in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Saturday 1 October 2022

Airline Credit Profile: How is a restructured Philippine Airlines (PAL) performing?

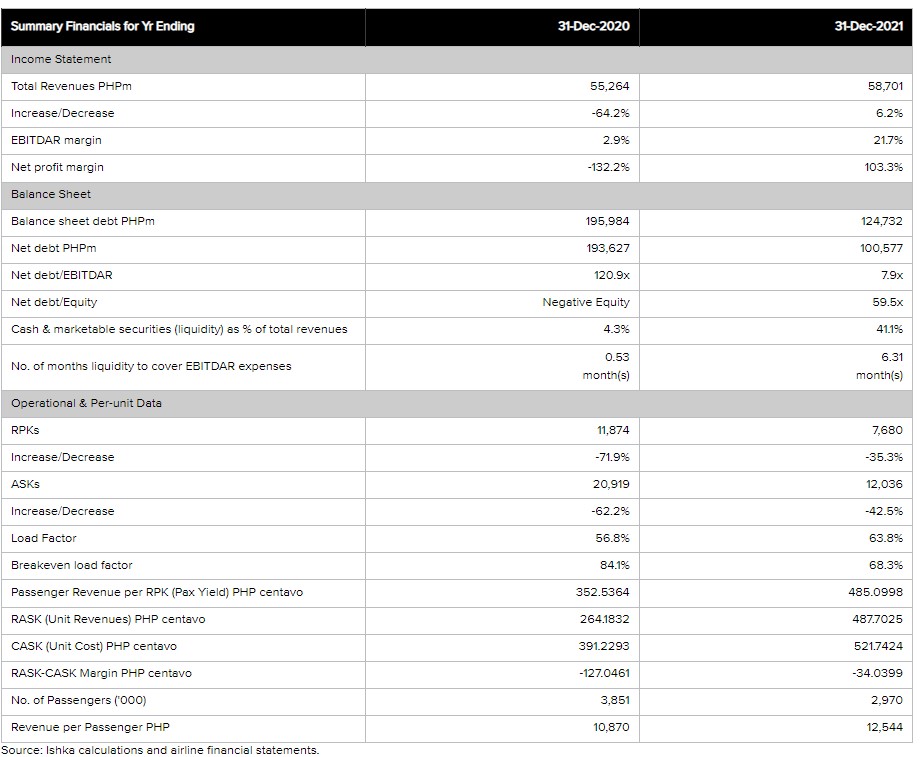

In earlier Insights, Ishka’s Airline Credit Profile team highlighted Philippine Airlines (PAL’s) deteriorating financial position and the factors that contributed towards its predicament. The Philippines was among the worst hit by the COVID-19 pandemic. Philippine air traffic was severely restricted for most of 2020 and 2021, which further damaged PAL’s financial position. The airline eventually sought Chapter 11 bankruptcy protection and restructured its debt and operations. Having emerged from court protection in late 2021, the question is whether that restructuring has made a difference. So far, it appears to have. After several years of negative performance, there have been several notable positives in PAL’s performance in 2022.

Philippine Airlines has successfully leveraged the rebound in air traffic in 2022. In addition to rebuilding its domestic network, which as of October 2022 had recovered to 90% of pre-pandemic level in terms of number of flights, the full-service carrier has also invested in re-establishing its international network ahead of most other carriers. As borders were opened and restrictions lifted, PAL re-launched flights between the Philippines and North America, Australia and the Middle East, carrying around a third of the country’s international passengers in H1 2022, compared to around a quarter pre-pandemic. Cebu, in comparison, carried just over 2%, compared to almost ten times that amount in 2019.

PAL Holdings’ (PHI), the listed holding company for PAL, revenues in the second quarter increased 42% q-o-q, reaching PHP34b (US$580m), the highest quarterly revenue since the pandemic began. With limited competition on its international routes in the first half, PAL is likely to have benefitted from high yields. And having restructured its operations recently, the airline’s cost base has proven favourable. While expenses also increased, driven by a rise in fuel costs in line with an increase in operations and high jet fuel prices, the airline managed to record relatively healthy EBITDAR margins.

In contrast to Cebu Pacific (Cebu), PAL also appears to have benefited from the depreciation in the value of the peso in several ways. The airline’s functional and presentation currency is USD; however, the holding company’s (PAL Holdings) functional and presentation currency is PHP. As such, PAL’s accounts (balance sheet and P&L) are translated to PHP using the applicable exchange rates. In contrast, Cebu’s functional currency is the peso. While Cebu reported sizeable foreign exchange losses in the first half, PAL in contrast reported a net positive foreign exchange position. There could have been an impact on the holding company’s peso denominated revenues which would include conversion of PAL’s USD denominated revenues to peso. The peso has depreciated between 10 and 15% against the USD and has been among the worst performing emerging market currencies from the region in 2022.

PHI reported a net profit of PHP4.4b (US$75m) for the six months ending June 2022 and the first profitable Q1 and Q2 financial results since 2016. As standalone financial accounts for the airline operating unit, Philippine Airlines, are not available, it is not possible to review the airline’s standalone USD-denominated performance.

PHI’s balance sheet has also improved since it restructured its debt, converting US$2 billion of debt to equity as part of Chapter 11 restructuring. As of 30th June 2022, it had cash and cash equivalents of PHP24b (US$409 million) and debt and lease obligations of around PHP20b (US$340 million) due within 12 months. Capital structure has also strengthened further in the first half of 2022 thanks to the equity infusion, profits and healthy operating cash flows.

Click on the image to see a bigger version of this table

The Ishka View

PAL’s performance in the first half of 2022 has been positive. It has been able to leverage the recovering operating environment, particularly from a small but high yielding international segment, recording healthy EBITDAR and net profitability. With restructured debt and a fresh infusion of equity, balance sheet ratios, including gearing and leverage, have improved. It has also generated robust operating cash flows which has also helped further repair the balance sheet.

However, these are still early days for the newly restructured carrier and the operating environment for airlines remains challenging. Like its peers in the region, it will also continue to face headwinds in the form of high fuel prices and unfavourable currency movements.

While there have been relative improvements, on an absolute level, the balance sheet remains weak. The majority (ca. 72%) of its long-term loans are based on floating rates, which in a rising interest rate environment also presents an additional cost challenge.

And while traffic recovery is expected to continue in the second half of 2022, unlike the first half, there could be more competition from Cebu and other foreign airlines on the international segment which could squeeze yields.

This is an excerpt from a recent review on Philippine Airlines’ Airline Credit Profile. To read detailed commentary and reports on nearly 160 airlines visit Ishka’s Airline Credit Profiles. Get in touch to find out more.

Sign in to post a comment. If you don't have an account register here.