in Aircraft values, Lease Rates & Returns

Wednesday 19 April 2023

Sale/leaseback update Q4 2022 / Q1 2023

Ishka's data sheet below provides a summary of recent sale/leaseback (SLB) transactions, request for proposals (RFP), key figures and active bidders. The datasheet is based on a series of reports on the sale/leaseback market.

For any questions or feedback, please email Joseph El-Helou at joseph@ishkaglobal.com or Dickon Harris at dickon@ishkaglobal.com.

SLB market overview

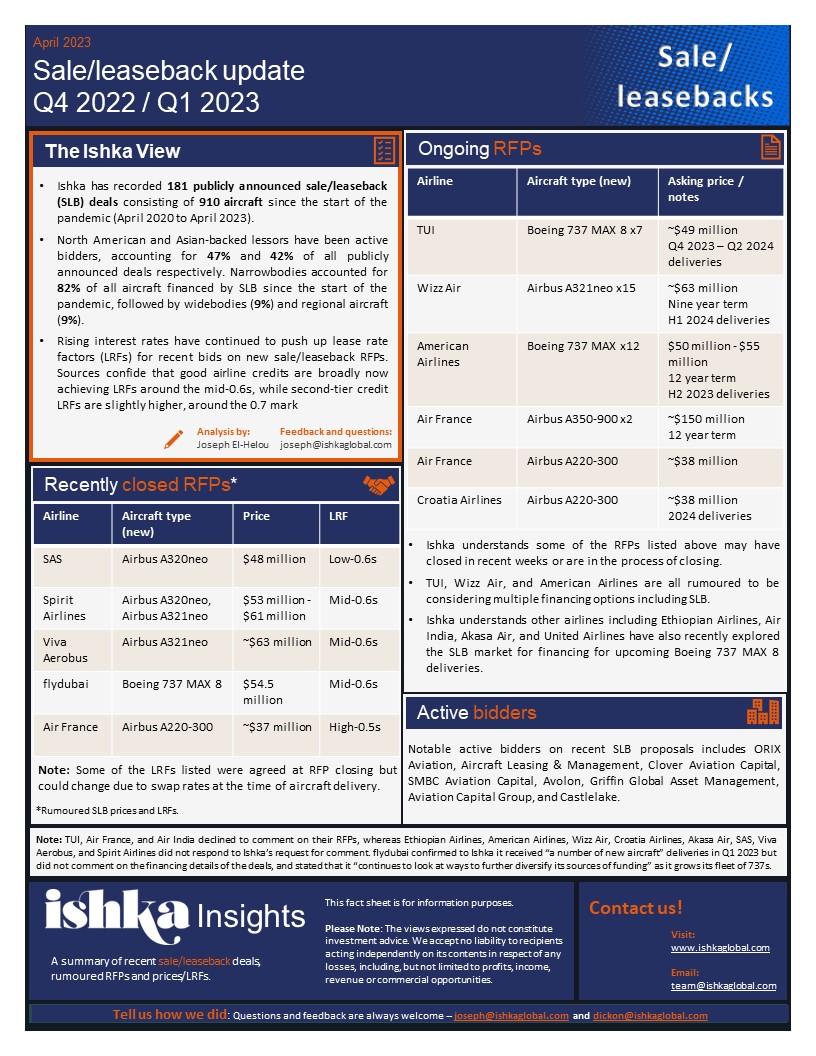

Ishka has recorded 181 publicly announced sale/leaseback (SLB) deals consisting of 910 aircraft since the start of the pandemic (April 2020 to April 2023).

North American and Asian-backed lessors have been active bidders, accounting for 47% and 42% of all publicly announced deals respectively. Narrowbodies accounted for 82% of all aircraft financed by SLB since the start of the pandemic, followed by widebodies (9%) and regional aircraft (9%).

Rising interest rates have continued to push up lease rate factors (LRFs) for recent bids on new sale/leaseback RFPs. Sources confide that good airline credits are broadly now achieving LRFs around the mid-0.6s, while second-tier credit LRFs are slightly higher, around the 0.7 mark.

Click here, or on the image below, to download the data sheet

Sign in to post a comment. If you don't have an account register here.