in Lessors & Asset managers , Aviation Banks and Lenders

Thursday 20 February 2020

CDB Aviation transitions its CEO

In January CDB Aviation, the Irish subsidiary of China Development Bank Financial Leasing Co. Limited (CDB Leasing), promoted its former Chief Commercial Officer, Pat Hannigan, to CEO. Ishka understands that the firm interviewed several candidates before selecting Pat Hannigan to lead the firm.

Hannigan, who was hired by departing CEO Peter Chang, stresses that the handover is about keeping the same “template” as before and adds that Chang was always due to leave the lessor. “That was always the plan and he kept exactly to the script. You've got to keep setting the business up for the next generation and he was great about that.”

One of the biggest consequences of the move is that it has cemented CDB Aviation as a Dublin-headquartered aircraft lessor. “That was the big debate of 2019”, admits Hannigan.

“Once I was in the frame for the job and it was becoming clear that I would take it, one of my prerequisites was that the team had to be here. The C-suite had to be in Dublin. It was just too difficult to run a platform that is constantly transacting throughout the week and to have two of your C-suite members in Hong Kong.

Extending the management team

Many of CDB Aviation’s executive functions were already in Dublin including origination, execution and the firm’s technical division. But the move from Hong Kong to Dublin means CDB Aviation is now looking for a CFO after Will Gramolt, CDB’s current CFO, decided to stay in Asia. “A talented guy, frankly we are going to miss him,” comments Hannigan. “We are in some early discussions with a few people.”

Hannigan adds that one of his first moves as CEO has been to “strengthen the team” and has promoted Peter Goodman to Chief Marketing Officer and appointed Craig Segor as the firm’s new Chief Investment Officer. Separately, the firm promoted Sign Kadou to run the Hong Kong office as head of Asia-Pacific.

The new CEO explains that sale-leasebacks, and placing aircraft, particularly in the current MAX grounding crisis have “become a business of its own” which Goodman now leads. He comments that Segor’s new role will be in charge of trading, pricing, M&A and portfolio acquisitions, allowing CDB Aviation to get a “proper” focus on where it deploys capital. “Particularly with the challenges coming up, they are also potential opportunities, and you need to be able to move quickly. So, if something crosses your desk, the deal team needs to be set up and put into action and on the buy side, Craig can do that and he's going to direct it.”

On buying opportunities

Bringing in Segor, a former senior ILFC executive and the founder and CEO of Plane View Partners, is a signal that CDB Aviation is key to carry on with its expansion. But what does that expansion look like in the current market?

One challenge other lessors have described is the lack of many lessor M&A opportunities. “We already know a few names that are thinking about it and we'll take a look. That's not to say that we're dying to buy a business and pay crazy money for it, but it's just another product.” He adds that CDB Aviation is fortunate because the shareholders are more interested in “sustainable” rather than rapid or reckless growth.

Looking at the future he says consolidation could happen from some of the new smaller lessors that have not built sufficient scale. “I think some of the new entrants into the market, particularly the guys doing very low-yielding deals may find in time that, actually, maybe that's not the smartest thing that they've done. Maybe they're the type of guys that will ultimately get consolidated into another entity. But when is that? Is it tomorrow, is it next week? Who knows?”

On dealing with the MAX

Ishka has argued previously that the industry is currently in a Super Sellers’ Market where lessors are likely to see a premium when selling leased aircraft because of the forced grounding of the 737 MAX (see Insight: ‘Forecast: 1,001 missing 737 MAXs by year-end 2022’). “Not an unreasonable view,” muses Hannigan who adds that it’s been an issue for the Airbus product as well thanks to delays with the GTF and the LEAP engines. He observes that while it is hard for fleet planners to commit to aircraft, as they want stability among the OEMs first, he predicts that many are realising slots will quickly disappear when “everybody starts to pile in”. “We're not saying that that has happened yet, but we're starting to see an upsurge in people looking seriously and negotiating LOIs for the Airbus product.”

On the future of the MAX Hannigan simply states that regulators are responsible for making sure the aircraft is safe and says that the residual value of the MAX is largely protected because of the sheer demand for aircraft capacity and the fact that he sees little change in engine technology in the next 10-15 years. “People still want to fly and if they do they will need that aircraft,” he comments.

