Monday 10 August 2020

ALC Q2: Deferral repayments “significantly” outstrip fresh forbearance requests

Repayment of deferred aircraft rents now “significantly exceeds” requests by airlines for new support, said Air Lease Corporation (ALC) CFO Greg Willis in the lessor’s recent Q2 earnings call.

At the same time, ALC stated that greater caution on the part of lessors has led to a fresh insistence upon security deposits and a hike in lease rate factors (LRFs) on sale-leaseback transactions.

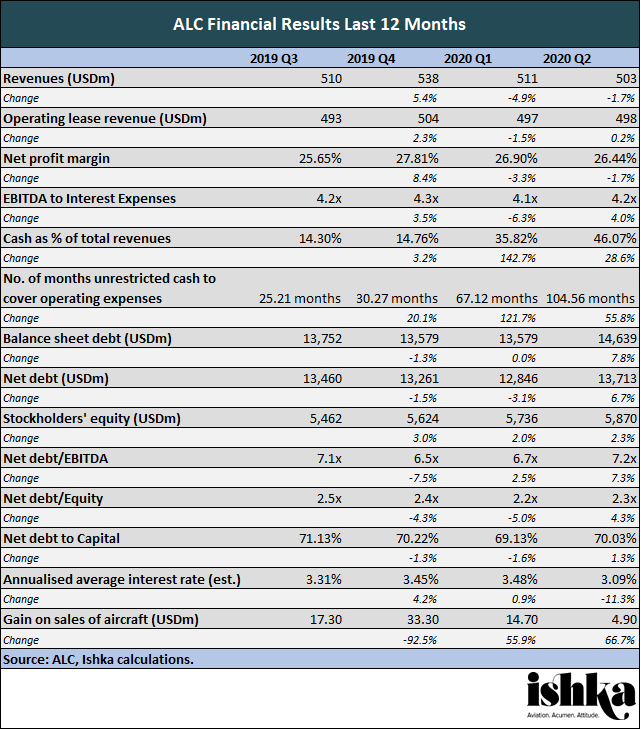

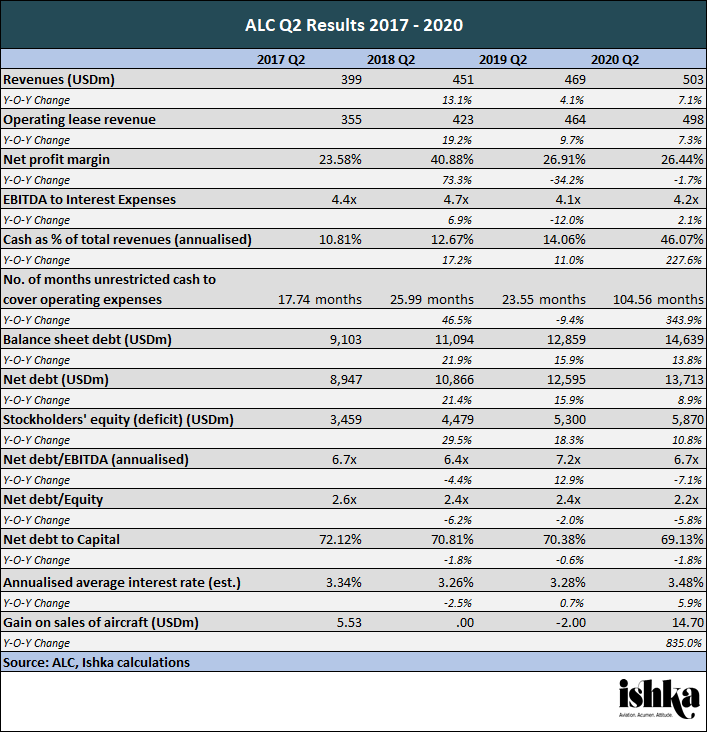

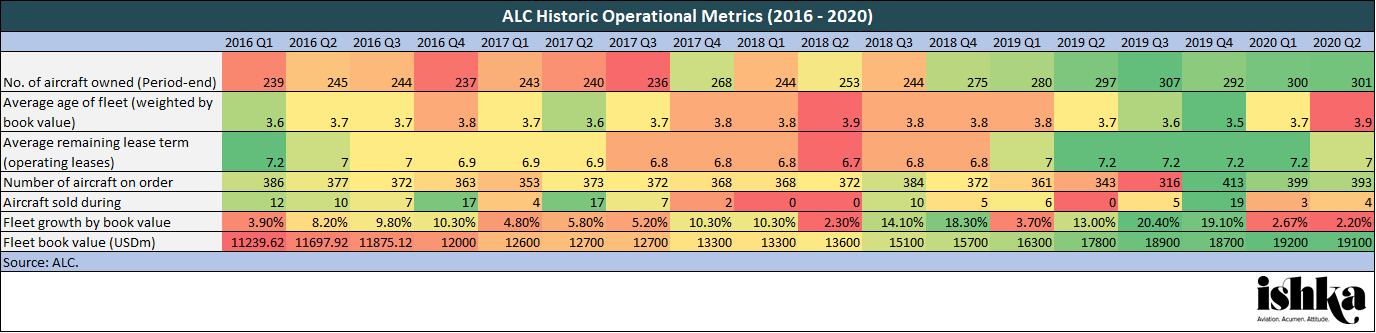

ALC posted overall strong results in Q2 2020: despite deferrals, the lessor saw year-on-year (YOY) increases in operating lease revenue (7.3%), although stagnant from the previous quarter (0.2%) and with an 8.9% YOY creep in net debt. Also despite deferrals, ALC claimed a Q2 utilisation rate of 99.6%, which the lessor ascribed to airlines prioritising operations with younger aircraft which benefits ALC’s fleet compared to lessor peers (ALC’s average fleet age edged up to a height of 3.9 years this quarter, partially due to the MAX grounding resulting in lower numbers of newly built aircraft than anticipated).

