in Lessors & Asset managers , Aviation Banks and Lenders

Wednesday 10 June 2020

NAC wins court approval to seek debt standstill from lenders

Regional aircraft lessor Nordic Aviation Capital (NAC) has received permission from the Irish High Court this week to negotiate a debt standstill and deferrals with its largest lenders.

NAC, like many lessors, has been hit by depressed revenues as airlines struggle to pay leases following mass groundings and travel bans in the wake of the Covid-19 pandemic. The lessor has over $5 billion in debt. NAC’s Counsel stated the group feared it could run out of cash in July and could breach agreements concerning repayments to its creditors by the end of June, according to The Irish Times. NAC’s Counsel stated that 65 of the group’s 75 customers are seeking leasing concessions and the lessor only collected 20% of rents due from its customers in April. The Counsel warned that estimated cash collections for June and July will also be very poor.

The lessor applied to the Irish High Court in Dublin to launch a Scheme of Arrangement under the Irish Companies Act, a mechanism available under Irish law that allows solvent companies to implement arrangements with lenders. NAC is seeking to defer its debt payments for the next 6 to 12 months. In addition to court approval, the lessor also needs the agreement of lenders voting in classes representing 75% by value and more than 50% by number for the scheme to go ahead.

Ishka understands that NAC has, broadly, two classes of creditors: a group of secured lenders, and a large group of unsecured creditors (most of which are tied to the firm’s large private placement). At the court the Counsel representing the bulk of the unsecured private placement creditors stated that, as matters stand, it was opposed to the scheme.

Last week NAC announced that its four shareholders (EQT Partners, KIRKBI Invest, Singaporean sovereign wealth fund, GIC, and chairman and founder Martin Moller) have agreed to invest $60 million (€53.5m) of new equity into the company. According to media reports, NAC’s Counsel argued the new equity will be used to reduce non-essential expenditure and cut costs. NAC’s Counsel proposed to scrap $5.7 billion in uncommitted capital expenditure for the next five years, obtain deferred payments under a $1.5 billion committed capital expenditure programme and reduce the number of proposed aircraft deliveries from 21 new aircraft down to eight.

The court ordered that NAC’s two group of creditors will meet separately with NAC on the 24th of June to vote on the scheme. NAC will then report the outcome to the judge the following day.

The world’s largest regional aircraft lessor

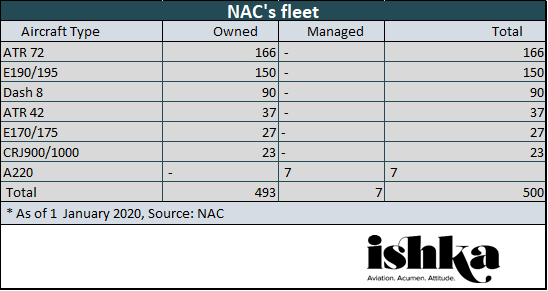

NAC grew rapidly over the past few years through a series of acquisitions, including buying rival platforms such as Aldus and Jetscape, and a sizeable orderbook to become the dominant leasing firm for regional aircraft. The lessor ordered 20 A220 family aircraft at the 2019 Paris Air Show and 105 ATR 72-600s (35 firm order, 35 on option and purchase rights for another 35).

In January this year it celebrated adding its 500th aircraft to its fleet. The occasion coincided with the opening of the lessor’s new headquarters at Gardens International in Limerick. The lessor employs more than 200 people across its global offices.

In February, NAC priced an $858.83 million US private placement – the largest private placement by an aircraft lessor. The deal is split between three, five- and seven-year tranches and achieved a weighted coupon of 3.92%. The transaction at the time reduced the firm’s secured debt to total assets to approximately 30%. The issue was arranged by Citigroup, Crédit Agricole, and Goldman Sachs.

But by early May ratings agency Kroll had downgraded the lessor’s issuer and senior unsecured debt ratings to B+ and B, from BBB+ and BBB respectively after warning of the “possibility of a distressed exchange” for NAC’s bondholders and other lenders.

The Ishka View

Now that NAC has won court approval it will need to obtain support from its lenders. Ishka’s view is that lenders are ultimately likely to support the firm’s new debt arrangements. Even the statement by the Counsel for the private placement creditors (in opposition to the scheme as it currently stands) is more likely to be a negotiating tactic, as opposed to a hard-line view against agreeing to a debt deferral. Nonetheless, the lessor still needs to get lender support relatively quickly. NAC’s financial year-end is June 30th. After that date the lessor needs to provide a plan within 90 days to show it has access to enough working capital for the next 12 months in order to obtain a statement from its auditors that it is a going concern.

NAC has grown aggressively in the last five years, and despite the significant amount of debt raised and the capital buffer it has secured, it has been struck badly by non-payment from airline customers hit by the Coronavirus crisis. The lessor has strong backers but the need to obtain a debt standstill is a worrying signal to lenders and is likely to impact the cost of future debt raising. Lessors of regional aircraft have been able to command sizeable returns. NAC boasted 15% equity returns in its 2018/2019 annual report. However, the risk in the asset class is the relatively weak credit quality of the customer base, few of which are flag carriers with access to state support, increasingly vital due to the sustained nature of this current pandemic.

Sign in to post a comment. If you don't have an account register here.