in Aircraft values, Lease Rates & Returns , Aviation Banks and Lenders

Wednesday 3 March 2021

A look at 5-year old aircraft values, Airbus’ loss, Chorus’ results and the Mexican 737 auction

This is a regular series from Ishka’s ‘Transaction Economics’ service. It delivers ‘the Ishka View’ on events that have a bearing on the near-term performance of aircraft values, lease rates, and the market dynamics that matter under today’s market environment.

IMPACT INTELLIGENCE 15th FEBRUARY – 26th FEBRUARY 2021

A DIFFERENT SPRING? Events and environment are conspiring to make it a challenging Q1 – Order cancellations and aircraft returns (Norwegian), aircraft groundings (for certain PW4000 powered B777s), to delayed B787 deliveries lease ‘renegotiation’ (see Malaysian), rightsizing (see the new Alitalia – ITA, now only 43 aircraft proposed), scheduled lease returns with no onward leases, and a mixed bag of lessor financials and refinancing’s - and still no passenger traffic rebound to write home about….Cargo remains one of the brighter spots, yet the ingredients for a wider recovery continue to be assembled. A lot is riding on a summer season ‘snapback’…..

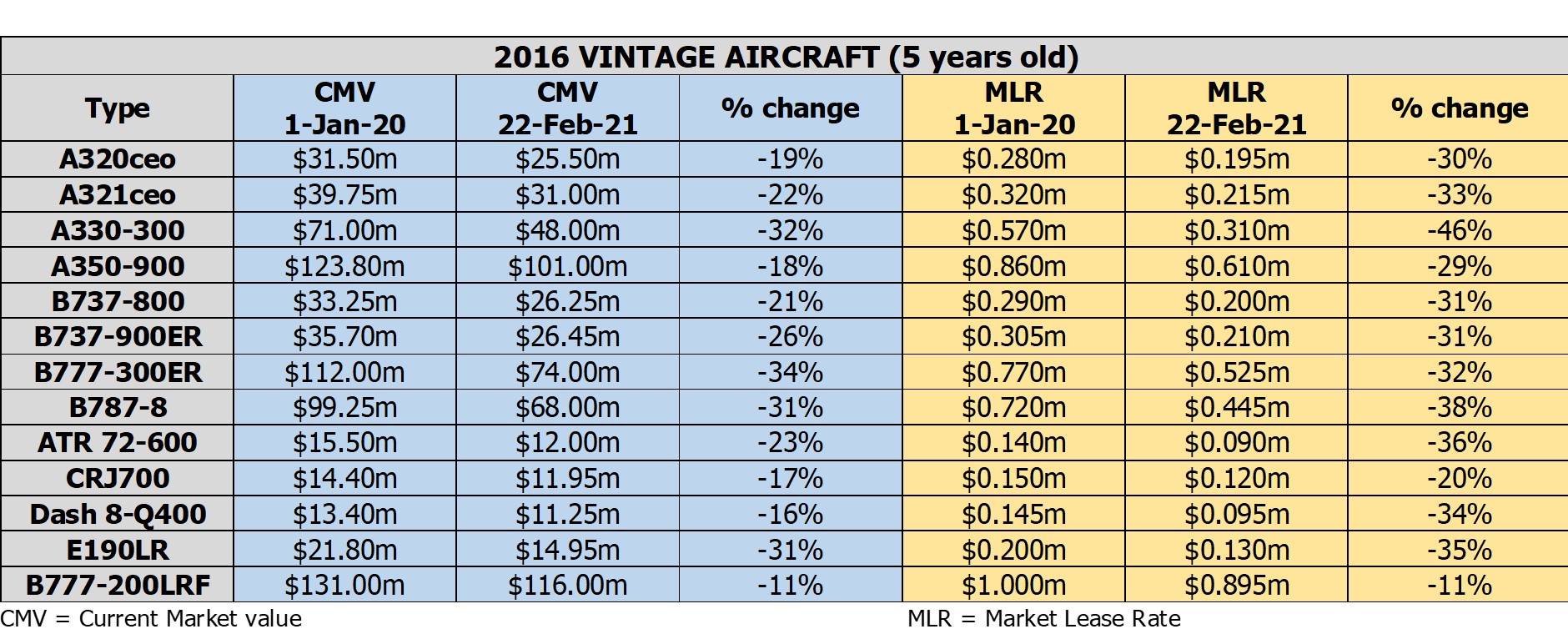

5-YEAR-OLD AIRCRAFT VALUES & RENTALS

As part of our regular series, we are providing a look at value and lease rates movements, comparing our view today with our view at the start of last year. This week we are looking at a mix of 5-year-old aircraft (2016 vintage). The values and lease rates assume aircraft are off-lease and available at each point in time and are illustrative of the changes seen to CMV and MLR rates over the last 14 months. Today there are many ‘Power-by-the-Hour’ (PBH) lease deals underway, rather than fixed rentals, at least in the initial months of an agreement, but our MLR rate is intended to reflect the underlying sentiment for that aircraft and vintage.

NOTE: The Values behind the above data reflect unencumbered aircraft and reflect what might be achievable based on the prevailing market conditions. ISTAT definitions apply. Values reflect Basic Configuration aircraft in ‘half-life’ or better condition. In reality, many aircraft are likely to be of a higher than basic specification. This data is for comparative and trend observation purposes. For more detailed appraisal and valuation information please contact the Ishka team.

THE ISHKA INDICATORS

