in Aircraft values, Lease Rates & Returns , Lessors & Asset managers , Aviation financings

Thursday 2 February 2017

Widebody evolution among public lessors

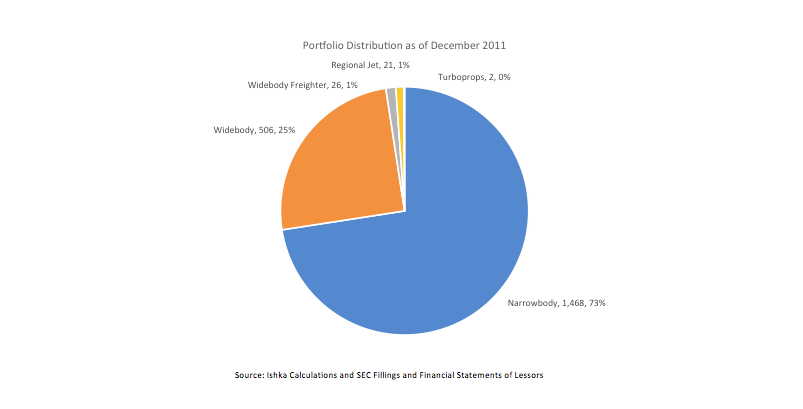

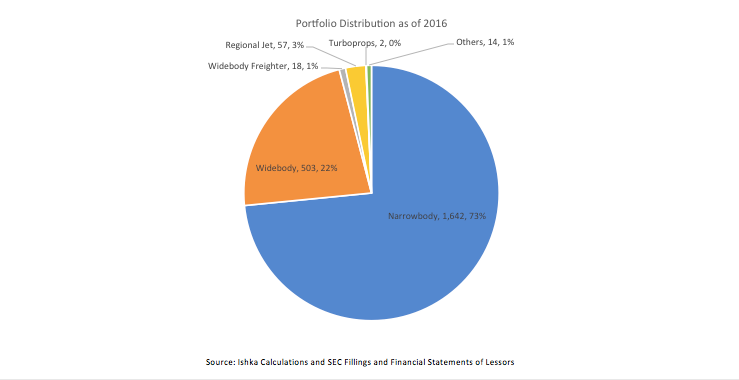

Ishka has analysed the portfolio of the public lessors between 2011 and 2016 to understand the evolution of widebody aircraft in their fleets. The study finds that, while some lessors have retained the concentration of widebodies in their portfolios (by number of aircraft) between 2011 and 2016, some others have significantly reduced their exposure. Overall the portion of widebody aircraft in these lessors’ fleet has marginally declined from 25% in 2011 to 22% in 2016. The Ishka View is that this change in the proportion of widebody aircraft is likely due to several factors.

One significant reason is concentration limits. Since 2011 many lessors have replaced older (midlife) widebodies with a younger generation of more efficient aircraft with considerably higher acquisition values. As a result it is likely that several lessors have hit their portfolio concentration limits (as a percentage of net book values) with fewer widebodies - reducing their overall numbers.

A separate reason is that some lessors have adapted their strategy to embrace a more liquid portfolio with a higher percentage of ‘plain vanilla’ narrowbodies (A320, B737 etc.).

However, it is important to note that these numbers reflect a very slight shift in the overall composition of the public lessors’ fleets. Lessors have significantly increased their fleet inventory since 2011 and their exposure to widebody assets has remained relatively consistent. Widebody aircraft, especially the twin-engine types, remain a significant portion of the lessors’s fleets and orderbooks. Given the key role of widebody assets to many of the world’s top airlines, Ishka expects the public lessors to continue to have a significant exposure to widebody aircraft in the medium-to long-term future.

Marginal change in collective portion of widebody fleet since 2011

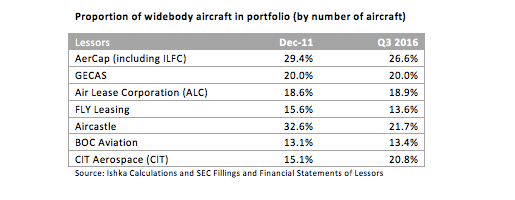

Ishka studied the portfolio of AerCap (including ILFC), GECAS, Air Lease Corporation, FLY Leasing, Aircastle, BOC Aviation, and CIT Aerospace to understand the evolution of widebody aircraft in their inventories since 2011.

