in Lessors & Asset managers , OEMs, Cargo & Engines

Tuesday 22 July 2025

Q2 engine prices and lease rates: V2500 lease rates dip, but 5Bs strengthen

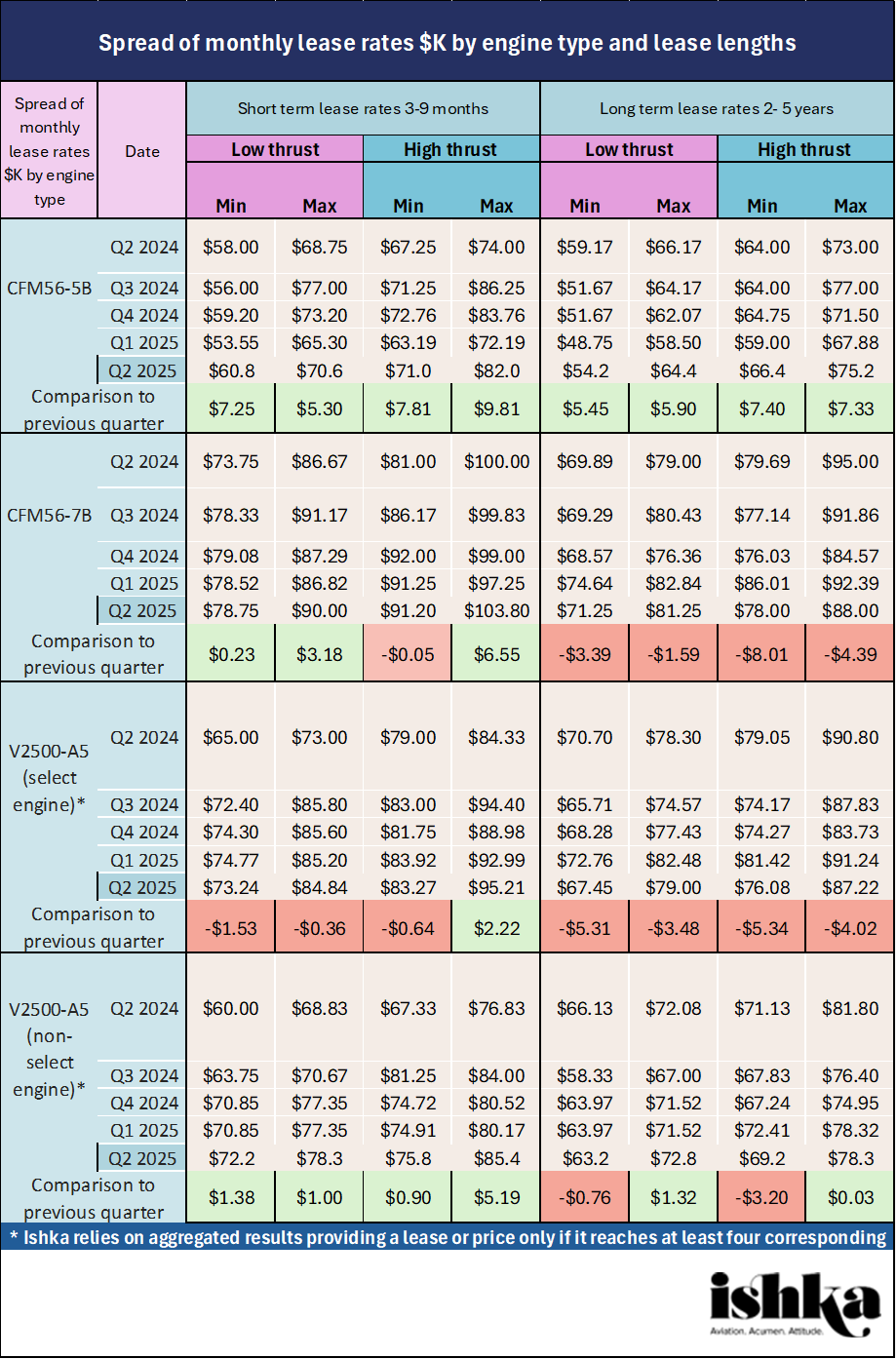

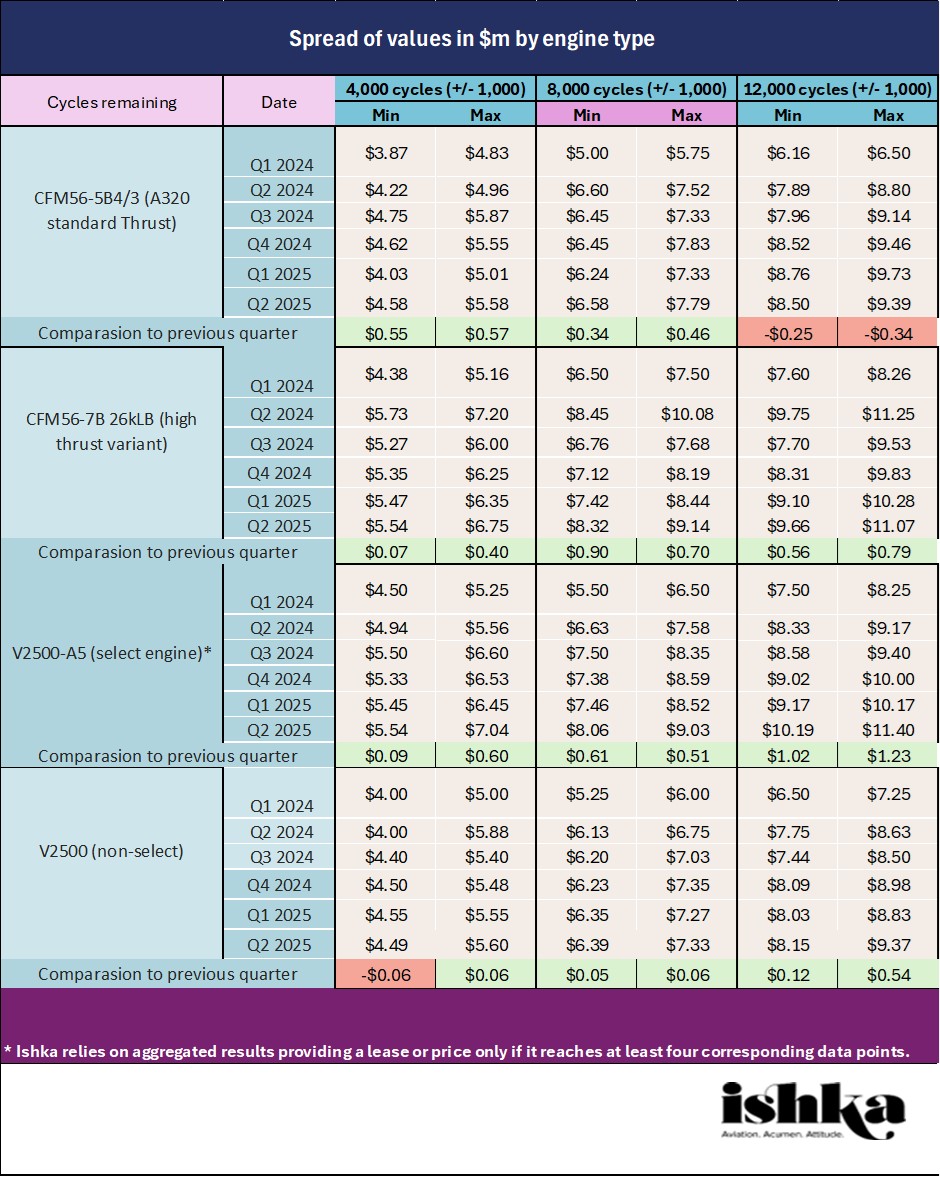

Lease rates for V2500-A5 Select engines have broadly dropped in the second quarter of 2025, according to Ishka research (see Table 1), but prices for previous-generation narrowbody aircraft engines (CFM56-5Bs, CFM56-7Bs, and V2500s) have remained stable compared to the previous quarter.

The Ishka survey explores spot market pricing for popular narrowbody engine types based on responses by active engine lessors and investors. The latest survey was conducted between May and June 2025.

CFM56-5B lease rates strengthen

CFM56-5B leases notably firmed in Q2 2025 but still sit within the average ranges across the past 12 months. This result contradicts commentary obtained from some engine traders who had expected a slight weakening of CFM56-5B leases rates this quarter, arguing that airlines were pushing back against high lease rates. Other lessors, however, confirmed that ‘good’ CFM56-5B engines are still obtaining ‘decent rates’ – a claim which appears to be supported by the results of the survey.

Lessors state there is a wide availability of CFM56-5B engines which is also shaping market perception. With several Airbus A319s recently parted out, sources say that there is good availability on the low-thrust CFM56-5B variants, while older 5B variants such as the CFM56-5B/P are also in “plentiful supply.” Crucially, lessors say there is still demand for the Tech Insertion engines (CFM56-5B5/3) and the ‘Evolution’ CFM56-5B engines.

Stabilising engine prices

Engine trading prices appeared to stabilise last quarter compared to the previous quarter. The CFM56-7B market remains “quite hot”, say traders. One trader states that there is currently minimal difference in value between high and low-thrust 7B engines, with only a small premium for high-thrust variants given the current level of market demand.

