in Lessors & Asset managers , Aviation Banks and Lenders

Friday 6 August 2021

Prices climb for 2013 vintage 737-800NGs vs A320ceos

Limited availability for 2013 vintage B737-800NGs has seen purchase prices and lease rates for the aircraft type overtake 2013 vintage A320ceos, according to Ishka’s latest pricing benchmark.

When it comes to utilization, B737-800 leads the way with around 86% of the 2013 vintage fleet currently in service, while the A320ceo figure stands at 78% for the same vintage. The B737-800 has a wider active base of 4047 (out of 4742 aircraft), while the A320ceo is seeing less aircraft in service, around 2800+ out of 4000 are currently in service, while 1300+ are inactive.

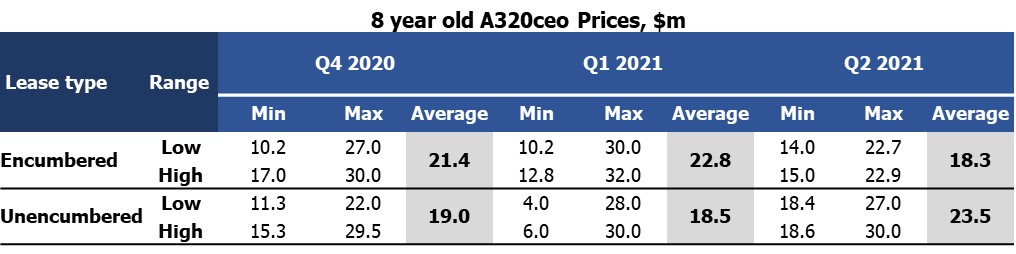

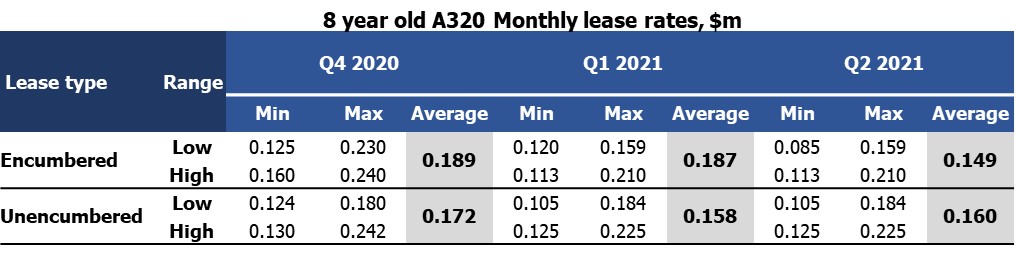

According to Ishka’s pricing benchmark, the average price for an encumbered eight-year-old A320ceo has fallen by nearly 20% from Q1 to Q2, while the average price for an encumbered eight-year-old B737-800 has risen by 4% in the same period.

Market sources indicate there is still a small demand from new start-up airlines that are looking at midlife narrowbody aircraft to enter the market, and some interest from Chinese lessors willing to bid higher prices for these classic variants depending on the credit quality of the underlying lessee (see Insight: ‘Sale/leaseback market heats up as more Asian lessors chase deals’).

The Ishka Aircraft Pricing Benchmark (APB) aims at (anonymously) collecting the market’s view every two months. Ishka asks market makers, including buyers, sellers and financiers (lessors, airlines, investors, aviation banks, asset managers, part-out companies, and advisors), their view on the market’s pricing and lease rates, and what they see at the two ends of the pricing spectrum. Ishka simply collects and reports on the prices the market sees, with no complex methodologies behind the numbers.

