in Lessors & Asset managers , Capital Markets

Wednesday 4 September 2024

BBAM launches Horizon 2024-1 ABS

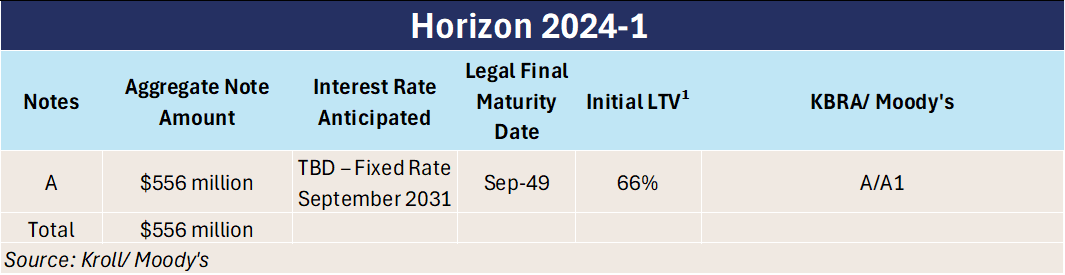

Aircraft asset manager BBAM is in the market with a $556 million aircraft, ABS Horizon 2024-1. The new single note deal will be used to acquire a portfolio of 17 new-tech narrowbody aircraft assets and has an initial LTV of 66.3%. The weighted average age of the portfolio is approximately 1.9 years, making it one of the younger aircraft ABS to hit the market.

The weighted average remaining term of the initial lease contracts is approximately 9.2 years. BBAM is the servicer and a BBAM-affiliate will retain the equity position in Horizon 2024-1 at closing.