Trading and selling aircraft

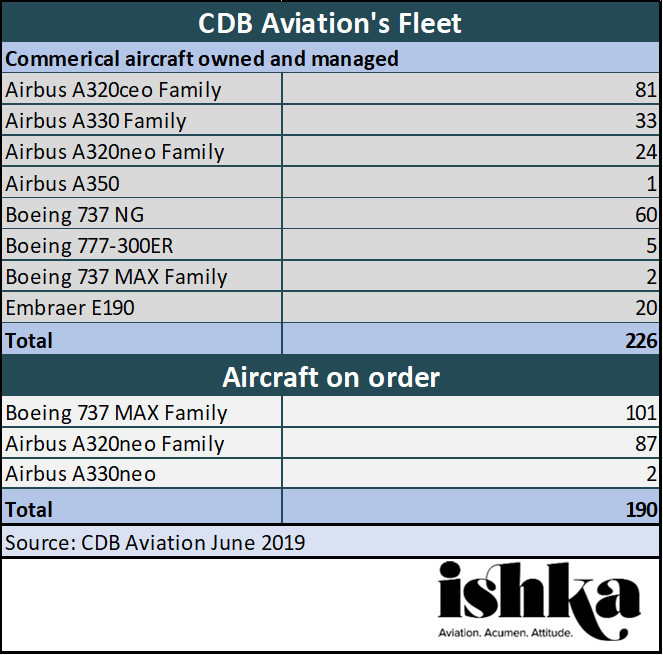

CDB Aviation sold 22 aircraft last year to help manage its fleet and bring down the average aircraft age. Looking forward, Hannigan states that the lessor has approximately 200 aircraft on order and plans to sell around 10% of its fleet each year but admits: “We probably won't be as active traders this year. I want to start to slow down the pace of selling and increase the pace of buying.”

After buying several portfolios of leased aircraft in 2018 the lessor did not purchase any in 2019 because “we just weren't willing to accept the returns that were available.” Instead, CDB Aviation decided to invest in arranging larger deals in the sale-leaseback channel. “Because of our resources we could do deals with 10 to 15 single-aisle aircraft or large widebody deals and we did three or four deals like that last year and that's helped with growth.”

Hannigan states that the recent trend towards larger sale-leasebacks deals is partly a result of airlines ordering huge numbers of aircraft and looking to lessors that can fund multiple aircraft to limit their counterparty negotiations.

Chinese lessors’ remarketing challenge

Lease rates are currently low on a range of aircraft types because of competition from lessors. One concern is that lessors struggling to remarket aircraft may be tempted to place aircraft at lower rates. In a January 2019 Ishka interview, Hannigan and Chang highlighted that Chinese lessors collectively had approximately 180 leased single-aisle aircraft with leases expiring by 2021 which could be returned to lessors (see Insight: ‘CDB Aviation boss: “Don’t expect to see new Chinese aircraft lessors”’).

Hannigan states that issue has not gone away and it is was one of the first challenges CDB Aviation had to address. Hannigan stresses that CDB Aviation was particularly active in getting a “crack” marketing team together and managing its aircraft portfolio. Last year, the firm transitioned seven A330s and placed 18 of its 20 Embraer 190s coming out of China.

CDB Aviation has seen its headcount rise significantly for the last three years but Hannigan notes that some of the other larger Chinese lessors have been active in recruiting skilled staff. “The problem I see is that we're going to have people competing for expertise in this area. It’s something we're conscious of in our business. As the CEO of the business, I have to create an environment here where the culture works for them and they want to stay with us because these are valuable people. Just think of what moving seven A330s smoothly out of China entails, you need a lot of good people.”

Lessors as a whole have struggled to place older A330 at decent rates (see Insight: ‘Airline bankruptcies compress A330 lease rates even further’). Hannigan argues that current compressed A330 lease rates are due to a “perfect storm” of the success of the 787, and more recently, the A330neo programme as well as the return of several A330s from Emirates.

“Unfortunately, it happened maybe two to three years before the natural replacement cycle. So, I'm not bullish, but I am hoping that the market will come back for the widebodies. The A330neo and the 787-9 are great aircraft and we will invest going forward in these aircraft types. But I think this is just the wrong time for A330s.”

Hannigan says CDB Aviation has been “laser-focused” on transitioning aircraft in 2019. He highlights that the lessor succeeded in repossessing four aircraft from bankrupt Jet Airways, two widebodies and two narrowbodies, and last year took delivery of 40 aircraft.

The Ishka View

Hannigan was widely tipped to take the CEO position but Ishka understands that several senior leasing candidates were interviewed for the role. In Ishka’s view the appointment is a positive move as it helps ensure continuity in a platform that has seen incredible growth in headcount in the last three years. The firm now has 117 employees with 34 new staff added in 2019 alone. Because of the backing of its parent, CDB Aviation has an enviable level of financial muscle behind the platform. Ishka notes that the lessor has already used that to win multi-aircraft sale-leasebacks and predicts that CDB Aviation is likely to be a formidable competitor this year again in that market.

Hiring Segor helps CDB Aviation be nimbler in the M&A space but Ishka wonders just how many lessor M&A opportunities there will be this year, as Ishka sees few signs of distress among lessors. It is harder to gauge the motivations of lessor owners but Ishka acknowledges that if any firm was planning to sell, now would be a good time as debt remains extremely easy to raise.

Sign in to post a comment. If you don't have an account register here.