in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Tuesday 27 May 2025

Tariff fears temper, but don’t deter, a frothy aircraft trading market

Aircraft sellers say trading in the first five months of 2025 has been largely unaffected by tariff threats and announcements from the Trump administration. "I have not seen it impacting transactions other than a slight pause in April for a few weeks, reflects one senior aircraft trader speaking at Ishka’s Aviation Finance Festival and Trading Summit: Midlife, Engines & Parts conferences, held last week in Dublin.

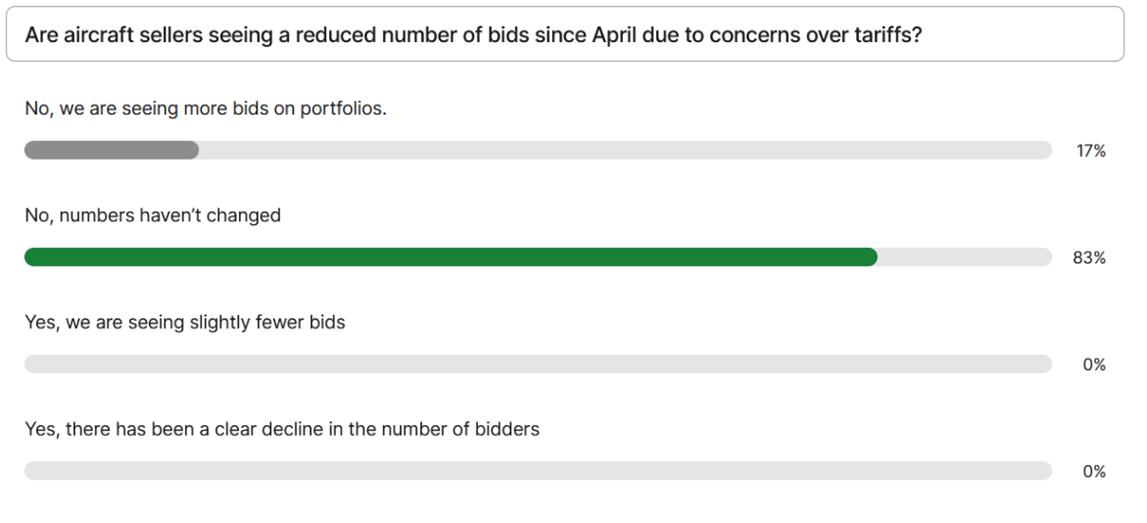

This view was shared by several traders talking to Ishka and was also confirmed in an audience poll (see results below). However, not all traders fully agree. A few have confirmed that while aircraft trading remains extremely robust, a number of bidders dropped out of recent transactions as they waited for more clarity around tariffs.

Dozens of portfolios being offered

Ishka notes that it is still clearly a sellers’ market with bidders eagerly pricing hundreds of aircraft on offer. Such is the level of activity that smaller teams are struggling to keep pace with the volume of aircraft on offer. "I think bilaterals are becoming increasingly significant, because clearly, no one can get through that volume of pricing,” reflected one trader, who added that one counterpart admitted to having a hundred aircraft in their pricing pipeline.

Traders speaking at the Ishka’s Dublin conferences say that this year they have noticed more latest-tech narrowbodies being introduced into offered aircraft portfolios. Leased neos and MAXs are also generating a significant price premium, say lessors, as several orderbook lessors, frustrated by the slow pace of deliveries, are also looking to acquire more aircraft in the secondary market.

Source: Ishka Aviation Finance Festival audience poll on 20th May 2025

Lessors want scale, and are still able to command extensions

At last week’s events, sellers stated that a number of buyers are looking to scale and are willing to pay a premium to achieve that. "In the past, a seller would maximise value by spinning a portfolio into a number of smaller pockets. Now, buyers are saying 'I want scale’," explained one seller.

In the meantime, lessors are still able to command healthy lease extensions for both narrowbodies and, increasingly, widebodies. There is some debate about the average length of recent extensions for Airbus A320ceos and Boeing 737NGs and the level of lease rates in extended leases. Some lessors state that they are seeing six-to-eight-year extensions depending on the condition of the engines. Others say narrowbody extensions are still typically four to six years.

“My sense is it's getting longer”, expressed one senior trader on one of the panels. “Over the last 12 or even six months, extension terms are getting longer, this is especially true on widebodies but also true on narrowbodies. I think that lessors are becoming a little bit more flexible on rates, so long as you can take the extension and term far enough out. And I think airlines, especially airlines that don't have enormous orderbooks […] are seeing a lot of value in the reliable current-technology airplanes, and are happy to extend them for longer than they were a year ago, a year and a half ago and even six months ago.”

The Ishka View

It is still clearly a sellers’ market and lessors are seeing a healthy premium on aircraft sold. But Ishka notes a couple of interesting contradictions. Several lessors are looking for scale and are willing to pay a premium to achieve that, a fascinating switch as previously buyers were able to negotiate discounts for bulk purchases. At the same time, many buyers are increasingly wary of economic risks caused by tariffs and what that means for passenger demand. As a result, there is increasing scrutiny of airline credits by lessors.

At least one lessor at last week’s Ishka conferences commented that they were looking to scale their credit and risk function in response to a more uncertain world following April’s ‘Liberation Day’ tariff announcements. As an example, some traders buoyed by the success of the trading market in Q1 2025 brought to market in Q2 aircraft leased to weaker credit airlines in Asia and found limited appetite among buyers.

Barring the unpredictable nature of current tariffs, all indicators still point towards an aircraft sellers’ market. The continuing problems with new aircraft deliveries, and the issues around latest-technology engine performance is extending the attractiveness of previous-generation narrowbodies to airlines. Traders confirm this and share that fewer sellers are now offering stubby-leased aircraft. It appears to be more profitable to extend these leases at better rates to then either sell or keep.

Sign in to post a comment. If you don't have an account register here.