Portfolio

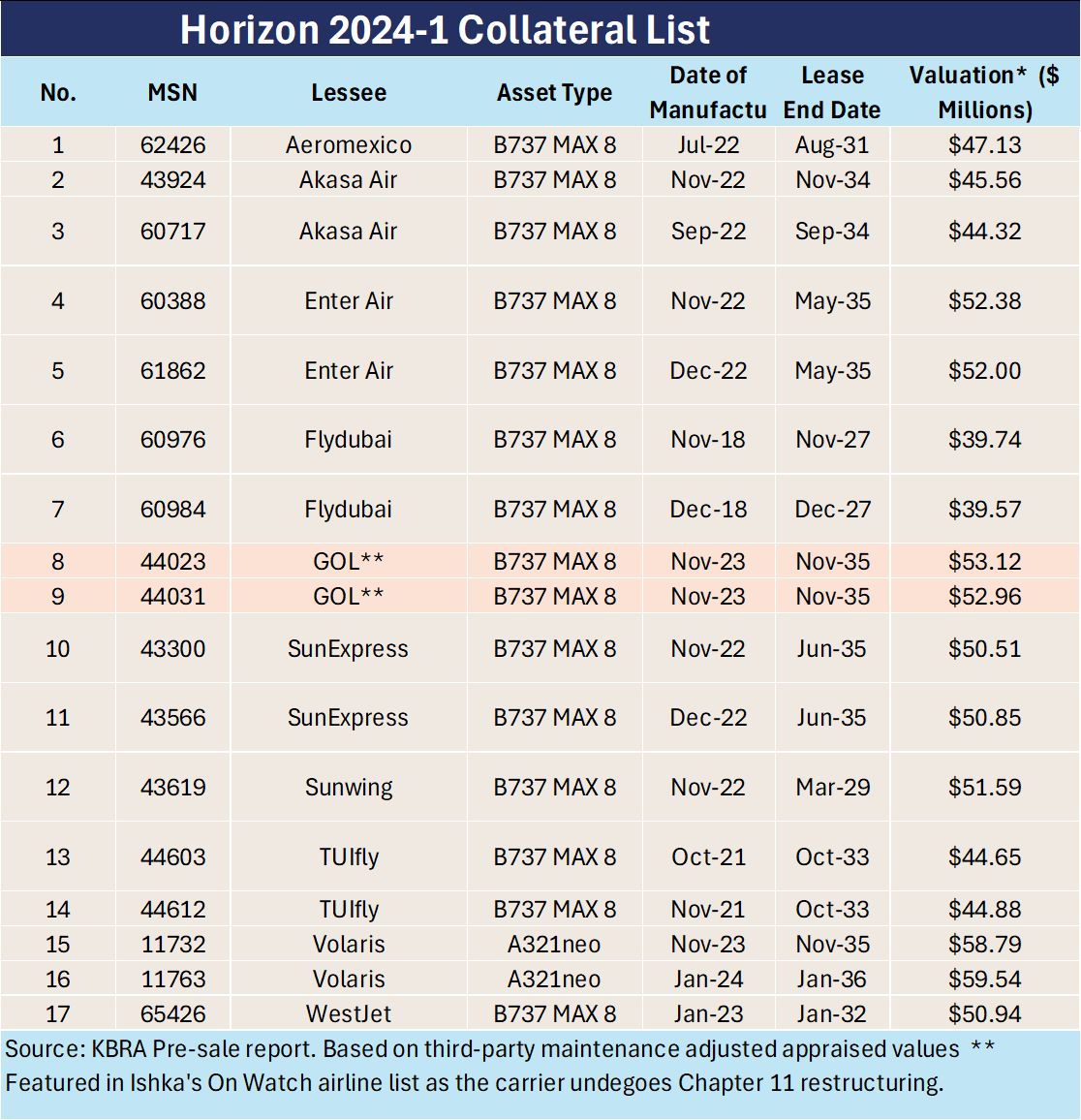

The ABS portfolio has 15 737 MAX 8 aircraft (85% of the portfolio by value) with two A321neo aircraft. 15 of the aircraft are less than three years old and only two aircraft are between three and six years.

Two of the aircraft in the portfolio are on lease to Brazilian-carrier GOL (12.7% by portfolio value), which filed for bankruptcy protection in 2024 and is currently undergoing Chapter 11 restructuring and has been included on Ishka’s On Watch list. However, as Moody’s points out under Chapter 11, Gol will continue renewing its fleet, returning older aircraft that are grounded and receiving new-generation aircraft.

BBAM owns 15 of the aircraft and has have letters of intent (LOIs) to acquire two aircraft on lease to Flydubai. The novation risk is seen as credit positive by Moody’s.

Structural considerations

One interesting aspect of the ABS is that it has a 20-year amortization profile prior to the anticipated repayment date (ARD) and a 16-year amortization profile thereafter. This is slower than the other aircraft ABS deals which have tended to include 13-year to 17-year amortization profiles. Kroll argues that the slower amortization profile is mitigated by the age of the aircraft and the low initial LTV. In addition the ratings agency states that under the amortisation profile the transaction is expected to de-lever to approximately 60% LTV by the ARD which makes it comparable to other aviation ABS transactions which typically range from 55% to 60% LTV by the ARD.

Moody’s also views the relatively slower amortisation as a credit risk and highlights the leakage of cash flows to the equity. It argues the minimal deleveraging in the first seven years increases the risk that subsequent lease cash flows or aircraft disposition proceeds will be insufficient to repay the rated notes. “Similar to other aircraft lease ABS transactions, the scheduled debt payments among the classes of notes and the E certificates limits de-leveraging of the notes prior to the ARD, absent a performance trigger breach, and collections in excess of scheduled note payments will be diverted to the E certificates,” explains Moody’s. “In contrast, deals in most ABS asset classes generally have stronger structures that preclude the erosion of credit enhancement through maintaining credit enhancement levels without trigger breaches.”

However, like Kroll, Moody’s states that the strong quality of the very young, current technology, narrowbody aircraft portfolio, and the portfolio's strong contractual cash flows mitigate these risks.

The deal also includes common structural enhancements including: a 3-month DSCR test of 1.15x resulting in rapid amortisation if triggered, a three-month 75% utilisation trigger, and a six-aircraft minimum number of assets test. The structure also benefits from a $5 million security deposit which can be used to cover senior expenses and shortfalls in interest and scheduled principal payments on the Series A Notes as well as a nine-month liquidity facility. There is a cash-trap if the DSCR falls below 1.20x which can be cured if the DSCR is at or above 1.20x for three consecutive payment dates.

The Ishka View

BBAM has waited for the US Labor day weekend to finish before launching its all-narrowbody aircraft ABS. The portfolio is predominantly Boeing 737 MAXs with two A321neos. Both Kroll and Moody’s perceive the young age of the aircraft as a credit positive. Kroll highlights that that the average weighted remaining lease term exceeds the seven-year ARD while Moody’s welcomes the limited novation risk, as BBAM already owns 15 of the 17 aircraft with the remaining two under LOI.

However, Moody’s states that the slow scheduled debt amortization profile and leakage of cash flows to the equity presents a credit challenge, albeit one partially mitigated by the asset quality of the portfolio and the strong contractual cash flows. Only two of the aircraft in the portoflio are on lease to an airline on Ishka’s On Watch list, GOL, which is undergoing a Chapter 11 restructuring. However, the restructuring process is likely to have limited impact on the carrier’s incoming new-tech aircraft. BBAM is one of the largest aircraft asset managers and has been active in the capital markets sponsoring five aircraft ABS and four aircraft EETCs to date. The smaller size of the deal and the fact there has been limited aircraft ABS issuance this year means there is likely to be demand among investors for the deal, but more will be revealed when pricing occurs later this week.

Sign in to post a comment. If you don't have an account register here.