in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Tuesday 14 April 2020

Ishka and Oriel cut aircraft values as airlines look to reduce fleets

Appraisers at Oriel and Ishka cut asset values and lease rates in early April across various aircraft types due to the coronavirus crisis and warn that further cuts are likely. Hit by sudden and likely year-long capacity cuts, airlines around the world are looking to rationalise their fleets even after the global lockdown lifts.

“There’s obviously a lot of older aircraft that probably will not see the skies again,” said Olga Razzhivina, director at Oriel and a senior ISTAT appraiser. “Even the aircraft that do remain with their current operators will be experiencing a lease rate reduction or holiday which will affect the overall lifetime earning potential.”

Sources state that many other appraisers are holding off on a lease rate or values cut due to the current transaction vacuum beyond airlines issuing sale-leasebacks as they look to free up capital.

“If we see any aircraft being returned today, the next lessee might be at a 25% lower lease rate,” said Eddy Pieniazek, head of Ishka Advisory. Airlines may be returning aircraft on operating leases with the view of “cherry-picking” aircraft two or three years later that have been returned by weaker credit airlines, said Razzhivina, when they “[might] pick up a younger aircraft at better rates.”

Ishka understands that for most lessors, at least 80% of lessees have asked for rent holidays, usually for around three months (see Insight). Razzhivina speculates that the 20% of airlines not asking for rent deferrals are either returning aircraft this year as a going concern and are not expecting any leniency or airlines that are not expecting to survive the crisis.

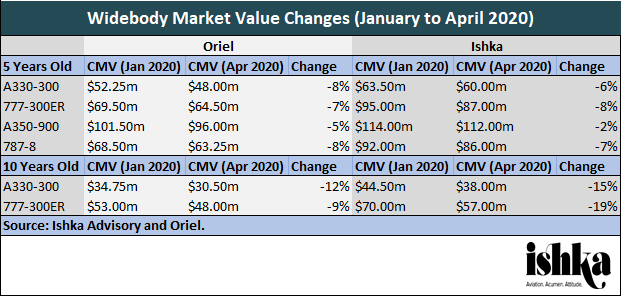

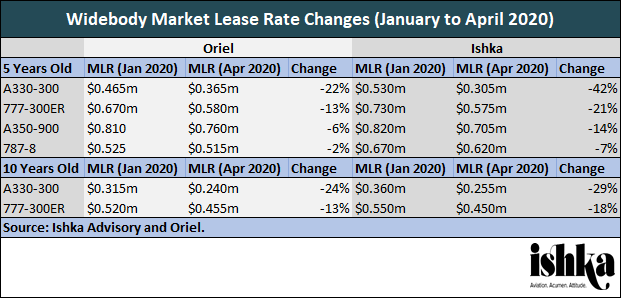

Widebodies: Pre-crisis weakness leading to deep value cuts

Both Oriel and Ishka Advisory recorded widebody aircraft values and lease rates as taking some of the deepest cuts, citing pre-crisis overcapacity and overreliance on key markets. Both highlighted midlife A330s and 777-300ERs coming to the end of their leases in 2020 as an uncertainty for their owners even before the coronavirus pandemic. Razzhivina, however, stated that in production widebody aircraft were in it for the “long haul” for airlines maintaining their widebody capacity.

A330s were hit hard by a slew of airline bankruptcies towards the end of 2019 that flooded the market and left many grounded (see Insight: ‘Airline bankruptcies compress A330 lease rates even further’). 777-300ER values had a slight boon in the form of 777X delays (see Insight: ‘777-300ER lease rates hold on the back of 777X delay’) and news of a coming freighter conversion programme. However, Razzhivina cautioned that the conversion programme is “not a panacea”, expecting that it will, by large, only impact aircraft coming through large operators and lessors.

Despite some weakness preceding the current crisis, appraisers still thought the widebody market would be hit disproportionately. Governments will ease lockdowns at different rates, so air travel’s restart will begin with domestic travel and therefore narrowbody and regional aircraft, Pieniazek argues. Passengers are also likely to be shy of straying too far from home, Razzhivina said, while memories of those stranded abroad during the pandemic remain.

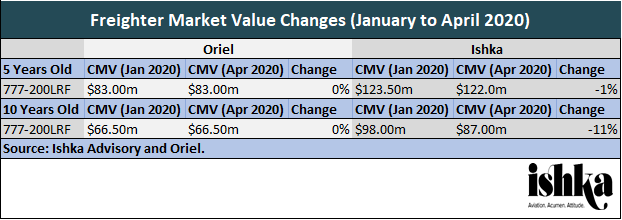

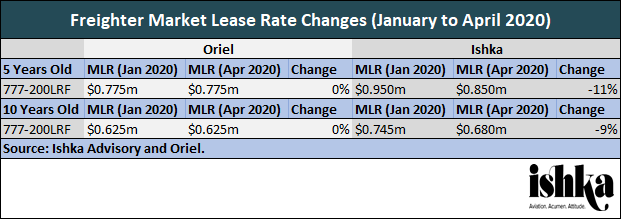

Cargo: Resist bounce-back “exuberance”

Airlines including Etihad, Jin Air and Qatar have been using their passenger widebody aircraft as freighters during the pandemic, transporting medical supplies. However, Razzhivina cautioned against over-exuberance on the cargo side; while China, a leader in global cargo operations, is coming out of its lockdown, the rest of the world is shutting down.