LESSORS POST PROFITS FOR FY2020…Despite the pandemic, Air Lease Corporation (ALC) total revenues remained fairly flat, dropping by only 0.1% to $2.015bn from 2019 total revenues of $2.017bn. ALCs rental revenues increased by 2% from $1.92bn to $1.95bn, while revenues from aircraft sales and trading dropped by 31% from 2019’s $100m to 2020’s $69m. The lessors’ depreciation expenses increased by 11% from $703m to $781m y/y, while net profit came in at $501m, a 13% y/y drop from FY 2019 revenues of $575m. At the end of 2020, the lessor owned 332 aircraft, a 14% y/y increase, while its investments in aircraft on operating lease dropped by 55% y/y, from $3.7bn to $1.6bn. At the end of 2020, the lessor held $1.73bn in cash and cash equivalents, while at the end of 2019 it held $320m in cash. The lessor also managed to reduce the composite interest rate on its debt from 3.34% at the end of 2019 to 3.13%. The lessor’s collection rate for 2020 stood at 88%. ALC also informed the market that it expects its collection rate to remain under pressure due to the pandemic. Chorus has also posted its 2020 results, having generated $753m in revenue for 2020, a 31% drop from its 2019 revenues of $1bn. The regional aircraft lessor and aviation services company has posted an operating profit of $90.9m for 2020, a 43% drop versus operating profits of $159m in 2019. The company also generated a net profit of $32.9m in 2020, down 69% from 2019. Chorus’ leasing unit generated a net loss for 2020 of $38.3m, having assumed impairments of $52.4m for 2020. The company attained a 60% revenue collection rate for Q4, a 10-percentage point increase over the collection rate of 50% for Q3 2020.

AIRBUS POSTS NET LOSS FOR FY2020… Airbus Group reported 2020 revenues of $60.5bn, having delivered 566 aircraft, while orders for the year totalled 268. The OEM had reported total revenues in 2019 of $85.5bn, indicating a year-on-year (y/y) drop of 29%. Airbus’ commercial aircraft arm generated $40.7bn in revenues in 2020, a 38% drop versus 2019 revenues of $65.6bn, and an operating loss of $1.6bn for the period – for 2019 it had posted a $2.2bn operating profit. At the end of 2020 Airbus held $17.5bn in cash and cash equivalents, an increase of 55% versus its 2019 cash position. At the end of 2020, the OEMs backlog stood at 7,148 aircraft, a slight reduction from 2019’s 7,482, while its inventory reduced by $1.3bn as the OEM reduced its work in progress having cut production rates during 2020.

