in Aircraft values, Lease Rates & Returns , Lessors & Asset managers

Sunday 2 February 2025

Aircraft trading: More money but more execution risk for aircraft sellers?

Readers travelling through Dublin Airport this January may have spotted an advert by aircraft asset manager IAT Leasing. Its ‘WE CLOSE DEALS’ tagline was a talking point during the Dublin Week industry gatherings designed to emphasise the leasing firm’s track record. Just over a year since launch, the lessor has closed three portfolio deals with another two understood to be in the works.

It also, perhaps unintentionally, differentiates the firm from the few aircraft buyers who have understood to have walked away from deals after their equity has declined a transaction. Aircraft sellers welcome the influx of capital in the secondary market but complain about higher execution risk.

Rush of capital for older aircraft

Lessors and asset managers confirm more capital is flooding into the secondary aircraft market for various reasons. Some of this comes from orderbook lessors hunting for serviceable previous-generation aircraft to achieve growth and provide aircraft to key customers impacted by new aircraft delivery delays. Separately, Ishka hears shareholders in a few mid-life lessors have injected additional equity to allow them to expand their fleets.

Last but not least, more asset managers are succeeding in winning equity mandates. Asset managers are wary about sharing too many details about their new investors, but Ishka understands they range from credit funds to boutique family offices. An equity mandate is a formal contract allowing an asset manager to show an investor a potential transaction, but it does not guarantee an investor will back a particular deal.

Many dedicated asset managers are excellent at managing these relationships, both in understanding their equity partners’ requirements and return hurdles, and presenting them deals that meet those needs. Others struggle, and as a result may drop out of a deal despite being shortlisted simply because the equity loses interest in the transaction or has been distracted by a different asset class, explains one active aircraft seller.

Lots of asset managers are armed with equity mandates to buy more aircraft but there’s often a disconnect, explains one leasing source. “You will get an asset manager who thinks they know what the investor wants, but there is no real track record between them.”

Aircraft buyers walking away from deals is not a new phenomenon – ultimately what the equity decides has always been beyond the control of asset managers. However, the issue has been getting more attention recently as bidders in secondary market portfolios swell. Some lessors have begun prioritising execution risk, sticking to ‘friends and family’ counterparties expressly to avoid this issue.

With some airlines taking up to nine months to novate aircraft, it is only natural that aircraft lessors would prioritise familiar and reliable counterparties. But there are also reasons why aircraft sellers should welcome and engage with new names. New equity investors often allow sellers to maximise returns, grow their trading relationships and build pricing tension when it comes to selling aircraft.

Assuming a ‘higher for longer’ rate environment

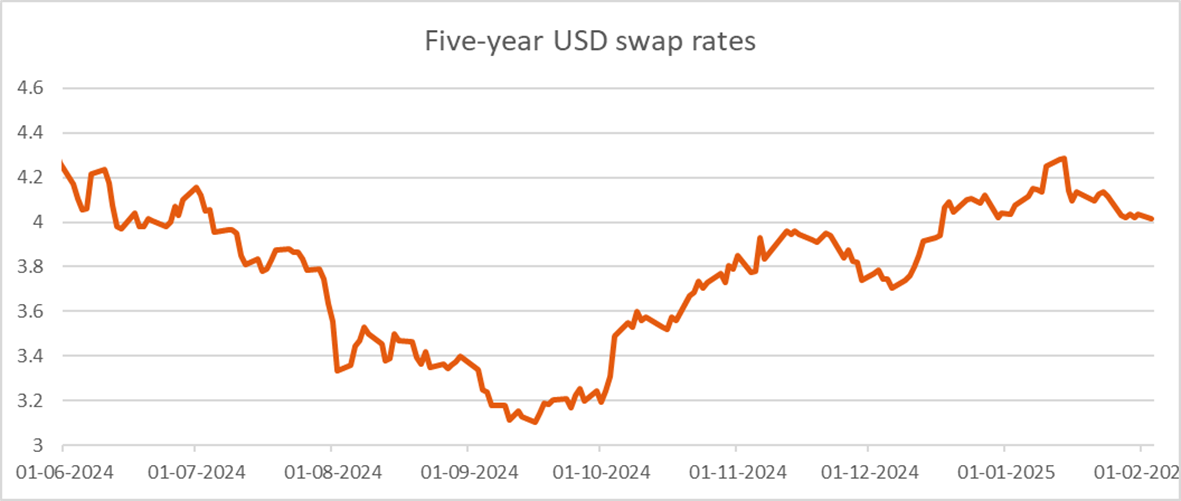

Another area of concern has been rising interest rates. Five-year USD swap rates have been steadily rising since September. Lessors are hoping that they may have peaked as there has been a decline in the weeks leading to mid-January (see chart below). Higher interest rates can increase the cost of financing for buyers squeezing their future returns and in turn might prompt them to ask buyers to drop prices.

But aircraft managers say rates are not really impacting trades, especially for older aircraft. “I think people have been pretty conservative with their interest rate assumptions. People are very aware that the particular space we invest in is more an ‘absolute return-type’ business. We're buying stuff with good unlevered yields that doesn't get too massively impacted by the cost of debt. We always are quite conservative, and we'll price it with quite a bit of a premium to the back end of the swap curve. So, we're not really buying stuff that's very rate sensitive, whereas maybe some of the younger or new-tech aircraft transactions with long leases are more competitive and rate sensitive, but typically we're still seeing people with swap adjustments in their pricing.”

Source Bloomberg, Ishka research

The Ishka View

Asset managers play a key role in aircraft investor outreach, educating new equity about aviation finance and aircraft leasing. Matching new equity with aircraft transactions is always tricky, but most asset managers can point to a decent track record.

More investors have been gravitating towards mid-life and older aircraft assets amid the current boon in residual values and lease rates driven by the lack of new aircraft deliveries and unscheduled maintenance downtime of some latest-generation aircraft. However, investors are likely to face stiff competition. Many of the largest orderbook lessors have been increasingly active in the secondary market looking for previous-generation aircraft assets. From what Ishka hears, this trend is only set to continue this year as aircraft sellers look to have a bumper year.

Sign in to post a comment. If you don't have an account register here.