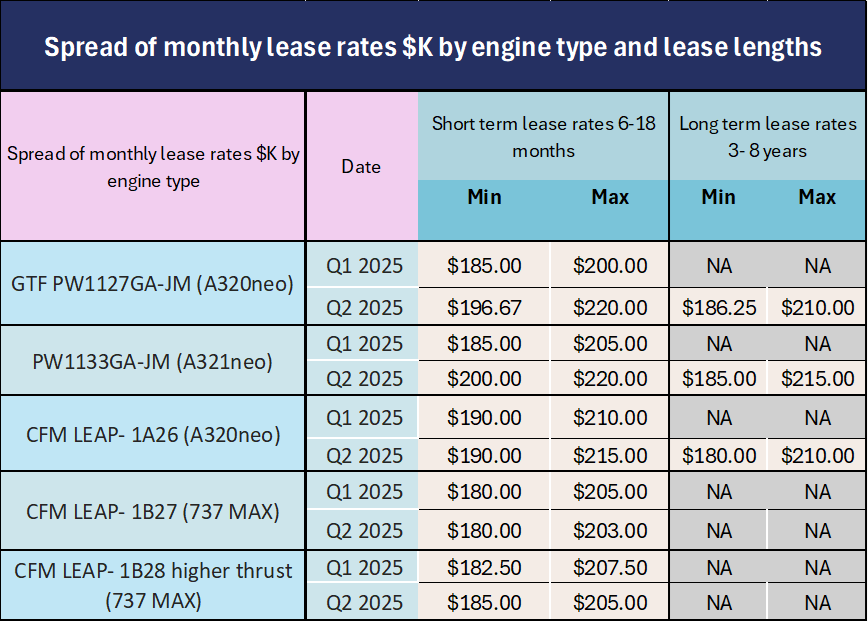

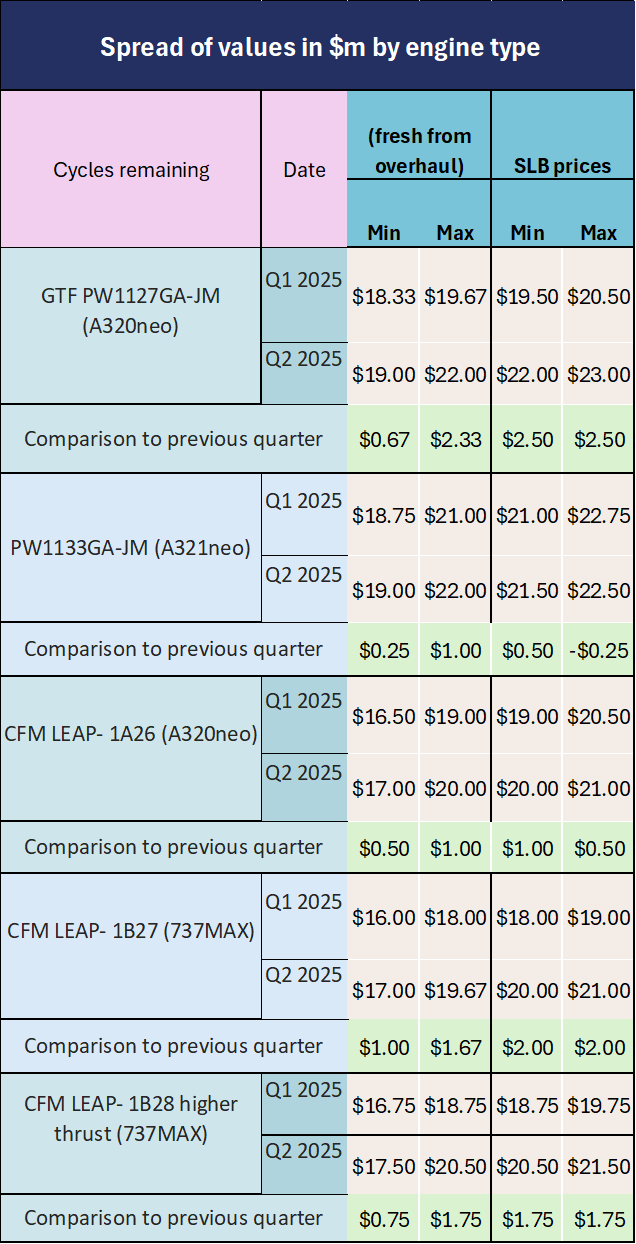

Ishka has also included new-tech lease rates and prices again for the second time in this iteration of its engine survey. Prices and lease rates have increased very slightly for the latest-generation narrowbody engines (Pratt & Whitney’s GTF engines and CFM’s LEAP engine).

The Ishka View

There has been some debate about how soon Pratt & Whitney’s progress with its GTF engine quick turns will begin to affect lease rates of previous-generation engines. Lessors say they expect to see an eventual decline in V2500 and CF5M56-5B lease rates, but there is wide disagreement as to how quickly that will happen. “Everything gets shifted to the right,” reflects one MRO source when it comes to Pratt & Whitney’s timeframes. As for V2500 lease rates, it is simply too soon to call. Some of the heat appears to be leaving the V2500 engine lease market, but Ishka urges caution in taking one quarter’s findings as a definitive trend. Ishka notes that lease rates for V2500s Select engines versus the older non-Select engines have narrowed, but there remains a clear gulf in residual values between the two engine variants. Trading as a whole remains at elevated levels, according to engine lessors, as MRO, part-out firms, and engine investors search for green-time and serviceable engines.

Sign in to post a comment. If you don't have an account register here.