Wednesday 14 August 2024

Lessor M&A: Will a sellers’ market help platform sales?

Several leasing companies are in the process of running a formal sales process, while others are rumoured to be ‘exploring’ a potential sale, sources tell Ishka.

Ishka hears that several firms, including NAC and Aquila Air Capital (Aquila), are in the market running a formal sales process. Aquila is understood to have mandated investment bank Evercore to run a sales process. Aquila Air Capital was publicly launched in 2021 by PE firm Warburg Pincus in partnership with Kepler Hill Capital and Al Wood, the former CFO at Boeing Commercial Services, and CCO at AeroTurbine.

The firm has been busy acquiring engines and, according to its site has a portfolio of more than 100 assets, consisting of commercial engines on lease to more than 20 operators across the world with a range of vintages. The lessor’s portfolio consists of CF6-80C2, CF6-80E, GE90-115B, CFM56-7B, CFM56-5B, PW4000, PW2000, and RB211-525E4 engines. Aquila declined to comment when contacted by Ishka.

Separately, Ishka reported earlier in April that Sky Leasing is in the market to sell Sky Fund V – a portfolio of leased aircraft – with Morgan Stanley running the sales process (see Insight).

NAC’s sales process

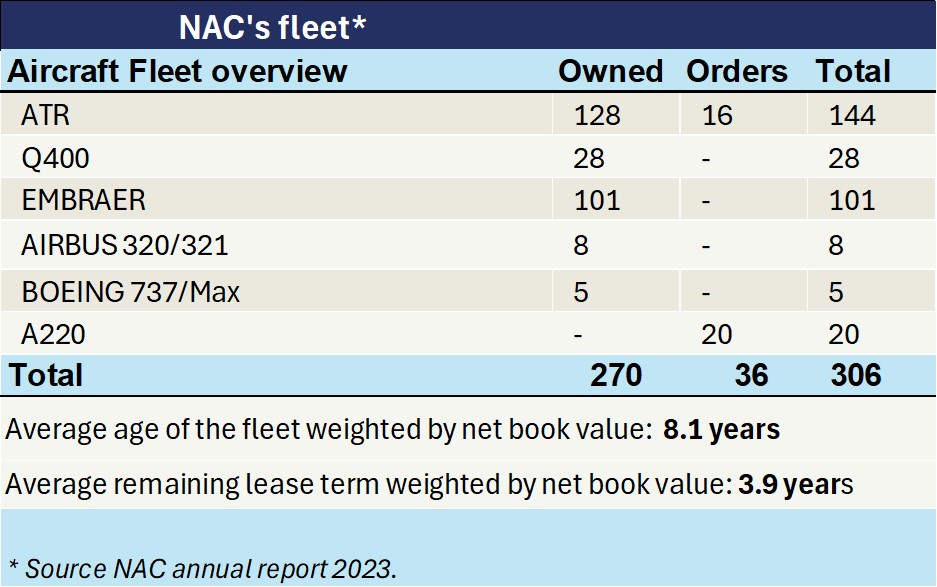

Another lessor that is up for sale is Nordic Aviation Capital (NAC). Goldman Sachs and Deutsche Bank were retained last year to advise on the NAC sales process following the firm’s exit of Chapter 11 restructuring in July 2022. Prior to its restructuring NAC was the world’s largest regional jet lessor but the firm has since been transitioning to acquire more narrowbodies. The successful sale by Chorus of Falko (see below) raises questions about the timing and the sales process of NAC. Goldman Sachs was also running the Falko sales process, and sources indicate that the NAC sales process was queued for that process to complete.

Sources talking to Ishka speculate whether the platform will be acquired as is, or instead split with the assets sold to other lessors with either regional jet or turboprop exposure, or a combination of both options. NAC is led by a number of experienced leasing executives with a background at GECAS including the President and CEO, Norm Liu.

One banking source explains that NAC’s shareholders include a mix of investors, including several who acquired stakes in NAC at a discount during the restructuring process and may be looking for a return relatively quickly (see Insight: “NAC finally gets restructuring plan approval”). If they sense conditions are right they may push for NAC to complete a sale sooner rather than later.

Whatever the stage or eventual plans for the whole platform, what has been clear is that NAC has been an active seller of its regional aircraft and engines. The firm has been recycling its mature regional aircraft to pay down it debt as it looks to acquire narrowbodies and place its ATR72 and A220 order stream. In the 18 months between July 2022 and December 2023 the firm sold close to 125 aircraft – an astonishing tally. Ishka understands that the lessor is likely to sell 50+ aircraft in 2024 – nearly all of which are out-of-production Embraer or Q400 aircraft.

Chorus sells Falko

At the end of July Chorus Aviation announced it had sold its regional aircraft lessor Falko Regional Aircraft Limited, and its affiliates, for $1.9 billion to HPS Investment Partners (HPS). HPS is understood to have paid $814 million in cash for the business and will either prepay or assume the remaining $1.1 billion of aircraft debt.

Chorus has sold the business just two years and three months after acquiring the firm in May 2022. The net sale price of $814 million represents 0.84x of Falko’s book value and is expected to result in an impairment on discontinued operations of $187 million as of 30th June 2024. Brookfield and Air Canada are Chorus’ largest shareholders.

Ishka understands that several PE firms including Ares, Warburg, and Davidson Kempner Capital Management (DK) were among the bidders for Falko with DK among the final set of bidders. Ares, Warburg, and Davidson Kempner Capital declined to comment when contacted by Ishka.

The Ishka View

So far there have only been a limited number of mandated M&A campaigns, but Ishka hears more platforms and smaller asset managers are informally entertaining sales discussions. “It is easy to understand why some equity may be thinking of an exit: asset prices are high, rents are high, and the mood music around airline performance is not great,” explains one aviation finance source on why some equity could be considering monetising their aircraft leasing investments.

There is no doubt that there is an appetite for aircraft assets (see Insight: “Trading update: ‘Sellers’ market’ persists despite ‘hundreds’ of available aircraft”) but the question is whether investors are keen to acquire fully staffed platforms or just assets? More capital is coming into the space which has helped sales. Other investors are looking to expand and want staff as well as assets. Two recent M&A processes, Voyager and Falko, were whole platform sales ( see Insight) .

However, other sources state the picture is more mixed. Many rival lessors looking at potential acquisitions simply want assets and not staff. Several leasing platforms have successfully sold assets this year, at a premium, but have struggled in turn to acquire to expand their fleets. “It is easy to sell, harder to grow” summarises one senior lessor who confides that continual sales pose a challenge for smaller asset managers that cannot easily recycle their capital. Refinancing existing portfolios is also an issue for smaller firms, thanks to higher interest rate costs. This has prompted some to wonder if shareholders of smaller asset managers, with relatively high costs, could be looking to exit as they struggle to grow. However, others argue that smaller lessors will stick to monetising assets in a hot sellers’ market, and hope that interest rates drop low enough to help them raise financing cheaply enough to begin expanding again.

Sign in to post a comment. If you don't have an account register here.