Eight-year-old encumbered A320ceo prices fall by 20%

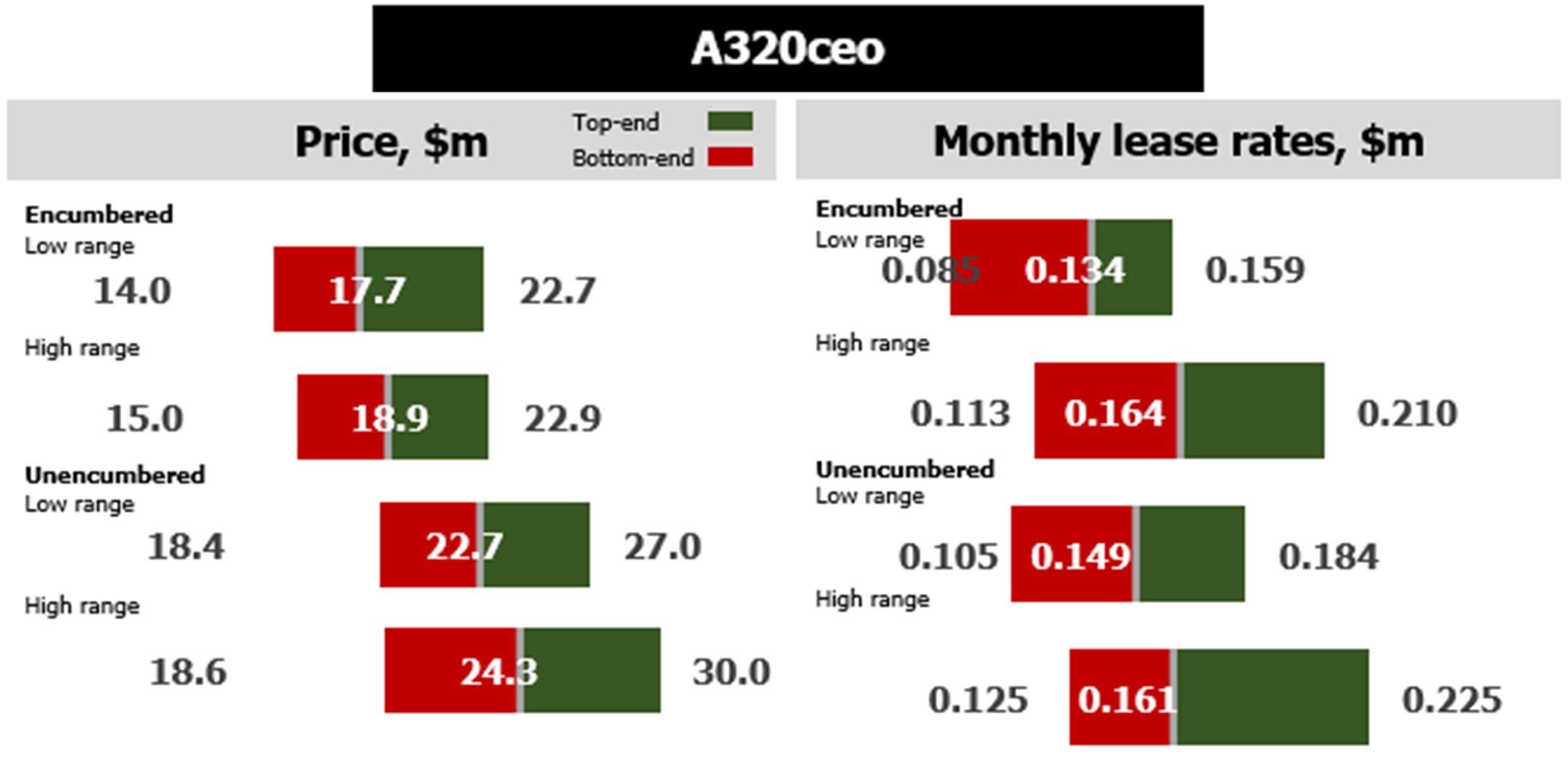

There has been a positive change on the price of an unencumbered A320 from an average of $18.5 million to an average price of $23.5 million, as seen in the table below. These are aggressive asking prices before the summer season and there is still a disconnect between bid/ask prices, as owners are unwilling to lower values and recognize losses on these assets.

It is expected that these prices will ease in the next edition of Ishka’s APB in Q3 2021. For encumbered prices, these have been pushed down, as the market’s high asking prices have now been pushed from $32 million in Q1 2021 to a maximum of $22.9 million in Q2 2021.

