in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Tuesday 3 October 2023

Asset managers survey: Returns drop for current and new-tech widebodies, but investors insist on higher ‘floor’ for narrowbodies

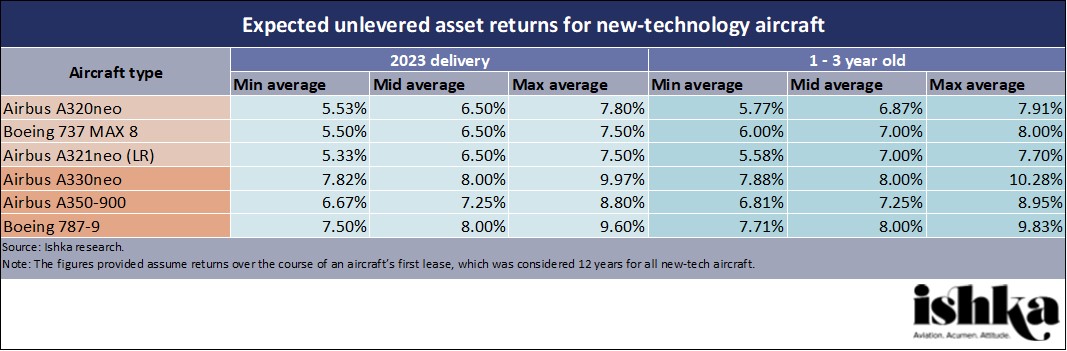

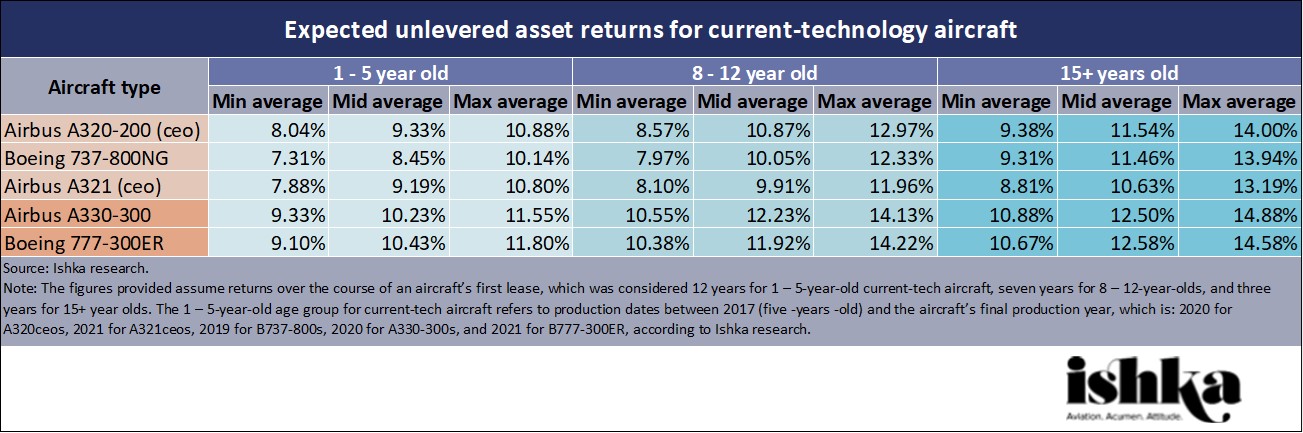

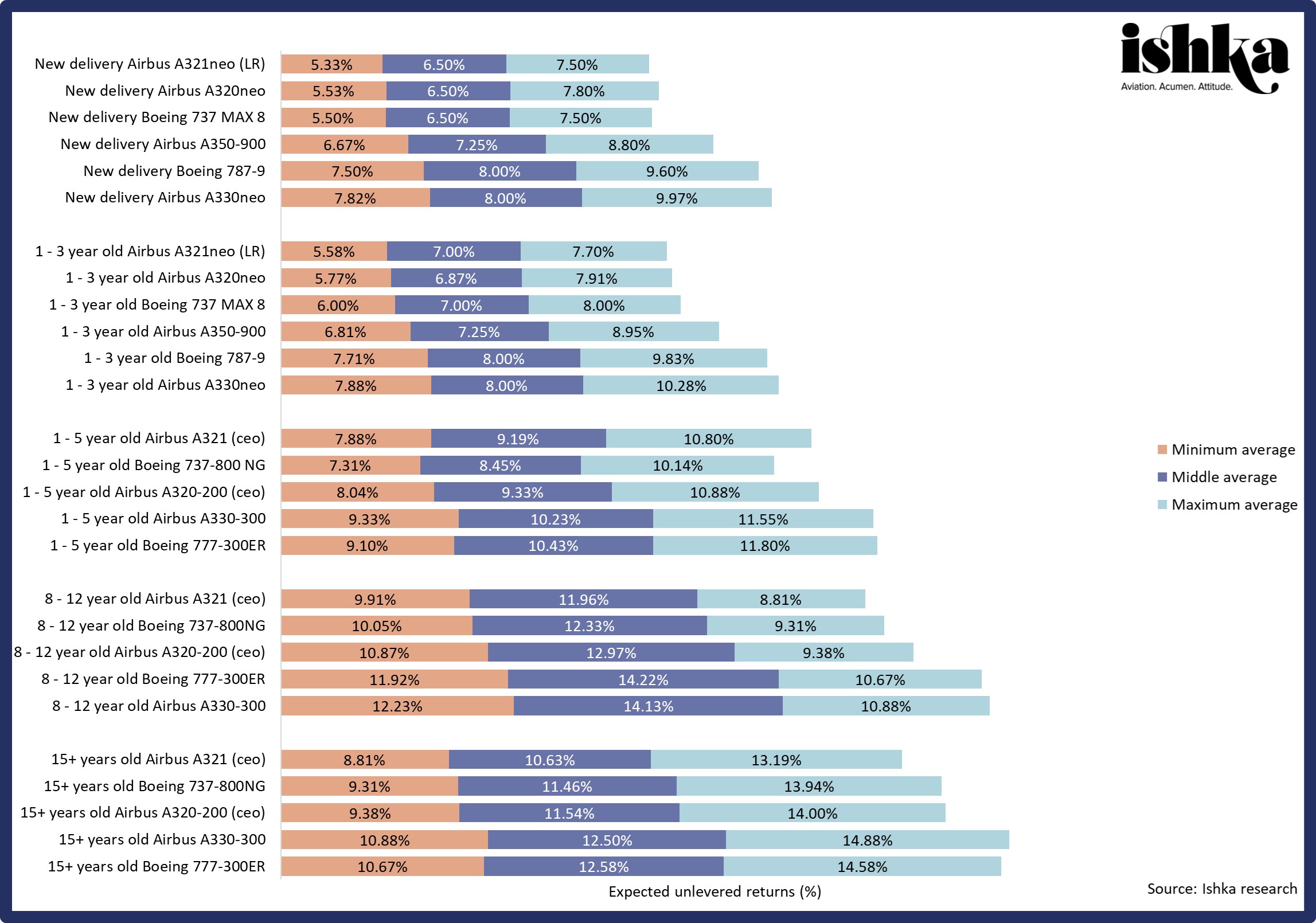

Both new-tech and current-tech widebodies have seen a decline in expected unlevered returns in the last six months, according to Ishka’s latest aircraft asset managers survey, a sign that investors and lessors have increased confidence in the demand for larger aircraft.

Meanwhile, unlevered returns have increased for both new-tech and current-tech single-aisle aircraft in the last six months as investors look to introduce a minimum floor for unlevered returns for aircraft investments.

Widebody demand compresses expected returns

Overall, average returns for current-tech widebodies - the Airbus A330-300 and the Boeing 777-300ER - have declined by 1.38% since Ishka’s March 2023 survey. Asset managers highlight that the drop in expected returns is due to changing investor perceptions around widebodies from investors, and a rising interest and need for widebody capacity by airlines.