In terms of absolute numbers, Ishka’s analysis reveals that the public lessors have marginally reduced the share of widebody aircraft in their fleet during the last five years. The number of widebody aircraft in their total collective fleet dropped from 25% in 2011 to 22% in 2016. While the collective change may not be substantial, digging deeper there have been a few important realignments at some lessors as they look to focus their portfolios on more liquid aircraft in their fleet.

As can be seen from the table above, while GECAS has maintained the proportion of widebodies in its fleet, AerCap (including ILFC), FLY Leasing, and Aircastle have realigned their exposure while ALC, BOCA and CIT have increased theirs.

The biggest changes come from Aircastle and CIT, which have reduced the number of widebody aircraft in their fleet. Aircastle’s change is primarily as a result of its de-risking strategy. Over the past two-three years, the lessor has undertaken several portfolio sales to shift from a relatively riskier midlife fleet to younger, more liquid aircraft with ‘longer remaining lease terms’ as per the lessor. The lessor is seeking to improve the quality and risk/return profile of its portfolio and therefore has exited from several midlife assets. The market has also been favourable in absorbing the relatively older aircraft.

Taking a contrarian position, the proportion of widebody aircraft in CIT’s portfolio has risen significantly since 2011. CIT has stated that it sees immense value in the intermediate widebodies and has increased its exposure to these twin-aisle aircraft. Since 2011, the US-based lessor has inducted several A330s and B787s in its fleet. However, it remains to be seen how the lessor’s strategy will evolve, now that it has been acquired by Avolon.

AerCap has made significant changes to its fleet since its acquisition of ILFC. It has traded several aircraft - selling around 177 aircraft worth nearly $5 billion. In the process, the number of widebody aircraft in its fleet has also gone down.

GECAS considered its widebody exposure in 2011 to be significantly underweight and had stated widebody fleet expansion as one of the strategies for growth and sustenance of its business. Nevertheless, the second largest lessor in the world has kept its proportion of widebody aircraft in its fleet relatively stable in the last five years.

Diverse motivations for fleet composition

Lessors manage a diverse set of strategies with respect to their portfolios and more than one factor is often at play when deciding its composition. It is interesting to note that five years down the line (between 2011 and 2016), the public lessors have reduced, albeit marginally, the number of widebodies in their fleet. As highlighted earlier, this is partly a result of the induction of newer widebodies with significantly higher valuations than the older widebodies that these lessors previously had, thus affecting their portfolio composition. The influence of the near-term strength in the narrowbody market has also led to lessors retaining a greater percentage of the more liquid asset.

Narrowbodies also dominate the orderbooks of the lessors with nearly 80% of the aircraft on order being single aisle aircraft. ALC and CIT remain the two major lessors in the top 20 customers who have placed orders for widebody aircraft. The bulk of the widebody orderbook is comprised of airlines. Of course, sale and leaseback transactions on delivery to airlines can heavily influence the eventual proportion of widebodies in a lessors’ portfolio.

The Ishka View

A lessor’s portfolio composition is dictated by several factors and the movement in numbers of widebody aircraft with the lessor group Ishka has analysed will reflect differing strategies and shareholder requirements, rather than a trend for or against the twin-aisle aircraft with these lessors. Narrowbodies for the foreseeable future will continue to dominate the portfolio of most lessors, both public and private, due to their relatively high degree of liquidity, being easily re-deployed at lease end as they represent the vast bulk of most airline’s fleets.

Both single aisle and twin aisle aircraft have seen a softening of lease rates driven by both competition between the number of new lessors in the market, and by the high rate of production and consequent availability of lift. As noted earlier the numbers reflect a very slight shift in the overall composition of the public lessors’ fleets. Lessors have significantly increased their fleet since 2011 and their exposure to widebody assets in dollar terms. Widebody aircraft remain a significant offering within the lessors’s fleets and orderbooks. Given the key role of widebody assets to many of the world’s top airlines, Ishka expects the public lessors to continue to have a significant exposure to widebody aircraft in the medium-to long-term future, to satisfy demand from their customer base. For further related analysis read Ishka’s earlier insight (Are twin-engine widebodies a good investment?).

Please Note: The views expressed do not constitute investment advice. We accept no liability to recipients acting independently on its contents in respect of any losses, including, but not limited to profits, income, revenue or commercial opportunities.

Sign in to post a comment. If you don't have an account register here.