in Lessors & Asset managers , Capital Markets , Aviation Banks and Lenders

Monday 31 July 2023

M&A: Voyager files for Chapter 11 after agreeing Azorra sale

Listen to the article

Aircraft lessor Voyager Aviation Holdings (VAH) filed for voluntary Chapter 11 bankruptcy last week after signing a $743.5 million sale agreement for the bulk of its assets to rival leasing firm Azorra Aviation Holdings (Azorra).

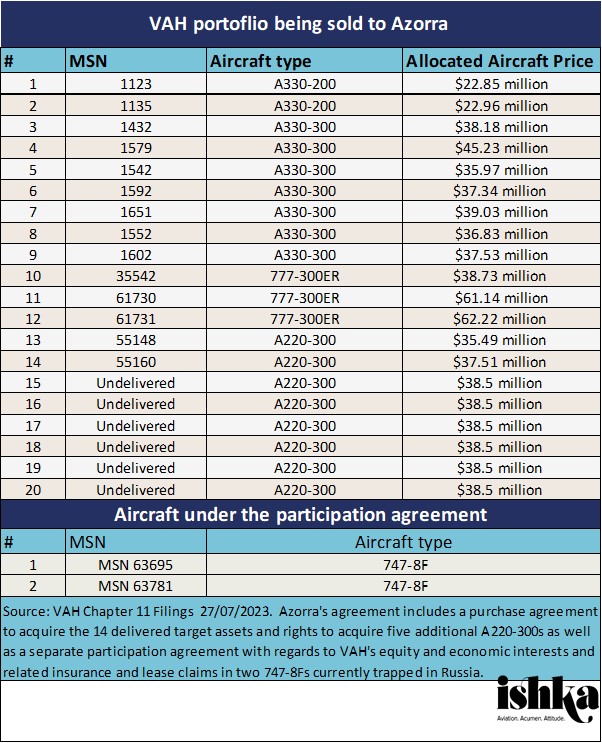

Under the terms of the sale Azorra Explorer Holdings Limited (an affiliate of Azorra) will acquire fourteen of VAH’s aircraft, “free and clear of any encumbrances” and the rights to acquire five additional aircraft leased to US carrier Breeze Airways.

The aggregate gross purchase price under the purchase agreement is up to $743.5 million, which includes the assumption of $200 million forward purchase commitments in connection with five Breeze A220s. Azorra has also signed a separate agreement for an economic participation for the two 747-8Fs, previously leased to Russia’s AirBridge Cargo, which are currently trapped in Russia. The freighters have contingent insurance policies in excess of $220 million, and primary and reinsurance policies totalling over $325 million. Azorra has made offers to retain all of VAH’s 13-strong US and European employees.

Hooman Yazhari will be stepping down from his role as VAH’s executive chair following a transition period and will continue as a non-executive Director. VAH has appointed Robert Del Genio from FTI Consulting as a chief restructuring officer.

Greenhill ran a marketing process over three months to sell VAH’s assets soliciting bids from over 60 potential bidders over two rounds of bidding. Of the thirteen potential bidders that participated in the first round, eight were invited to submit best and final offers in a second round. Six bidders submitted second-round bids (four bids for substantially all the aircraft and two bids for a subset), before Azorra was selected as the winner.

Azorra won a tightly fought battle to acquire VAH’s assets. Ishka understands other bidders included Altavair, Deucalion, and Castlelake. Sources indicated earlier this summer that Azorra and Castlelake were the leading bidders for the portfolio (see Insight).

Why Voyager chose to sell

In the Chapter 11 first-day declaration Del Genio stated VAH was hit by a “perfect storm” of macro-economic events, including the pandemic, the Russian invasion of Ukraine, and record-high inflation. These events compounded the company’s already strained portfolio, which was highly leveraged and faced lease rate step-downs on some of its aircraft in 2023.

Moreover, Del Genio explained that some of VAH’s former employees had made inaccurate statements to auditors in connection with its 2021 audit, causing a delay in the delivery of the company’s audited financials for 2021 and which, in turn, caused a ripple of defaults with the company’s aircraft financing facilities.

With only unattractive third-party financing options available, VAH had "its back against the wall", according to Del Genio, and was forced to accede to lender demands to sell certain aircraft by the end of 2023.