Comparing Q2 2021 to Q1 2021, there is a 20% negative change on the A320ceo pricing, which is mostly driven by the price range narrowing, with the lower end prices rising slightly, moving from $10 million - $14 million and at the highest end pricing coming down aggressively from $30 million to $22.7 million.

It appears that expectations remain high from the seller’s perspective on the market, with a disconnect between the ask/bid.

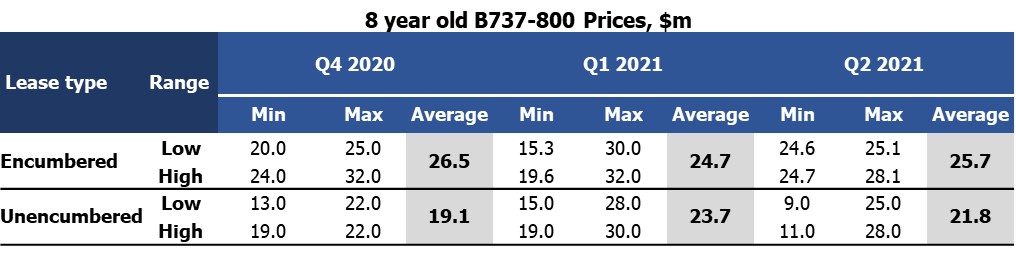

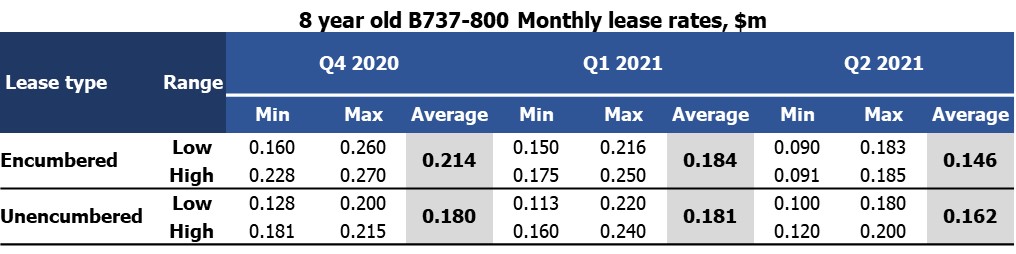

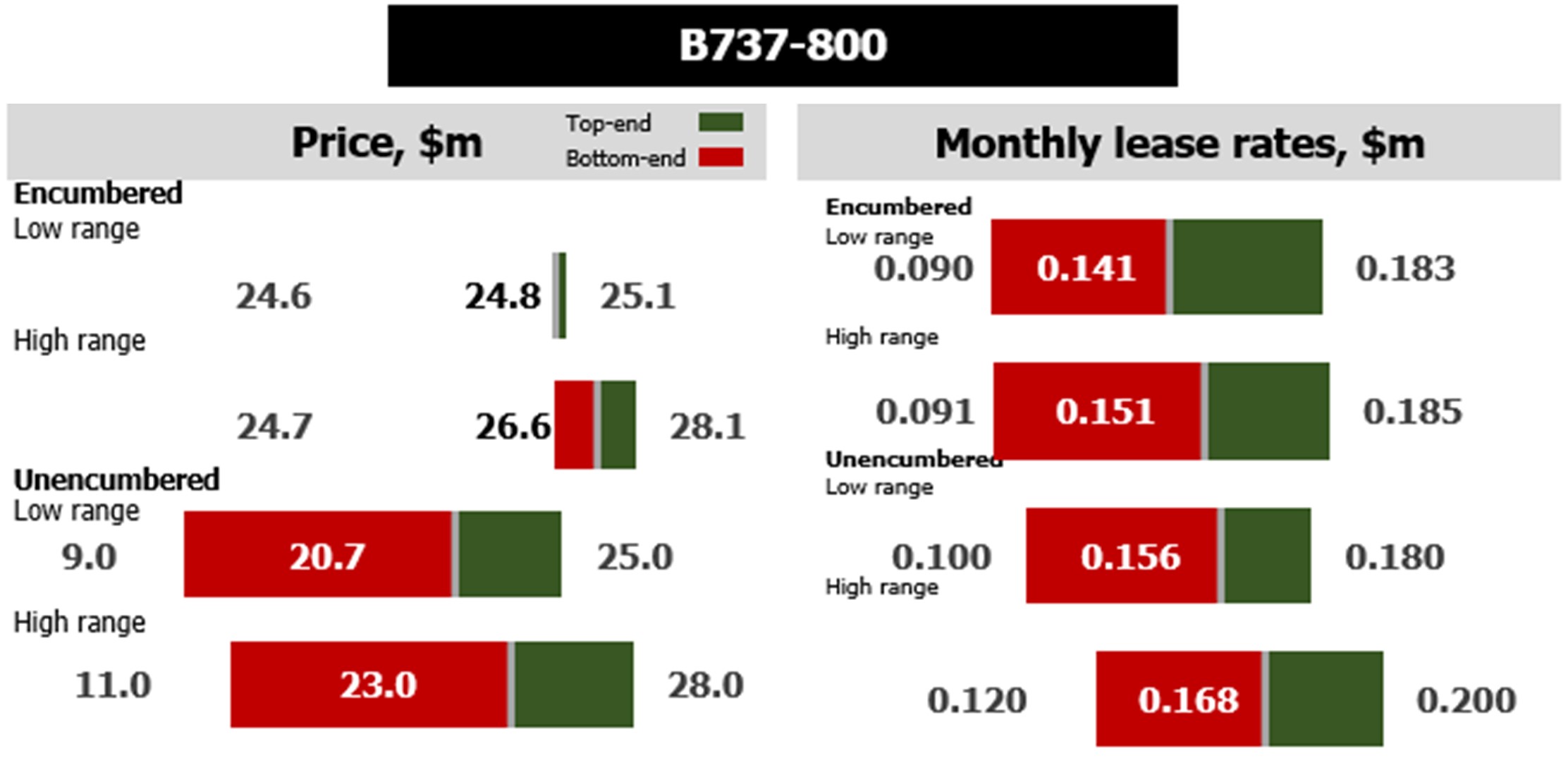

B737-800 prices stable, MLRs drop as MAX still grounded in China

The B737-800 appears to be holding its pricing levels better than the A320ceo, moving from $26.5 million at the end of 2020 to $24.71 million in Q1 2021 and slightly higher to $25.73 million.

Contributors to the APB back what the data shows – in China, airlines are using the B737-800 above the global in-service average and well above the US. The proportion of B737-800s in service with Chinese airlines currently stands at 99% (100% for 2005 and 2013 vintages). This is driven by both the Chinese domestic market’s strength and the continued grounding of the MAX.

Some activity in the market includes interest in the former Norwegian aircraft (some are expected to be converted into cargo aircraft), while the interest in certain other regions is strong, wide and varied. The demand is coming from low-cost companies including Transavia and Flybondi and from start-ups such as Flyr and Avelo

