in ESG & Regulation , Other

Thursday 4 July 2019

Will an EU fuel tax push airlines towards new-tech aircraft?

With efforts to tax aviation fuel gaining traction in Brussels and across the EU, Ishka examines the impact that proposed kerosene taxes could have on airlines and, in turn, aircraft demand. Could an EU fuel tax boost airline demand for more fuel-efficient aircraft?

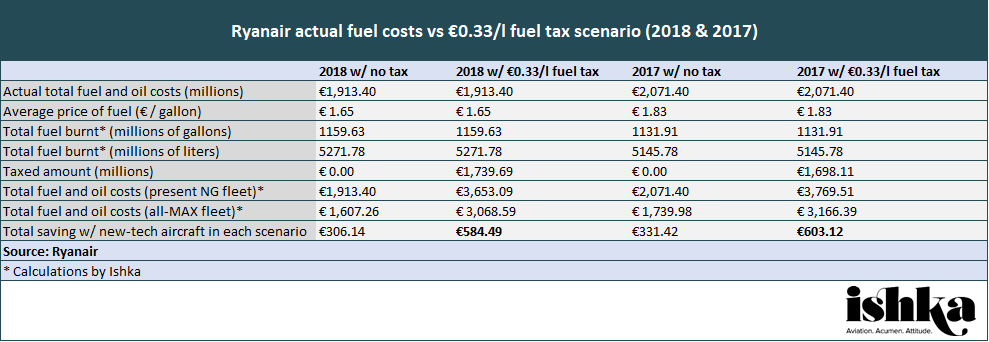

In this Insight, Ishka looks at how the tentative €0.33/litre tax on aviation fuel could impact one of Europe’s largest airlines, Ryanair, and how the proposed European kerosene levy has been gaining momentum.

Tax projection: $120-a-barrel equivalent

Source: Ryanair, calculations by Ishka

Click here to download the data behind the chart.

Applying a €0.33/litre tax to Ryanair’s estimated fuel burn in the past two years would have amounted to a 90.92% increase in fuel costs from €1.91 billion ($2.16 billion) to €3.65 billion ($4.12 billion) in 2018 and a 81.64% increase from €2.07 billion ($2.34 billion) to €3.76 billion ($4.24 billion) in 2017. This compares similarly to Ishka’s previous estimate of an 82.44% increase in 2018 - 2019 fuel prices for airlines (see earlier Insight).

If Ryanair were to theoretically transition from its current all-737 NG fleet to an all-737 MAX fleet, a type that according to the airline has a 16% lower fuel burn, it would be looking at annual fuel savings of €584.49 million ($659.56 million) in 2018 and €603.12 million ($680.57 million) in 2017 in a €0.33/litre tax scenario.

A €0.33/litre tax scenario would effectively double the fuel costs from the present $65-per-barrel environment to virtually one that equates to $110 to $123-per-barrel.

When early A320neo and 737 MAX demand assumptions were produced in 2010 and 2011 they were based on $100-per-barrel assumptions and industry observers agree that demand for these aircraft has been less than forecasted due to relatively lower fuel prices. Accordingly, fuel excise duties at an EU level would theoretically boost demand for these aircraft types.

How likely is it that a jet fuel tax will be implemented?

There appears to be a growing political momentum behind a new EU-wide fuel tax.

The Netherlands, France and Sweden have in recent weeks proposed taxing fuel in intra-EU flights. This would go beyond taxing kerosene fuel on domestic flights, which only Norway does, and instead apply them to intra-EU/EEA traffic.

Earlier in late May, French President Emmanuel Macron also pointed out during an interview with French regional newspapers that he wants to advance "the common taxation of kerosene in Europe" and pleaded for "a real international negotiation" on this topic. French Minister for Transport Élisabeth Borne subsequently raised the issue during a meeting with her European counterparts in Luxembourg in early June. The IMF has also been a long proponent of taxing aviation.

Currently, fuel for international commercial aviation is exempt from taxation in the EU under the 2003 Energy Tax Directive, itself following the 1944 Chicago Convention. However, that 2003 directive also states that if a tax on kerosene is to be introduced, it should be set at a minimum €330/kilolitre (see earlier Insight).

Dutch State Secretary for Finance Menno Snel said in a press statement on 20th June that “despite this [Chicago] treaty, it should still be possible to tax kerosene, if we do it with other European countries.” Snel’s statement came at the start of a two-day meeting of EU finance ministers at The Hague to discuss ways to tax aviation. The conference hopes to present its conclusions to the freshly elected European Commission, where the main parliamentary groups support taxing aircraft fuel (see earlier Insight).

Snel told Reuters on the sidelines of the conference that “it is a no-brainer that the possible contribution of the aviation sector” will be put in the “first-week agenda” of the next European Commission President.

Swedish Finance Minister Magdalena Andersson and International Monetary Fund (IMF) tax policy division head Ruud De Mooij, both keynote speakers at the event, respectively pleaded for “bilateral or multilateral agreements as a way of going forward” and putting an end to aviation’s “undertaxation.”

Airlines push back

Days before the conference in The Hague, representatives of Europe’s biggest airline lobbying group, Airlines For Europe (A4E) went on a media offensive at the Airbus chalet at the Paris Air Show. The lobbying group, which is currently chaired by Ryanair CEO Michael O'Leary, went on to tackle the “flawed analysis” of an “EU-commissioned report” modelling the €330/kilolitre tax in the context of the “meeting in The Netherlands” due the following week.

At the A4E press in Paris event attended by Ishka, a representative of EasyJet and Norwegian CEO Bjorn Kjos cited commitment to industry sustainability initiatives and orders for new technology aircraft as tokens of their pledge to reduce emissions. “The more excise you put on the less possibility each airline will have to invest on a new fleet,” Kjos remarked.

On the OEM side, Hubert Mantel, Head of Environmental Affairs at Airbus, provided a more nuanced response to the recent calls for jet fuel taxation. “We favour any mechanism that will go international,” he said, adding that Airbus “believes that incentives are a better way” including for airlines to “renew or accelerate renewal of their fleet.”

The Ishka View

An aviation fuel tax in Europe looks increasingly likely. And if it is introduced it will not replace existing market-based measure schemes such as IATA-supported CORSIA and the EU’s Emission Trading Scheme (ETS). It will be another cost for airlines to swallow.

But the EU does need the full support of its members for a new taxation scheme to successfully apply maximum pressure on carriers to be more fuel-efficient. If only two countries were to bilaterally agree on a kerosene tax, then, in theory, an airline like Ryanair could tentatively refuel in a tax-exempt country before operating a fifth-freedom flight between kerosene-taxing countries.

Ishka believes that the new tax has broad political support – especially as individual countries are finding it harder to justify taxing other forms of transportation and not aviation. What does it mean for investors? Temperate fuel prices have kept some vintages of older technology aircraft types like the A320ceo and the 737 NG in demand with airlines. A new European fuel levy helps the case for new technology aircraft but could hasten the retirement of older types.

Sign in to post a comment. If you don't have an account register here.