in Aircraft values, Lease Rates & Returns , OEMs, Cargo & Engines

Friday 3 February 2023

Remarketing Watch: Parts scarcity drives demand for end-of-life aircraft.

Listen to the article

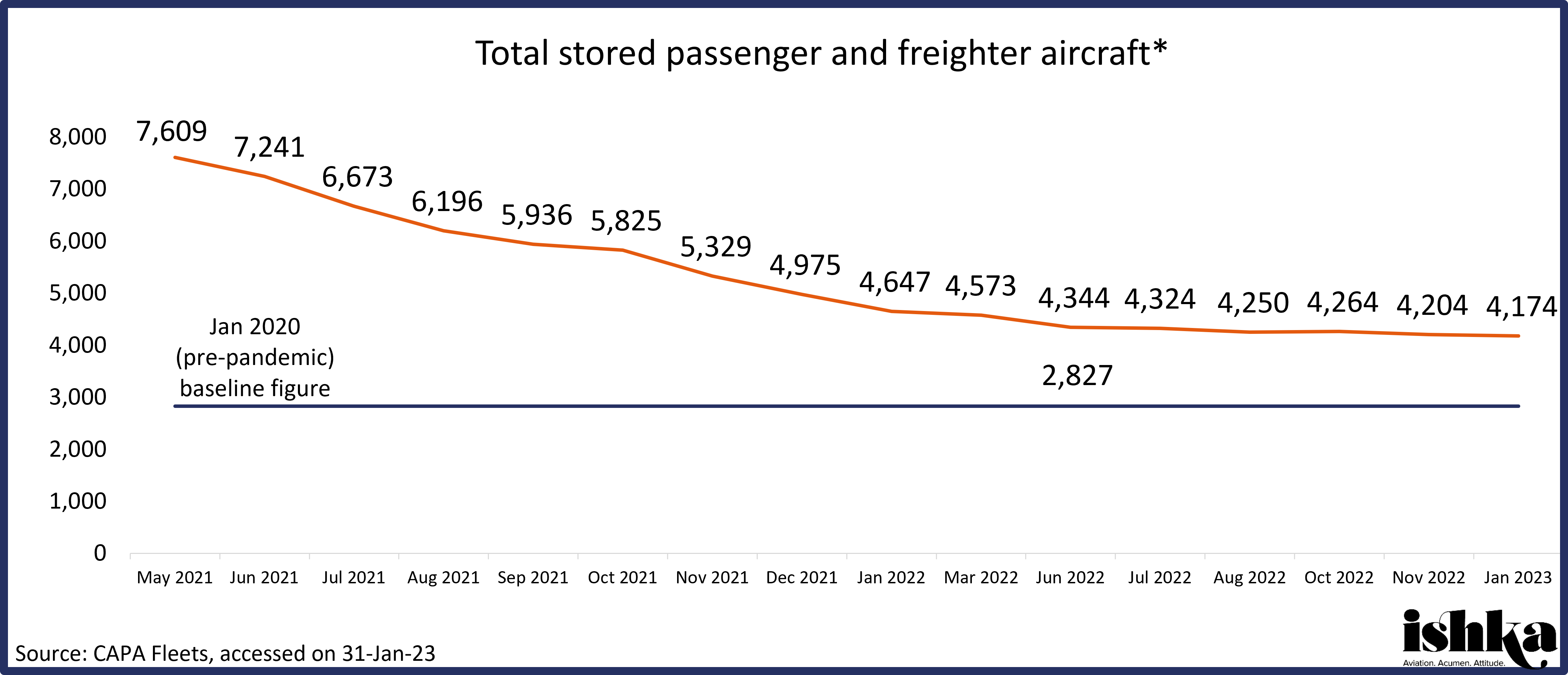

A scarcity of aircraft parts and engines is driving demand for older and end-of-life aircraft, sources tell Ishka. With increasing demand for lift, and a lack of new equipment deliveries from manufacturers, competition is rising to source aircraft and engines suitable for part-out. Ishka understands that purchasers of assets for part out are in some cases willing to pay premiums in order to secure valuable parts.

