in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Monday 20 May 2024

Aircraft ABS market ‘open’ but lessors question likely LTVs

Lessors speaking at the Ishka Aviation Finance Festival in Dublin last week argued that the ABS market is now “open” for aviation issuers, but warned that the risk of low LTVs and high transaction costs could limit the number issuances in the near term.

Ishka understands that there are at least two aircraft ABS deals likely to issue before the summer and hears rumours that another three aircraft ABS transactions are being prepared for a potential September or October issuance.

“I do think [the market] is available. I just think, by the time you've priced in the expenses involved in the structuring and looking at the cash flows available for debt service your LTVs are so low that your overall costs means it just isn't competitive. But I do think that's changing. I do see base rates in the near-term decreasing, and spreads then certainly constrained or compressed,” commented one senior lessor at the Ishka Dublin conference.

A senior lessor in another panel agreed, reflecting that if base rates did decrease it might result in “supercharged” ABS activity, given the number of potential issuers until recently unable to access the public markets.

Pent-up demand

Several lessors have raised financings through warehouse facilities with the expectation that this debt could be taken to market via an ABS issuance. Many of these warehouses were extended when the aircraft ABS market effectively shut down in 2022 and through most of 2023.

Carlyle Aviation Management Limited’s $522.5 million aircraft ABS remains the only public commercial aircraft ABS to price since 2021. At the end of 2023, engine lessor Willis Lease Finance Corporation successfully priced a $410-million engine ABS, while Ashland Place closed a successful aviation loan ABS in late 2023 (see Insights: ‘Update: Willis prices WEST VII engine ABS’ and ‘Ashland Place markets debut aircraft loan ABS’).

One senior investor speaking at the Ishka conference reflected that while conditions remained “uneconomic” for issuers, given the cash flows needed to service a large ABS transaction, conditions were improving. Ishka’s appraisal arm has been tracking the steady rise of lease rates across practically all aircraft types since Covid lows.

Moreover, improving debt collection and higher lease extension rates have helped the performance of existing ABS transactions. “Really, there's quite a bit of investor demand in a market where there hasn't been any supply, and we look at the universe of what is outstanding, these are amortizing transactions, so this is going down every single month,” commented the same investor.

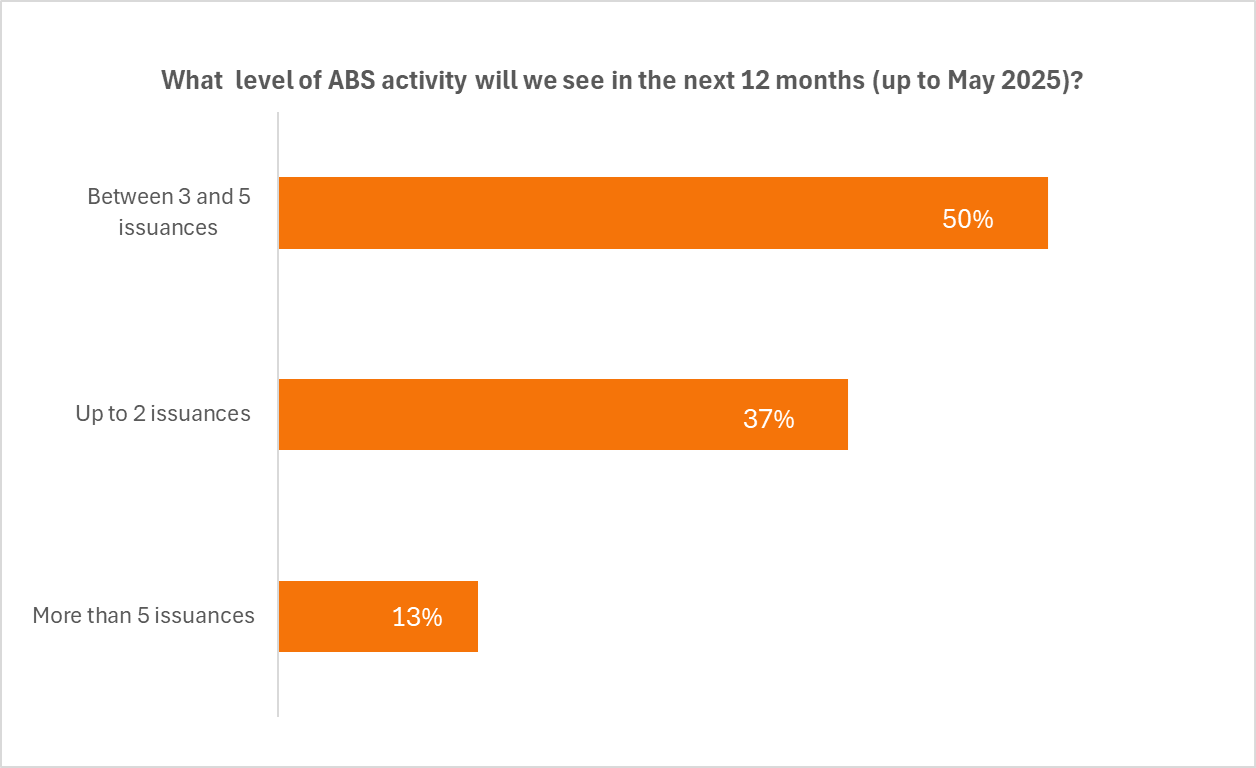

Source: Ishka Dublin 2024 Conference Poll

Source: Ishka Dublin 2024 Conference Poll

The Ishka View

It was always a question of when, rather than if, the commercial aircraft ABS market would come back, at least for senior debt. Lease rates may be improving but it will still take time for lessors to assemble portfolios that will reflect this trend fully, as many lessors shake off low lease rates agreed at the height of the pandemic.

Aviation lenders are the one thing that could force more issuances, confides one senior US lessor. However, for the last few years lenders have agreed to extend or upsize warehouse facilities originally designed to be taken out by the ABS market.

Banks appear reluctant to force aviation borrowers to access the ABS market, but Ishka hears that other sectors such as commercial real estate have seen borrowers forced to refinance in the capital markets. Ishka expects that the next wave of aircraft ABS issuances, assuming they will be successful, may prompt a conversation in January 2025 between lenders and lessors about finally vacating some of their warehouses.

Sign in to post a comment. If you don't have an account register here.