Castlelake’s new rated lessor set to chase SLBs

US asset manager Castlelake, L.P. (Castlelake) launched a new rated leasing subsidiary, Castlelake Aviation Limited (CA), last week which is set to acquire primarily “newer technology” aircraft and is expected to be an active player in the sale/leaseback market, according to ratings agency Fitch.

Sources indicate that the rated entity has been created to help the lessor raise cheaper recourse debt and unsecured financing from the capital markets.CA has been rated BB- by S&P, Ba3 by Moody’s, BB by Fitch, and BB+ by Kroll.

Ishka understands that CA, which will be managed and serviced by another Castlelake subsidiary, has acquired 71 aircraft from two of the lessor’s existing funds. CA has $100 million of equity capital provided by funds managed by Castlelake and is raising a mix of secured and unsecured debt instruments to fund the portfolio.

CA’s fleet metrics are notably different to its parent. CA’s initial fleet consists of 71 young and mid-life in-production aircraft with a weighted average age of 5.7 years and average remaining lease term of 10.3 years, according to Kroll. Castlelake, in contrast, managed 352 aircraft with an average age of roughly 12 years as of June 2020. Roughly 65% of CA’s fleet are narrowbody aircraft and 58% of the initial portfolio is expected to be Tier 1 lessees according to Fitch.

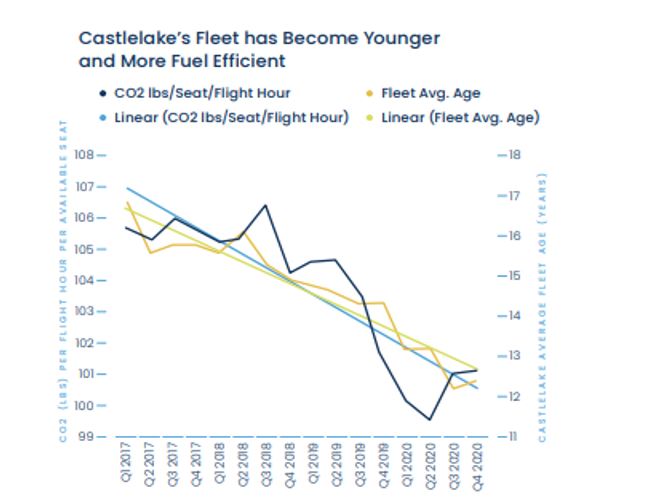

Source: Castlelake ESG presentation 2021

New lessor will chase SLBs

The new lessor is in the market with a $1.18 billion, five-year senior secured Term Loan B to be issued by Castlelake Aviation One DAC. Pricing chatter on the new term loan B facility is reported by Bloomberg to be between L+275-300 with the deal understood to be likely close this week. It has also raised a $750 million senior secured revolving facility. Moody’s noted the lessor’s initial reliance on secured debt for funding but stated the entity has plans to shift its funding to a greater composition of unsecured debt.

CA's growth will be supported by Castlelake's existing near-term pipeline of aircraft leasing deals, which the firm states includes “active” negotiations for over 40 aircraft representing over $2 billion in potential investments, primarily in newer technology assets.

Rating agency Fitch stated the lessor’s “aggressive growth strategy” will “focus” on sale/leaseback transactions and stated that it expects CA to generate annual pre-tax returns on average assets of approximately 2% in 2022 and 2023.

The rating agency added that this is “commensurate” with Fitch's 'BB' category earnings and profitability benchmark range of 1% to 4% for balance sheet-heavy leasing companies with an operating environment factor score in the 'BBB' category.

The rating agencies have highlighted several credit positives. Including the long remaining lease term, and Castlelake’s proven track-record as an aircraft asset manager.

However, the ratings agencies have also highlighted a couple of credit concerns. Both Fitch and Moody’s highlight the potential conflict of interest of an asset manager having a large leasing entity which it also both owns and manages. In addition, Moody’s also highlighted the high-concentration of AirAsia Berhad, a Malaysian airline, which makes up just under a third by value, of CA’s fleet.

The Ishka View

Castlelake has leaned into its deep structuring expertise to create a new rated leasing entity to help ease its access to the capital markets. The new entity creates strategic options for Castlelake which is still able to use warehouse financings to acquire mid-life aircraft for the ABS market, but will now also be able to access other sources of financing to become more competitive in the sale/leaseback market and new aircraft space. The new leasing entity is therefore a first important step in allowing Castlelake to eventually access the unsecured capital markets.

As returns become tighter in the space the ability to raise cheaper debt will be vital to help boost returns for investors. This is especially true for the sale/leaseback market where competition has significantly increased in the last nine months, and a space where Castlelake is increasingly active. Castlelake's timing looks fortunate. The fixed income market has generally been very robust and CA’s term loan B looks likely to price quite tightly thanks to a warm reception from a frothy CLO market. All of this bodes well for Castlelake when it does choose to issue unsecured debt.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.