While in periods of ‘normal’ part availability airlines may be amicable to the trading of parts between operators, however sources tell Ishka that many are currently sitting on “stockpiles” of Used Serviceable Materials (USM). In some cases, immediately available USM is selling for more than the price of brand-new material from the manufacturer confide sources.

Engine demand in particular is far outstripping availability, as on-wing engines approach maintenance requirement deadlines. “I think what's driving it - certainly to a degree - is that there was a general slowdown in shop visits on engines etc. during the pandemic. And some of these engine types were flying a lot, particularly those that were powering freighters. Many of these engines are now reaching the time they need to go into the shop. At the same time, supply chain and production issues mean that there's a shortage of material for the engines when they come in,” Julian Balaam, a director at Skytech-AIC tells Ishka.

Another key factor affecting the demand for aircraft and parts is the relative rarity of aircraft variants, either in service or parted out. Older aircraft variants, with diminished fleet sizes, will require parts for service which are less likely to be commonly available. For example, Ishka understands that Pratt 4000 engines are particularly in demand – not least due to the number of older widebody freighters using the engine type.

“With all aircraft types, when you get a type that's coming towards the more mature stage of its life, people just stop overhauling engines,” explains Ted Van Zundert, aircraft remarketing and sourcing manager at SGI Aviation. “Then you’re left with quite a few airlines still flying that aircraft type - they don't want to spend a lot of money on overhauls, and so they go around scooping up all of the green time engines. So, you do see a surge in prices.”

On the other end of the aircraft lifecycle, newer tech USM is similarly sought after due to the low numbers of part-outs, according to sources. Boeing 787 USM, for example, is especially valuable, as very low numbers of the variant have been torn down and the supply of new parts is also constrained.