UK COURT APPROVES MALAYSIA AIRLINES RESTRUCTURING…Malaysian Airlines’ parent company’s (MAG - Malaysia Aviation Group) restructuring plan was given approval by a UK court for a deal between its leasing unit and the majority of its lessors. MAG stated the scheme received unanimous support from relevant lessors allowing the airline to implement its plan. Khazanah Nasional, Malaysia’s sovereign wealth fund, will also inject $890m to fund the airline through 2025.

THE TRANSACTION VACUUM

Finnair has completed a new sale and leaseback agreement for an A350-900 with JLPS Holding Ireland Limited. The aircraft is expected to be delivered to the airline by Q2 2022 on a 12-year lease term. Finnair notes that the transaction would have a positive cash effect of more than $100m when compared with the option of Finnair owning and operating the aircraft. Titan Aircraft Investments (TAI), the Titan Aviation / Bain Capital Credit JV, has added its first aircraft to the portfolio - a B777F. The aircraft was acquired from Atlas in November 2020 and has been leased back to the group. Tajik Air has put its sole widebody, a 34-year-old B767-300 up for sale. The aircraft has been parked since 2019 and had previously been operated by Delta Air Lines and Tradecraft Air. Dubai Aerospace Enterprise has signed long-term lease agreements for a batch of seven CFM LEAP-powered A321neo aircraft which are due to be delivered to IndiGo in 2021. According to Airbus, IndiGo has to date taken 120 of 332 A320neos on order and 30 of 398 A321neos on order. The airline also holds orders for 25 ATR 72-600s. The Mexican Air Force is auctioning a set of aircraft, including a 33-year-old VIP-configured B757, with an initial price of $2.75m, and a VIP configured 32-year-old B737-300, which is being auctioned with a $1.6m starting price.

SPOOLING UP… KLM has received its first E195-E2 aircraft, part of an orderbook featuring 25 firm orders and 10 options. The E2 aircraft are being leased, with 10 from ICBC and 15 from Aircastle. KLM’s regional arm – Cityhopper - currently operates 17 E175-E1s and 32 E190-E1s. Itapemirim is preparing its start of operations with the anticipated arrival of an A320ceo, part of a set of 10 aircraft the airline expects to phase in. The 151/2-year-old aircraft was, until September 2020, operated by Vueling Airlines. Recent reports suggesting that Thai Airways International was planning to buy 20-30 aircraft in 2025 have been denied by the airline’s president, who has added that when demand goes up, the airline is more likely to lease aircraft rather than own. StarBlue Airlines has requested clearance to operate from Bucaramanga, Colombia, with either A320, ERJ145, E170 or E195 aircraft on both domestic and regional flights in Latin America. Air Lease Corporation has announced long-term lease placements for 2 used A320ceos with Qanot Sharq Airlines which deliver this March and are the first two aircraft in the fleet of the Uzbekistan start-up airline.

Citilink now plans to add five more ATR 72-600s to its fleet during 2021 to support domestic network growth, having previously planned to add them in 2020. The airline currently operates 7 ATR 72-600s, 41 A320ceo, 10 A320neo, and two A330neo. Jazeera Airways is considering an order for 13 aircraft as part of plans to increase fleet size from 17 to 30 by to 2025. The airline has previously considered adding A320s, B737s, A220s or Embraer E2s. Singapore Airlines has removed one of its A380 from storage to undergo refurbishments to its First and Business class cabins. The aircraft is a 9-year-old unit, first delivered to the airline in 2012.