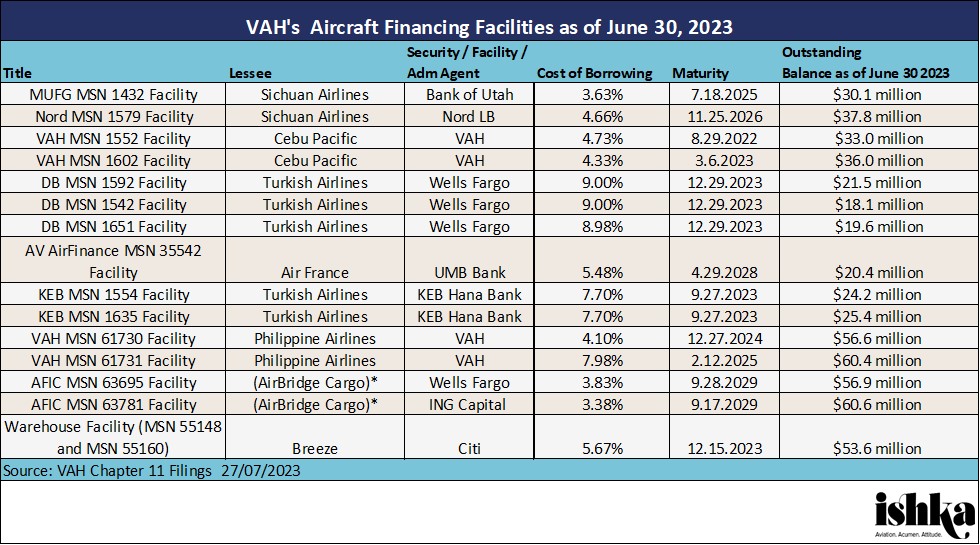

Voyager’s maturing aircraft facilities

The sale of VAH’s assets was caused primarily by the need to refinance three aircraft financing facilities set to mature between December 2022 and April 2023. The delayed 2021 audit, along with other covenant defaults, occurred as these key facilities were maturing.

According to VAH’s filing, the lenders were unwilling to refinance the maturing debt. Facing mounting pressure from the lenders under various maturing aircraft financing facilities, VAH hired Greenhill in October 2022 to explore strategic alternatives including a potential sale. The company did successfully obtain some waivers with regards to its aircraft financing lenders but these, according to VAH’s filings, came at a high cost. VAH was forced to make pay downs in excess of $50 million with respect to certain secured aircraft loans as well as agree to engage in immediate marketing and sales processes for seven aircraft across six facilities, and also agree to sell one aircraft.

Selling the seven aircraft would have left the firm “sub-scale” with negative cash flow, an overleveraged capital structure, and negative book equity, according to Del Genio. As a result, Greenhill recommended that the lessor find a buyer for the firm’s portfolio – a process which Azorra eventually won.

The Ishka View

It has been a long journey for Voyager which was, until relatively recently, one of the very few all-widebody lessors. Voyager experienced a significant restructuring in 2021 of its unsecured notes which ultimately resulted in a change in ownership from Centerbridge Partners and to Pimco and several other funds. Now, the firm it looks set to change hands again to Oaktree Capital and Azorra following the announcement of the sale agreement.

The leasing firm has suffered since the onset of the Covid pandemic. In addition to facing the continued effects of Covid, which were exaggerated for widebody aircraft, Voyager had to address a significantly delayed 2021 audit and the effective loss of two Boeing 747-8F freighters trapped in Russia, which are the subject of outstanding insurance claims. Under pressure from its secured lenders, with nearing debt maturities and with investors unwilling to inject any further funds, the lessor was forced to explore strategic options for its business.

The sale agreement to Azorra is a win for VAH's current management team which battled recent several crises but ultimately succeeded in running a competitive sales process. The resulting deal sees the transfer of Voyager’s aircraft and employees to Azorra which will be a significant expansion for the rival leasing firm from its current fleet of regional jets and narrowbodies. - once the transaction completes.

VAH’s Chapter 11 process is a sale implementation tool which will help ensure a quick sales process. Sources indicate that using Chapter 11 in this way is fairly common for US buyers, allowing investors to maximise value and help “clean up” any existing liabilities. For the Azorra sale agreement, this is pertinent with respect to the two aircraft trapped in Russia.

There are still questions about what exactly will happen to the two 747-8Fs, and Ishka will continue to monitor and update readers on the sale as it moves through the Chapter 11 process.

Sign in to post a comment. If you don't have an account register here.