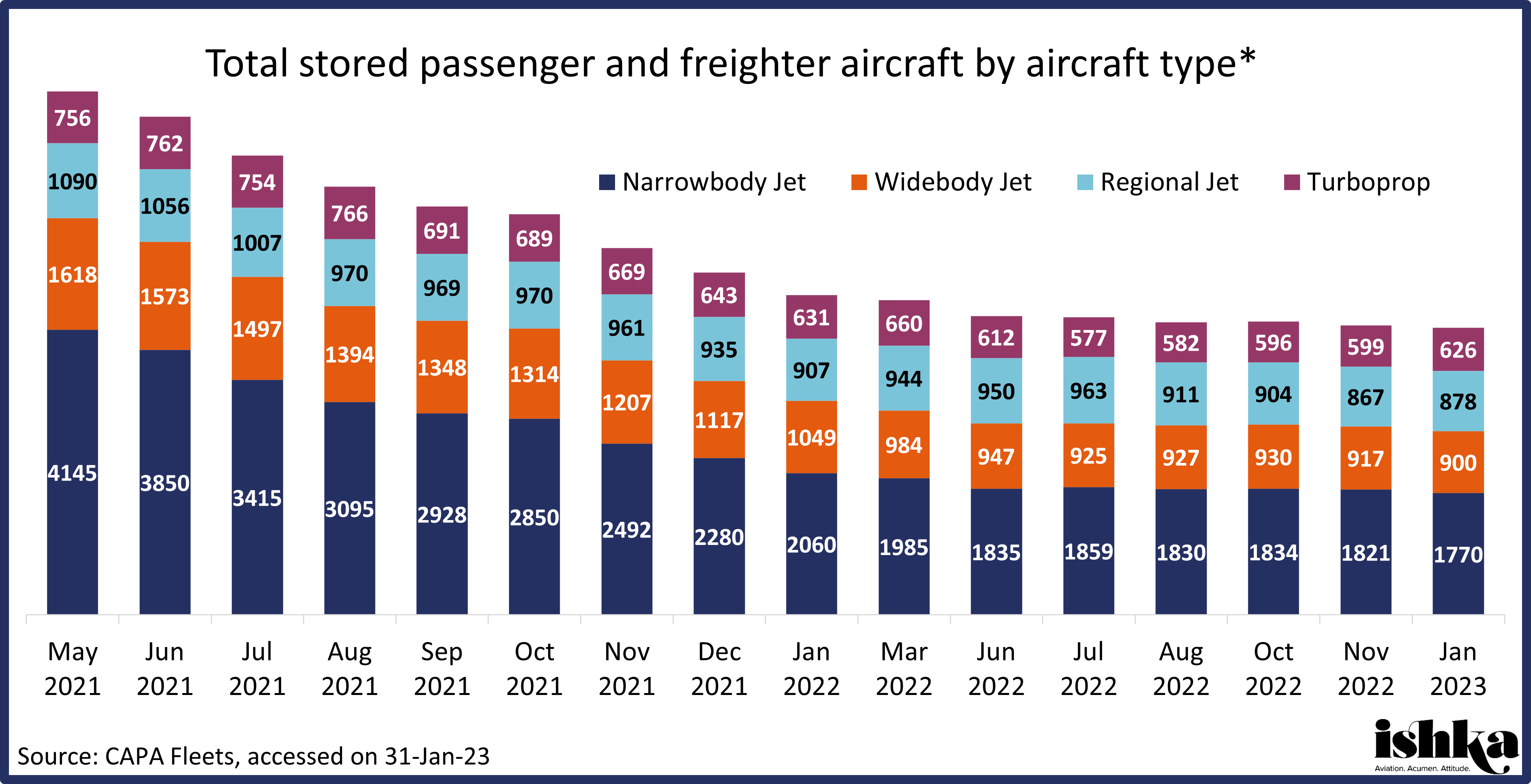

The low availability of parts is a key problem for airlines looking to keep their fleet in the sky – and for operators and others looking to reactivate stored aircraft. Another issue is the physical capacity of the MRO shops, as the number of requests creates a bottleneck, adding to delays yet further. Labour shortages persist, and costly delays in returning aircraft to service after being parked are common, say sources. One remarketer speaking to Ishka also points out that smaller carriers, without dedicated maintenance facilities, are more at the mercy of MRO delays, making it harder to adapt to changes in demand.

Limit on lease extensions?

Lease extensions remain popular among operators, sources tell Ishka, but in some cases the availability of those aircraft is being constrained. Aircraft earmarked by lessors for part-out or freighter conversion will have a limited availability for extensions.

“An airline might say ‘I want to extend my widebody lease in two years’ time,’ but the aircraft might have been earmarked by the lessor to go for conversion, so they won’t be able to extend it,” explains Van Zundert.

Delays in widebody deliveries such as the Boeing 777X and Airbus A350 are exacerbating supply problems in a similar manner to the widely covered narrowbody problems of the last few years, sources tell Ishka. Remarketers point to the reactivation of A380s and A340s by carriers like Lufthansa as a less than ideal option for airlines, but one that is necessary to maintain market share.

A potential resurgence in widebody demand was highlighted by various lessors to Ishka in Dublin two weeks ago, particularly due to the initial stages of China’s reopening to international travel.

The Ishka View

During the heights of the pandemic, avoidance of shop visits by operators resulted in a slowing of part-outs amid reduced demand for USM. Now, however, as the need for MRO visits comes to a head, high demand for parts and materials is driving market appetite for end-of-life assets – even extending to younger assets for which the value of the stripped-down parts, in some cases, is greater than that of the aircraft as a whole. Many operators are looking for serviceable and green-time engines to help keep aircraft in the air.

“We are seeing strong appetite out there from engine buyers and they’re prepared to push quite hard to get them. I think that reflects into mid-life and late-life aircraft values as well,” notes Balaam.

While this boom is good news for remarketers and asset owners of these types of aircraft, one remarketer speaking to Ishka notes that this could be causing a headache for new investors looking for healthy returns on portfolio investments as the assets are simply not available cheaply enough to be an attractive long-term investment. While Ishka notes a degree of lessor optimism towards a pickup in portfolio trading in 2023, trades still remain relatively low.

Sign in to post a comment. If you don't have an account register here.