The lessor also put efforts into shoring up liquidity through Q2, roughly tripling its cash position YOY ($264 million versus $926 million). This was partially achieved through its June $850 million 3.375% bond (BK128986 Corp), which one person with knowledge of the matter described as “opportunistic” given appetite from investment grade bond investors (see Insight: ‘Lessor bond issuances plummet in Q2 2020’). ALC explained that the clear support governments have shown airlines was central when selling the bond to investors (see Ishka’s airline bailout series).

With a growing number of airlines in bankruptcy or restructuring, ALC listed only exposure to Aeromexico and Virgin Atlantic (see Ishka’s airlines on watch series). The lessor expects its five aircraft with Aeromexico to remain with the airline and that its five widebody orders delivering to Virgin Atlantic through 2024 will also go ahead, with “some” deliveries rescheduled. However, the lessor does except depressed levels of aircraft investment from airlines and further deliveries to get pushed out.

In order to maintain consistency across all our lessor reports, we base our analysis on a standard financial template. As such, some numbers may vary from the lessor reported figures. E.g. we include gain/(loss) on aircraft sales in total revenues. To know more about our methodology, get in touch at team@ishkaglobal.com or ask the analyst.

Fresh deferrals requests halve from Q1

ALC agreed to half the number of deferrals in Q2 compared to the previous quarter. In Q2, the lessor signed a further “incremental” $65 million in rent deferrals – around 3% of its total liquidity position – bringing the total to $190 million lease payments deferred with 59% of its airlines. ALC announced nearly double that amount in Q1: $125 million in lease payments for around 46% of its customers. Now, new requests are largely driven by government travel restrictions than lack of government support, said Willis.

These remain short-term, partial deferrals, said ALC CEO John Plueger, the majority of which will be repaid in the next 12 months. ALC stated in Q1 that it had agreed to some power-by-the-hour arrangements, though this was not repeated in Q2. ALC’s collection rate for Q2 was 91% and 89% in July, versus 90% and 86% in Q1 and April respectively. In “many cases”, Plueger added, ALC had negotiated lease extensions along with the deferrals.

SLB LRFs edge up

Willis observed an increase in lease rate factors on sale-leasebacks through Q2, the CFO said, as volatile airline credit risk led to a “cautiousness” around sale-leasebacks for ALC. Willis did not specify across what assets and ages this might apply, although the lessor’s focus is on young, in-production narrowbody aircraft. ALC’s CFO also hinted at a wider conservatism for new deals, with Willis stating that: “For us, placing a new aircraft now opportunistically with a carrier also has a lot of credit metric concerns.”

Correspondingly, one of the biggest financial hits of the quarter came to ALC’s gain on sale of aircraft as both airlines and traders both deferred signed deals and grew more cautious in inking new ones. ALC recorded $4.9 million in gains on the sale of four aircraft, the lowest since 2019 Q3. While ALC aimed to deliver $250 million of aircraft in Q2, the lessor ultimately took delivery of only one aircraft from its order book during the quarter.

Along with creeping LRFs, Willis described a “stronger hand” from lessors in obtaining security packages in response to the crisis: Plueger described ALC itself as “intently, religiously committed” to security packages.

Careful eye on OEM schedules

ALC is watching OEM delivery delays “very carefully”, said Plueger, given the 12-month break clauses in many purchase agreements signed with OEMs. “We could see some further adjustments downward of production rates,” the leasing chief said (see Insight). “We believe that ultimately the majority of our MAX forward order positions will be delayed more than 12 months.”

Another “billion dollar question” surrounds the backlog of built 787s set to deliver to Chinese carriers, according to chairman Steve Udvar-Hazy. Some 20% to 25% of built 787 aircraft are in storage awaiting delivery to Chinese airlines, the chairman said, adding that “in the short term […] we’re not seeing a lot of customers asking for [20]21 positions. But we are seeing airlines asking for 22 and 23 positions.”

The Ishka View

ALC posted strong Q2 results despite industry-wide disruption, beating analyst estimates as aircraft continue to return to the skies. Nonetheless, with customers seeking deferrals, ALC increased its liquidity position and upped its debt, ending the quarter with $6.9 billion in liquidity to comfortably see it through the crisis. As ALC stated, investors appear to be soothed by the obvious and wide-ranging support governments have shown for airlines during the pandemic, a decreased sense of risk that expands to lessor notes.

ALC argues that, despite the global fleet overall expecting to contract, airlines will be upping their reliance on lessors to populate their fleets going forward, aiming to avoid the initial heavy capital expenditure of direct OEM purchases. This will tally as long as airlines see sufficient demand to expand their operations, however Ishka questions whether this demand will outstrip the fleet rationalisation movements carriers are currently undergoing. This will, however, be a greater issue for leasing companies focusing on older aircraft than ALC’s 4-year-old fleet.

Sign in to post a comment. If you don't have an account register here.