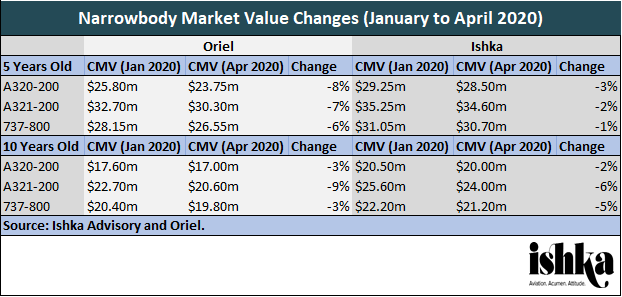

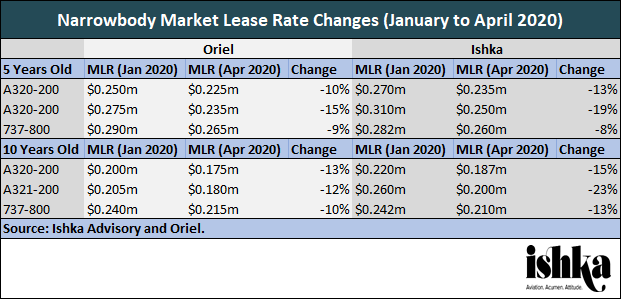

Narrowbodies: “Moderate” reductions on current gen

Ishka Advisory and Oriel expect “moderate” value reductions on current generation narrowbodies during the current downturn. For narrowbodies, both appraisers saw the largest drop in values on five-year A320-200s and 10-year A321-200s.

While A320ceo values had seen some boost as of late from neo delays and 737-800s from the MAX grounding, both are “effectively end of line assets,” said Pieniazek. “We saw some demand for cover as of late, but that has obviously dissipated now.” Pieniazek noted a “slow drip-feed” of NG retirements at the moment, along with A319s, and forecasted accelerated retirements in 2020 and 2021. These would be “true retirements” for current generation narrowbodies, said Razzhivina, with operators no longer needing the lift rather than because their engines are worth more than the aircraft itself.

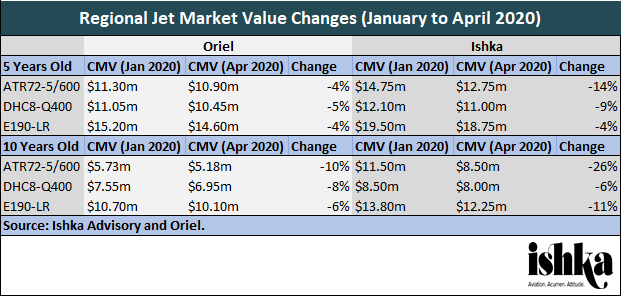

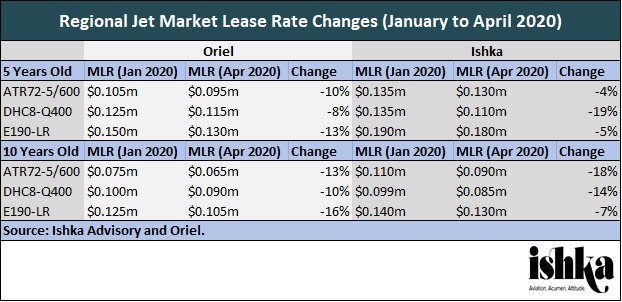

Regional jets: Question mark over fleet rationalisations

Although appraisers thought that regional air travel would start up again before long haul, many individual regional jet programmes had enough issues to see their values hit harder than those of narrowbody aircraft.

ATR72-500s and -600s suffer from overproduction and weaker customers, according to Ishka Advisory, despite freighter conversion options. On Dash8-Q400s, Pieniazek described the Flybe bankruptcy as a “big overhang” (see Insight: ‘Flybe finally folds’). Flybe operated around 10% of the world’s active Q400 fleet, primarily midlife aircraft. Razzhivina, however, pointed out the Q400’s lower production numbers in recent years as keeping a level of control on supply.

Razzhivina also warned that E190s were “quite vulnerable” to wholesale fleet rationalizations, with airlines like Air Canada, American Airlines and Azur already announcing plans to phase the type out.

The Ishka View

With airlines looking to rationalise their fleets after the global lockdown recedes, which aircraft types will survive the cull? Airline schedules will give an indication of where carriers are cutting their fleets, but, for now, appraisers at both Oriel and Ishka have tipped the ‘out of production’ aircraft as among the first to be dropped from fleets. Correspondingly, those aircraft (especially widebodies) saw the greatest dip in values initially, from both appraisers.

Both appraisers emphasised the increased volatility of lease rates over aircraft values, along with the wider range of factors that need to be considered when reaching a valuation. These include airline credit, maintenance reserves and return conditions. Many airlines will also forego lease extensions on aircraft coming to the end of their leases this year, which are often considerably higher than the off-lease market rate.

For more information on Ishka Advisory's aircraft values, contact eddy@ishkaglobal.com.

Sign in to post a comment. If you don't have an account register here.