SPOOLING DOWN… Jin Air reportedly returned two B737-800s to lessors last month. The airline is also planning on returning two additional 737-800s to lessors soon. According to ch-aviation the airline currently owns one B737-800 and one B777-200ER, and leases 21 B737-800 and 2 B777-200ERs. Air Serbia has decided to accelerate the phase-out of 2 B737-300s, retiring them in Q1 rather than at the end of 2021. Air France is set to retire four B777-200ERs by Q2 2021, replacing the aircraft with A350-900s. The airline has 25 B777-200ERs with an average age of 21 years - 11 are currently inactive with 14 operational. Edelweiss Air is reportedly planning to reduce fleet complexity by removing its two A330-300s from the fleet by end 2021. The airline operates four A340-300 aged on average 17 years, while the two A330-300s are on average eight years-old and leased from AerCap. Air Namibia will reportedly return its two A330-200s to Castlelake. Finnair is set to dismantle and recycle a 21-year-old A319 for parts. British Airways has officially scrapped its last A318, a 12-year-old all-business configured aircraft, which was used on the London City – JFK route. Boeing has ferried a B787-9 to Victorville for temporary storage, the aircraft is set to be operated by Air Premia, which plans to start operations with 3 B787-9s. The Irish High Court has heard that progress is being made on settling Norwegian Air Shuttle’s (NAS) liabilities with lessor ICBC, which would end the leases of 10 aircraft to NAS subsidiaries. Another lessor, Aercap, has reportedly indicated it would not oppose Norwegian’s application to end its leases. In another development in the Irish High Court, it appears that Norwegian, Arctic Aviation Assets and Airbus have agreed ‘the terms of a consent order’ which would cancel the aircraft the group has on order. Norwegian originally ordered 100 A320neo aircraft, and currently has 88 orders outstanding, including 58 A320neos and 30 A321neoLRs, after several order refinements. Under the terms, Airbus will keep any prepayments it has already received and is also due another $847,800 from Norwegian. Aerocircular, the recently established aircraft dismantling business at Ostend, Belgium, this week received the first of seven Lufthansa A320ceos for part out, all of which are over 20 years old. All seven are due by mid-May 2021. Aerocircular had earlier dismantled a Lufthansa A319 in Frankfurt.

CARGO CORNER

Sequoia Aircraft Conversions and Split Rock Aviation have agreed to market a second B777-300ER freighter conversion programme. The programme includes Sequoia Aircraft Conversions, the Kansas Modification Center, and the National Institute for Aviation Research at Wichita State University. Texel Air has ordered its first B737-800BCF to add to its fleet. The carrier operates three 737s, including one -700 and two -300s. It would become the first in the Middle East to operate a B737-800BCF aircraft. Titan Airways has agreed to wet-lease an A321P2F aircraft to Amerijet on a proof-of-concept basis, while some of Amerijet’s B767Fs are undergoing maintenance. Amerijet currently has 14 aircraft in its fleet, including two B727F, three B767-200BDSF, one B767-200SF and seven B767-300ER BDSF aircraft. SmartLynx Malta has entered partnership with DHL Express where its two newly acquired A321P2Fs will support DHLs European network. SmartLynx Malta will acquire two more A321P2Fs this year and up to four more in 2022. Air Incheon has added a B737-800SF, on lease from Aviation Holdings III Investments.

AIRCRAFT VIEW

PW4000-112” POWERED B777s SUBJECT OF EMERGENCY AD…The US FAA has issued an emergency Airworthiness Directive (AD) requiring the inspection of fan blades on the Pratt & Whitney PW4000 (112”) engines prior to their return to service, following the uncontained engine failure experienced by United Airlines flight UA328 last week. There are approximately 128 B777s powered by the PW4000-112” engine, and the directive applies only to the PW4000-112” model, on which the fan blades are unique to this engine type. The process will require shipment of the fan blades to P&W where Thermal Acoustic Imaging (TAI) inspections will be used to confirm airworthiness. According to Boeing, 69 aircraft of the type were in service while 59 are in storage. Boeing has recommended all such aircraft are grounded pending investigation. United, All Nippon ANA, Korean Air, JAL and Asiana are the major operators.

DASH 8-400 PRODUCTION TO BE PAUSED…De Havilland Aircraft of Canada has stated that production of the Dash 8-400 will be paused at the end of the first half of 2021 after the OEM completes production of all remaining currently confirmed orders for the type. Deliveries will continue until the end of 2021. According to CAPA data the OEMs orderbook totals 30 aircraft although some may no longer be firm (15 were to be delivered to SpiceJet, two to Biman Bangladesh, three to Ethiopian Airlines, three to France’s Securite Civile, three to TAAG and four to unknown customers). The Production facility at Downsview is being vacated (having previously been sold and leased back) by the end of 2021, and the OEM hopes to resume deliveries using new production facilities elsewhere, subject to demand.

Click here to download this report in a PDF format..

Sign in to post a comment. If you don't have an account register here.