SKY achieves record yield on aircraft ABS

Aircraft lessor SKY Leasing (SKY) has closed its $663 million ABS SLAM 2021-1 which achieved a record low yield for an aircraft ABS.

The ABS, which has now closed, will be used to acquire a portfolio of 15 single-aisle aircraft including 10 A321neos and one 2020 vintage A330-900 on lease to Delta Air Lines. Ishka understands that 95% of the portfolio was acquired via sale/leasebacks, most of which (90%) were acquired after the onset of the Covid-19 pandemic.

The portfolio features the youngest average aircraft age for an aircraft ABS to date, with an average age of 1.6 years and a weighted average lease term of 11.1 years.

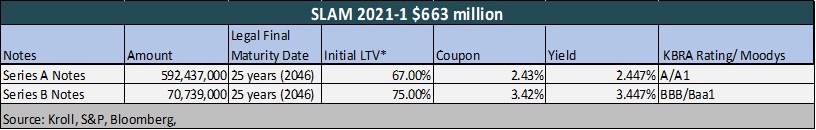

The transaction is split between two series of notes: $592.4 million series A Notes with an interest rate of 2.434%, and $70.7 million of series B Notes with an interest rate of 3.422%. The notes have an initial loan-to-value (LTV) of 67.0% and 75.0% respectively.

Ishka understands at peak subscription the deal was 3.5x oversubscribed on the A notes and 18x oversubscribed on the B notes. After the price was tightened the deal remained 2x oversubscribed on the A notes and 9x oversubscribed on the B notes.

SLAM 2021-1 is serviced by SKY Aero Management Limited and SKY Leasing, LLC while an affiliate of SKY will be retaining the equity in SLAM 2021-1. SKY states that it expects to refinance its existing warehouse debt financing facility with proceeds from the SLAM transaction.

Speaking to Ishka, Matthew Crawford, head of capital markets at SKY states: “The success of the ABS execution is a validation of the high-quality aircraft and airlines in the portfolio. The demand for the portfolio is a testament to our airline customers ability to manage a very difficult operating environment over the last 12 months.” In a statement, Crawford also noted: “We are pleased that the SLAM portfolio attracted a diverse, global group of investors to achieve the lowest all-in yield ever for an aircraft ABS.”

Portfolio: One A330neo and lots of A321neos

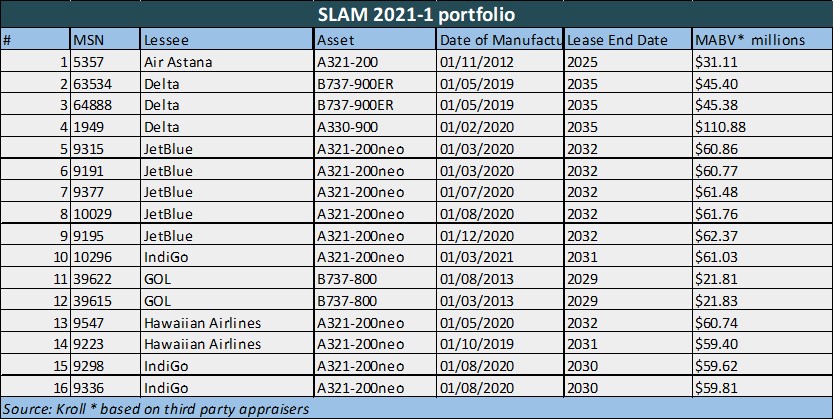

At just 16 aircraft, the SLAM 2021-1 portfolio is one of the smaller aircraft ABS portfolios. The bulk of the portfolios, 15 of the 16 aircraft (87.5% by value), are narrowbodies. These include ten A321-200neos (68.7% by value), two B737-900ERs (10.3% by value), one A321-200 (3.5% by value), and two B737-800s (4.9% by value). The portfolio also includes one 2020 vintage A330-900 on a 15-year lease to Delta which expires in 2035.

Kroll states that transaction has a covenant that requires a minimum of five aircraft to be delivered or the transaction will be in rapid amortization to pay down the notes faster, first to the Series A Notes and then the Series B Notes, sequentially, with equity locked out. Only two B737-800 aircraft (4.9% by value) in the portfolio are not yet owned by SKY or its affiliates. All of the aircraft are expected to be transferred to the issuers during the 270- day delivery period.

Structural enhancements

In addition to the typical structural features common in aircraft ABS transactions, SLAM 2021-1 also includes several structural enhancements informed by Covid-19. These include a three-month DSCR test compared to the six-month DSCR test common to aircraft ABS deals before the pandemic.

In addition, the transaction also includes a security deposit account, which will be funded with the cash security deposits associated with the initial leases that expire prior to the anticipated refinance date (ARD). According to Kroll, any excess amounts on deposit will be used to cover senior expenses and interest on the Series A Notes and Series B Notes, and cannot be leaked to equity.

According to Kroll the deal has a nine-month liquidity facility and a debt service coverage ratio (DSCR) of 1.15x and early amortisation trigger in which the excess cash will be used to pay down the Series A notes and then the Series B notes if the DSCR is less than 1.15x or the utilisation of the portfolio falls below 75% within a three-month period.

Rapid amortisation will also be triggered if the issuer collectively owns less than five aircraft at the end of the delivery period. Similarly, a DSCR Cash Trap Event will occur after the third payment date, if the DSCR falls below 1.20x but can be cured if it is at or above 1.20x for three consecutive payment dates.

The Ishka View

SLAM 2021-1 has arguably one of the strongest aircraft ABS portfolios Ishka has seen to date. A combination of young assets, strong lessees and crucially an 11-year plus average remaining lease term helps explain the warm reception it received from investors. It will be interesting to see if SKY is tempted to issue a series C note based on the level of investor interest.

A recent debate in several aircraft ABS conference panels is the value of a diverse portfolio versus a select portfolio of better-performing assets. As one banker explained, is diversity simply for diversity’s sake worth it? SLAM 2021-1 is not a particularly diverse portfolio. It is a smaller pool of aircraft than typical aircraft ABS deals and the top three lessees, JetBlue, Delta and IndiGo account for nearly 80% of the portfolio. 68% of the portfolio by value are A321-200neos, and 71% of the lessees are based in the US. The portfolio reflects the flight to quality that many investors are seeking in new aircraft investments, but not always able to obtain.

Ishka understands that there are several other aircraft ABS deals being prepared. It is not clear if some of the other aircraft ABS deals in the pipeline will adopt a similar approach in terms of asset selection. SLAM 2021-1 sets a difficult precedent for many asset managers to emulate, given the increasing competition lessors now face acquiring new-tech assets on lease to better lessees.

.png)

.svg.png)

Sign in to post a comment. If you don't have an account register here.