Asset managers also indicated that average returns for new-tech widebodies - the A330neo, Airbus A350-900 and Boeing 787-9 - have also declined from 9.26% to 7.75%, a significant drop largely driven by changing price expectations by secondary market buyers and reduced expectations for higher range returns.

One asset manager agrees arguing that the reduction in returns is due to the realisation among buyers that many sellers are not willing to trade widebody aircraft at a discounted price to offer buyers a hefty premium. One asset manager stated that A330 owners were becoming more bullish about market prospects, and stated that potential sellers are not selling a young widebody for more than 12% returns. “Those deals are just not closing”.

Both new-tech and current-tech widebodies have seen a decline in expected unlevered returns in the last six months, according to Ishka’s latest aircraft asset managers survey, a sign that investors and lessors have increased confidence in the demand for larger aircraft.

Meanwhile, unlevered returns have increased for both new-tech and current-tech single-aisle aircraft in the last six months as investors look to introduce a minimum floor for unlevered returns for aircraft investments.

Narrowbody returns steadily increase, investors warm to A320ceos

Ishka notes that returns have increased for both new-tech and current-tech single-aisle aircraft. Overall returns for new-tech narrowbodies - Airbus A320neo, Boeing 737 MAX 8 and Airbus A321neo - have increased by 47 basis points in the last six months from 6.26% to 6.73%. Similarly, current-tech narrowbodies - A320ceos, 737-800NGs and A321ceos - saw a 31 basis points rise over the same period.

Several asset managers talking to Ishka confirmed that new-tech single-aisle aircraft returns had not materially shifted since the last survey with SLB returns, in particular, remaining “tight”. “There's more capital chasing a smaller market due to fewer deliveries,” reflects one leasing chief on the current single-aisle SLB returns. “I think investors are under more pressure to just deploy, and make assumptions about the residuals being good . In reality, what it means is that lease rates have not kept track with increasing interest rates. So, you've actually got an unlevered average return that doesn't really budge much while levered returns are, are obviously much lower than they used to for most new deliveries.”

However, rising interest rates appear to have had some impact on minimum returns with asset managers surveyed consistently pricing a slight increase in their return expectations. Several lessors were notably more bullish, indicating that better returns were becoming possible in the secondary market particularly where sellers needed to show ‘proof of concept’ (i.e. sales) and generate cash flow.

Two asset managers spoke at length about the changing perceptions of the A320ceo and stated that the “perceived overhang” of A320ceos in 2021 has “evaporated” with considerable demand for the asset type.

The Ishka View

The asset managers survey captures buyer’s expectations for acquiring aircraft both via sale/leasebacks as well as through the secondary aircraft trading market. The sale/leaseback market continues to be relatively competitive but there appears to be upward pressure on how low lessors are willing to go to acquire assets, judging by the results of the survey.

Rising interest rates have forced asset managers to up minimum returns for single-aisle aircraft but the renewed interest, and confidence from airlines and investors in widebodies has seen returns drop since the last time Ishka surveyed asset managers back in March.

This renewed confidence has helped aircraft trading in general. Some asset managers that managed to buy distressed assets during Covid, including widebodies, are seeing some opportunities to sell and book profits.

Aircraft buyers appear to accept that there is an increasing limit as to the amount of premium that sellers are willing to confer when selling aircraft, which has driven down maximum returns. But on the flip-side, buyers also confirmed that they were seeing many more opportunities for deals with returns “starting at 8%” indicating that some sellers are more willing to reach buyers’ appetite levels. Ishka hears that the next three to four months could be busier for the secondary market after what appears to have been a fairly constrained year of aircraft trading so far.

It is worth noting that many of these surveys were conducted by Ishka immediately before Pratt released further details about the increased number of GTF inspections it now needs to conduct (see Insight: ‘“RTX: hundreds of additional GTF inspections to ground A320neos’) This will have had a significant impact on how investors view current-tech single-aisle assets as the supply of single-aisle aircraft looks set to become increasingly constrained.

Sign in to post a comment. If you don't have an account register here.