in Aircraft values, Lease Rates & Returns , OEMs, Cargo & Engines

Friday 13 June 2025

Briefing: MRO turnaround times are improving...slowly

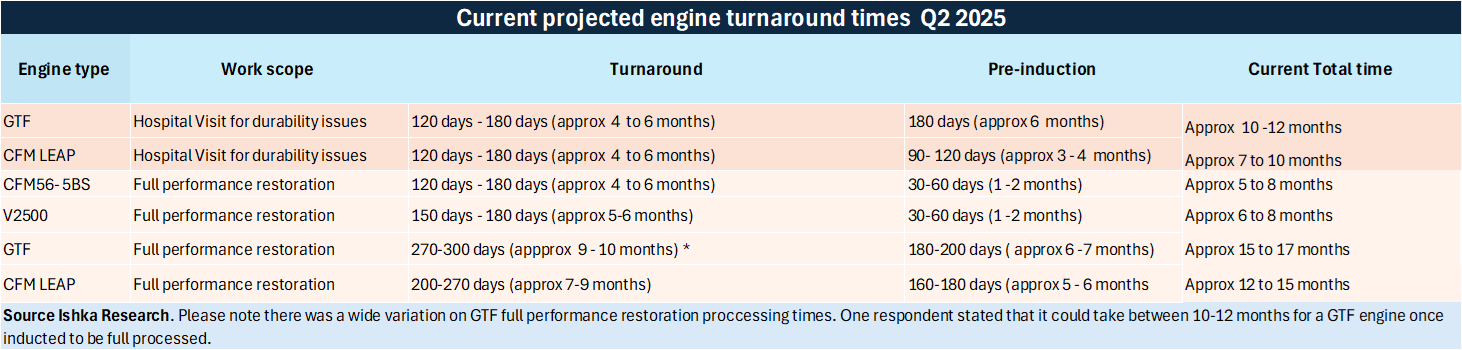

Engine lessor CEOs say that MRO turnaround times for latest narrowbody technology engines are improving but warn that it could be several years before LEAP or GTF engines routinely complete a full performance restoration within 120-days.

Pratt invests in MRO capacity but expect a six-month wait to be seen

Pratt & Whitney (Pratt) is still trying to reduce its backlog of inspections and repairs due to the powder-metal issue which has impacted the performance of many of its GTF engines. Pratt announced plans to expand its MRO output by 30% in 2025 and has opened new MRO facilities in China and the US to help reduce the GTF backlog. In April this year the firm announced two new deals with its existing partners Delta TechOps and MTU Aero Engines to expand coverage.

One way the firm has tried to improve turnaround times is by investing in dedicated MRO capacity for simpler repairs or ‘Quick Turns’. Pratt has been triaging engines by doing initial borescope inspections to determine if they can quickly process an engine or not, explained one panellist speaking at Ishka’s Trading Summit: Midlife, Engines & Parts conference.

This has helped speed up the number of GTF engines coming out of the shop but it appears to have delayed wait times for full performance restorations. Ishka notes there is a wide degree of variation in how long lessors estimate processing times take for full performance restoration visits for a GTF engine. One source states that the variation depends on material delays, while others point out that in one or two instances arguments between Pratt and some of its customers over who should foot the bill, and potential compensation, mean there are some GTF engines not being properly processed which is creating interminably long shop turnaround times.

Ishka’s senior consultant, Stuart Flye, states that trying to average the total turnaround times for a full performance engine restoration is ‘a challenge’ given the bespoke and varied nature of each potential shop visit. “It really depends on what you need to get done, and whether there are parts in place or not. Wait times can vary significantly too depending on how influential the airline or lessor is and their ability to be assigned MRO slots in advance, but it is fair to say that even the very top names face fairly lengthy waits at the minute.”

Ishka hears that the first available slot for a full performance restoration performance for a GTF engine is in 2026.

The long road ahead

Richard Hough, ELFC’s CEO, speaking at Ishka’s Trading Summit: Midlife, Engines & Parts conferences, expressed his opinion that despite some improvements in MRO turnaround times, it will likely be 2029 before the GTF sees total turnaround times for a full performance restoration dip below 120 days and potentially 2028 before CFM’s LEAP achieves the same milestone.

“I think you'll get to 120 days by 2029 on the GTF. That's my best estimate at the moment. What Pratt have got to do is to start getting engines out of the shop at a quicker rate than they're getting them into the shop right now.”

Hough explains that Pratt was forced to take in GTF engines to inspect them, and “put them back out with contaminated powder metal, because they didn't have the spare parts manufactured that were clean. Now, everything that they're making is clean, both in terms of the original production and in terms of MRO, so that should start seeing a positive impact.”

Hough says Pratt is making progress but that ultimately the OEM needs to reach 90 day -turnaround times for MRO shops to be profitable. “No shop is making money with a 120-day turnaround times because you have got engines just sitting in the shop, you're not processing events, you're not getting your final invoices through. So, it's just got to get down lower than that,” he adds.

CFM International and RTX Corporation (Pratt and Whitney’s parent firm) did not offer comment when contacted by Ishka.

The Ishka View

Lessors and aircraft investors are still very concerned about shop visits for latest-tech engine overhaul. Long MRO delays can ultimately significantly impact long-term returns for both engine and aircraft lessors as they look to remarket aircraft and engines.

It is not just long transition times that are spooking investors about latest-tech engine shop visits, but also the cost which can be “scary figures’” according to one source, because engine owners are being forced to simply replace whole parts as Pratt is still developing repairs. With engine OEM LLP escalation costs running roughly at 9% or 10% for Pratt and GE “there is a real onus on OEMs to develop repairs”.

Both CFM and Pratt are looking to improve the durability, processing time, and aftermarket offering for the latest-technology narrowbody engines. Pratt has a steeper hill to climb compared to CFM for various reasons. These include CFM’s wider aftermarket MRO network and the sheer number of engines that need to be inspected. Pratt, and CFM, are investing in their engines, but engine investors still face potentially lengthy delays when it comes to MRO turnaround times.

Sign in to post a comment. If you don't have an account register here.