently the largest lessors, such as Avolon and BOC Aviation, which have strong liquidity and are likely to negotiate favourable terms. Smaller leasing platforms are likely to face a harder time to shore up capital to weather the current crisis.

Sign in to post a comment. If you don't have an account register here.