With the B737-800, lessors seem to be testing the market with unencumbered aircraft, pushing expectations higher. However, lessees still seem to have an advantage in the market, despite recent rises.

The Ishka View

The market is expecting the PBH durations to start decreasing from the 12-18 months previously noted by the Ishka APB to six months, as mostly short-medium haul air travel markets come back, and airlines see their cash positions improving. Across assets and vintages, market makers have been reporting some extreme measures from lessors to place their aircraft, again highlighting how this remains a lessees’ market, and from conversations with contributors the sentiment is that the market still shows volatility with a widespread in pricing.

B737-800 NGs have had an unnatural boost in demand from China due to the MAX grounding. China was the first to ground the MAX on 10th March 2019 and has not allowed the aircraft type to fly since. However, there are now indications that this may be changing as Reuters reported on 5th August that a Boeing 737 MAX departed for China to conduct a flight test as part of an attempt to gain approval from Chinese regulators. Dave Calhoun, Boeing CEO has said he expects the 737 MAX to win approval before the end of the year.

There are currently a lot of 2013 narrowbody vintage aircraft available, but the available aircraft is dominated by A320ceos. However, at this age the biggest range in pricing depends on the condition of the aircraft and how much maintenance is required on the asset.

Sign in to post a comment. If you don't have an account register here.